What is the Kakao Pay Rights Offering?

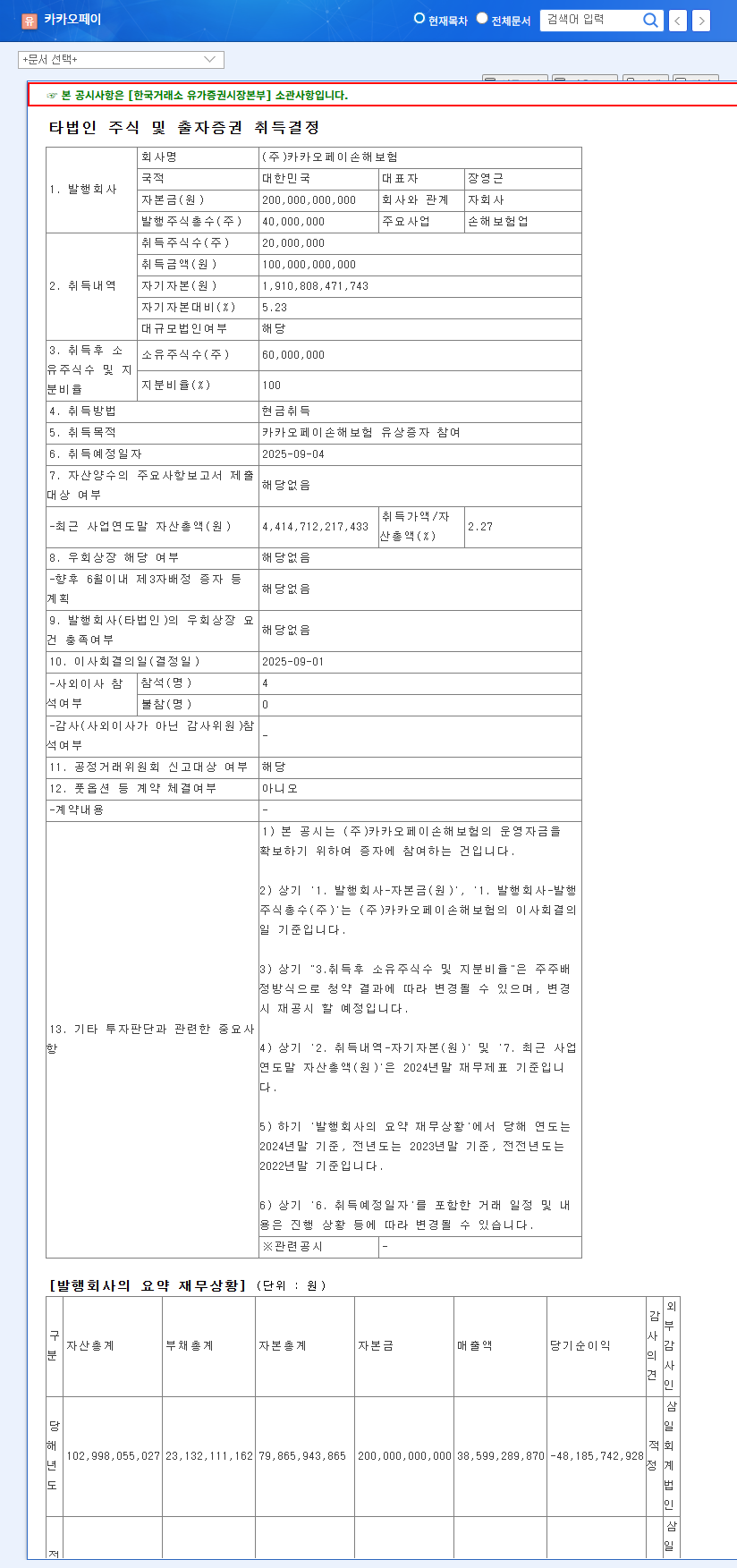

On September 1, 2025, Kakao Pay announced a ₩100 billion rights offering for its subsidiary, Kakao Pay Non-life Insurance. This capital increase is intended to secure operating funds and will be conducted through a rights allocation method.

Why the Rights Offering?

Kakao Pay Non-life Insurance is experiencing rapid growth, offering innovative services that combine fintech and insurance. The funds secured through this rights offering will be utilized for developing insurance products, strengthening marketing efforts, and investing in systems. This strategic investment aims to enhance Kakao Pay Non-life Insurance’s competitiveness and expand its market share.

Impact on Kakao Pay?

- Positive Impacts:

- Strengthened competitiveness of the subsidiary and enhanced fintech-insurance synergy.

- Securing long-term growth potential for the Kakao Pay group.

- Short-term improvement in financial soundness.

