1. What is happening with SK Square’s Treasury Stock?

On August 28, 2025, SK Square announced its decision to dispose of KRW 300 million worth of treasury stock (1,914 shares) to fund long-term performance incentives. This represents a very small portion of the total outstanding shares.

2. Why is SK Square disposing of treasury stock?

The disposal is intended to cover employee long-term performance incentives, a common corporate practice. It is not expected to negatively impact the company’s financial health or business operations. In fact, it could enhance corporate value over the long term by motivating employees.

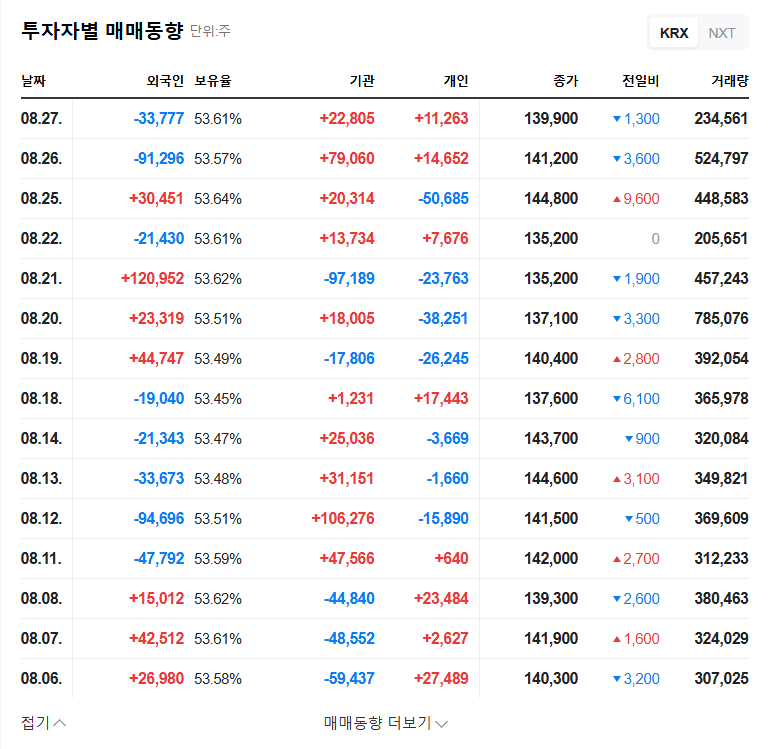

3. How will this impact the stock price?

The impact on the stock price is expected to be minimal due to the small size of the disposal. While it may slightly affect short-term supply and demand, the amount of KRW 300 million is not significant enough to cause substantial price volatility.

Investors are likely to focus on SK Square’s fundamentals, such as SK Hynix’s performance, the returns from SK Square’s own investments, and the profitability of its commerce and platform businesses.

4. What should investors do?

Instead of fixating on the news of the treasury stock disposal, investors should thoroughly analyze SK Square’s Q2 2025 semi-annual report, focusing on:

- SK Hynix Performance and Outlook: As a major investment asset of SK Square, SK Hynix’s performance heavily influences SK Square’s value.

- Investment Business Performance: Check for stable revenue generation.

- Commerce and Platform Business Profitability: The profitability of 11st, One Store, etc., are key investment points.

- Macroeconomic Changes: Consider the impact of macroeconomic factors like fluctuations in interest rates and exchange rates.

In summary, this treasury stock disposal is a minor event. Long-term investors should prioritize SK Square’s fundamental performance and growth strategy.

FAQ

Is the disposal of treasury stock a negative sign for SK Square?

No, the small scale of the disposal and its clear purpose (employee incentives) suggest it won’t significantly impact the stock price.

What should investors consider when investing in SK Square?

Focus on SK Hynix’s performance, returns from SK Square’s investment portfolio, and the profitability of its commerce and platform businesses.

What is the outlook for SK Square?

The outlook depends on factors such as SK Hynix’s performance, investment returns, and improvements in the profitability of its commerce and platform segment.