1. What Happened?: KOSDAQ Listing and Large Shareholding Report

Adphorus will enter the KOSDAQ market on August 5, 2025, through a SPAC merger. Accordingly, the ‘Large Shareholding Report (General)’ was published on August 29th. This report confirms the status of shareholding changes and management influence of existing shareholders. In particular, the representative reporter, Lee Eun-hyun, holds a 49.56% stake, securing stable management rights.

2. Why is it Important?: Listing as a Stepping Stone for Growth

The KOSDAQ listing is expected to be a significant growth momentum for Adphorus. The funds secured through the listing will be used for new service development, overseas market expansion, and R&D investment. Also, the title of a listed company will greatly contribute to improving corporate awareness and credibility.

3. So What Will Happen?: Positive Fundamentals and Growth Potential

Adphorus boasts solid fundamentals. The stable growth of the advertising platform business and the high growth of the reward-based advertising platform ‘Green Fee’ are core competencies. Future growth engines such as full-stack platform expansion, strengthening big tech partnerships, and launching new B2C services have also been secured. As of the first half of 2025, the company has excellent financial soundness with an operating profit margin of 12.44% and a debt-to-equity ratio of 23.5%.

4. What Should Investors Do?: Considerations Before Investing

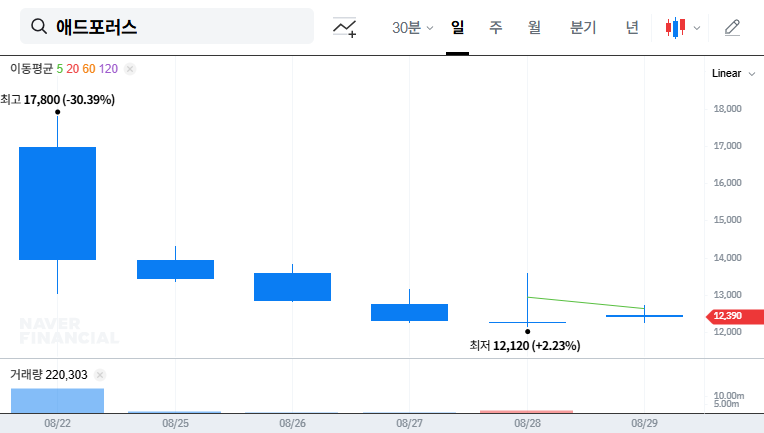

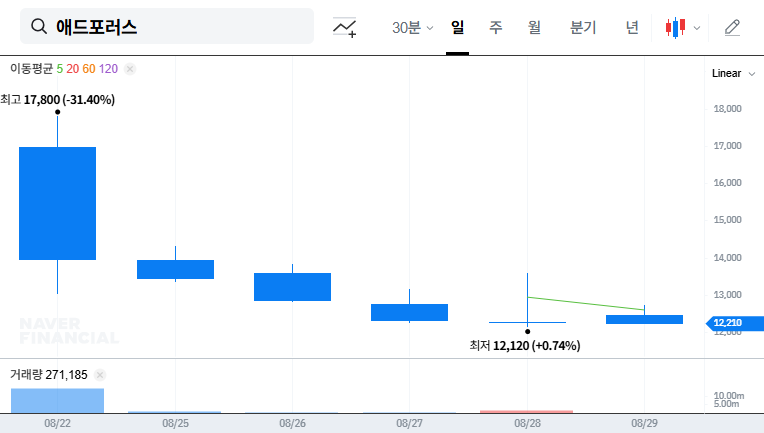

While Adphorus has high growth potential, there are a few things to consider before investing. Stock price movements after listing may fluctuate depending on market conditions and investor evaluations. In the highly competitive ad tech market, continuous technological innovation and differentiated service provision are essential.

When is Adphorus’s KOSDAQ listing date?

August 5, 2025.

What is Adphorus’s main business?

Advertising platform business and operating the reward-based ad platform ‘Green Fee’.

What are the key takeaways from this large shareholding report?

It confirms stable management rights through representative reporter Lee Eun-hyun’s 49.56% stake.