1. What Happened?

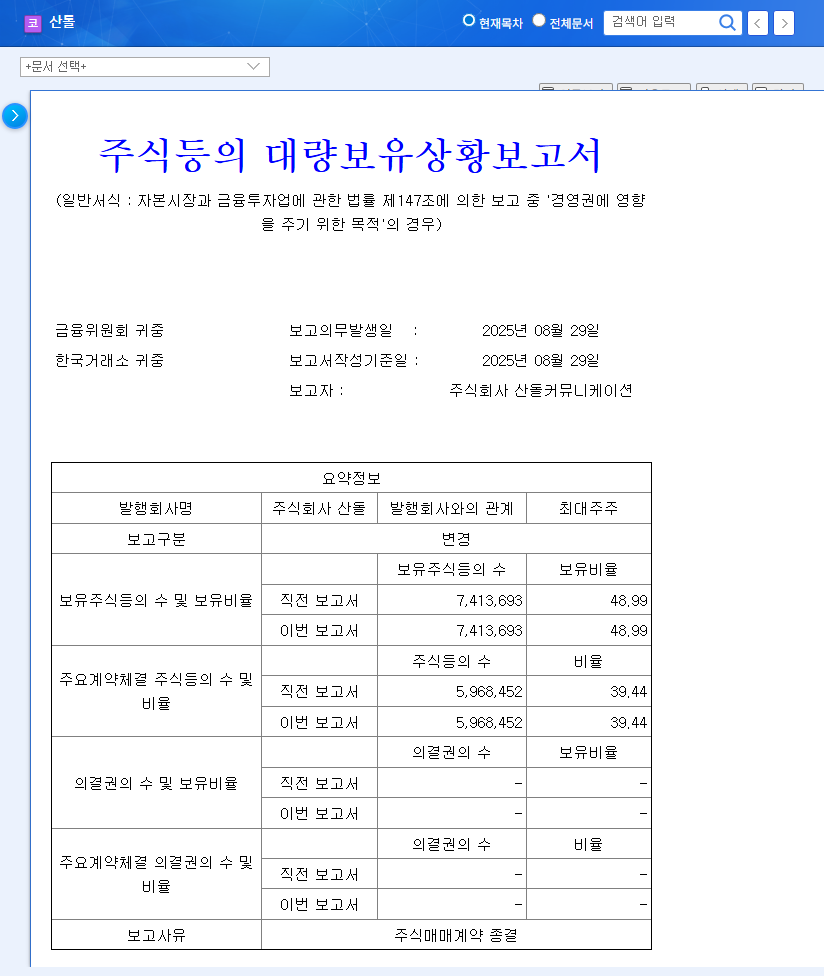

On August 29, 2025, Sandoll Communications sold approximately 2.98 million shares of Sandoll stock to KCGI. This transaction didn’t alter Sandoll Communications’ ownership percentage, suggesting a transfer or restructuring within the existing majority shareholder group. Currently, there appears to be no change in management control.

2. Why Did This Happen?

The precise reasons for the sale remain undisclosed. Further information is needed regarding KCGI’s identity and investment objectives. Depending on whether KCGI is a financial or strategic investor, Sandoll’s future strategy may shift.

3. What’s Next for Sandoll?

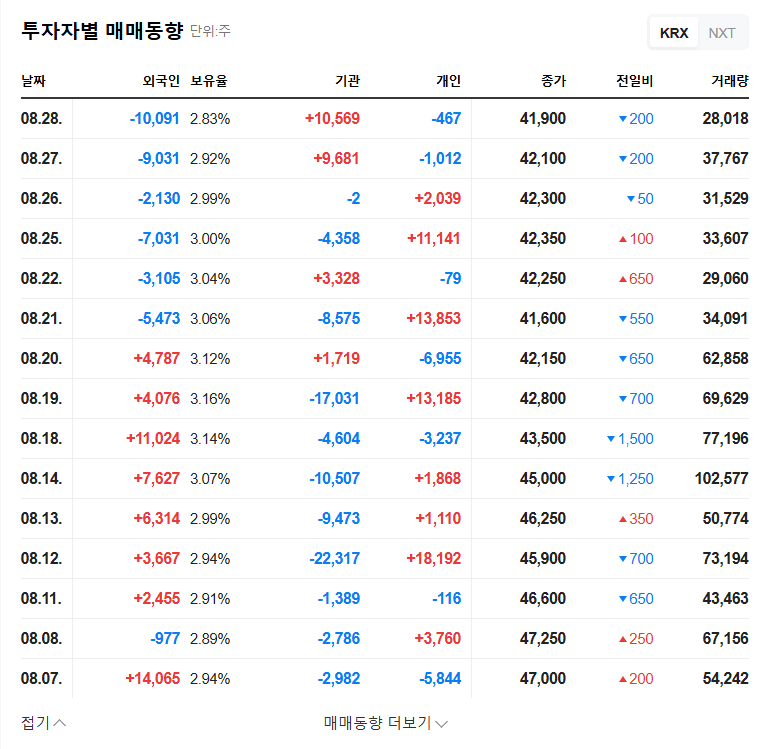

- Short-term Impact: Increased stock volatility, market supply and demand fluctuations, potential resolution or escalation of management uncertainty

- Long-term Impact: Depending on KCGI’s objectives, potential changes in management transparency and stability, possibilities for business synergy, and shifts in shareholder composition and management structure

4. What Should Investors Do?

- Research KCGI: Analyze their business areas, financial status, and potential synergies or conflicts of interest with Sandoll.

- Seek official statements from Sandoll’s management: Obtain clarity on the background of the transaction and future plans.

- Monitor stock price and trading volume: Be mindful of short-term volatility and observe long-term fundamental changes.

- Track Sandoll’s new advertising business performance: Evaluate the success of their diversification strategy.

Note: This analysis is based on currently available information and may change as further details emerge.

Frequently Asked Questions

What is KCGI?

Detailed information about KCGI is not yet publicly available. Further disclosures and news reports should provide additional insights.

Will this sale change Sandoll’s management?

Currently, there are no indications of management changes. However, depending on KCGI’s future actions, management changes cannot be ruled out.

What should investors pay attention to?

Investors should consider KCGI’s information, management’s official stance, stock price and trading volume trends, and the performance of Sandoll’s new advertising business when making investment decisions.