- Negative Impacts:

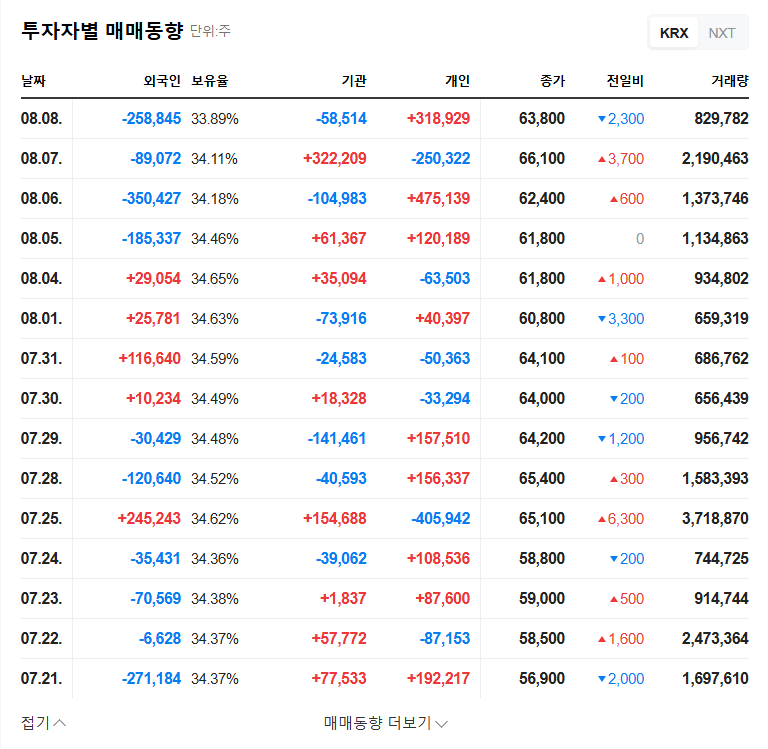

- Potential for short-term stock dilution due to the rights offering.

- Continued challenges for Kakao Pay in improving profitability and managing debt ratio.

Kakao Pay maintains a high net capital ratio, providing a buffer against interest rate fluctuations. However, improving the parent company’s profitability and managing its debt ratio remain key challenges.

Investment Strategy for Investors

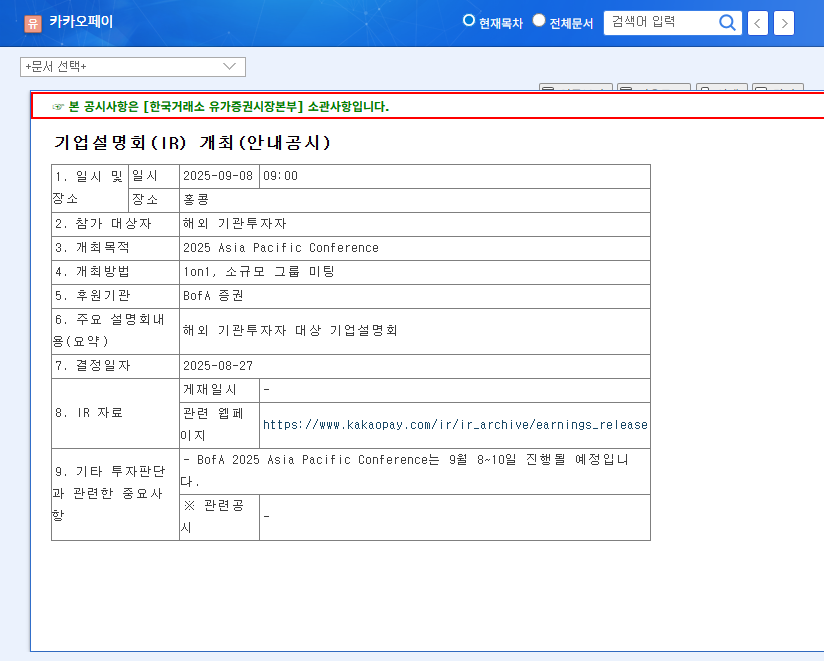

This rights offering could provide positive momentum in the long term. However, investment decisions should consider Kakao Pay’s efforts to improve profitability and macroeconomic variables. Closely monitoring future earnings announcements, business plans, subsidiary growth trends, and interest rate and exchange rate fluctuations is crucial.

Frequently Asked Questions

When was the Kakao Pay Non-life Insurance rights offering announced?

It was announced on September 1, 2025.

What is the size of the rights offering?

₩100 billion (approximately $XX billion USD).

How will the funds be used?

The funds will be used for operating funds, developing insurance products, strengthening marketing, and system investments for Kakao Pay Non-life Insurance.

What is the potential impact on Kakao Pay’s stock price?

While there’s a potential for short-term dilution, the rights offering is expected to positively impact the stock price in the long run by strengthening the subsidiary’s competitiveness.