What Happened?

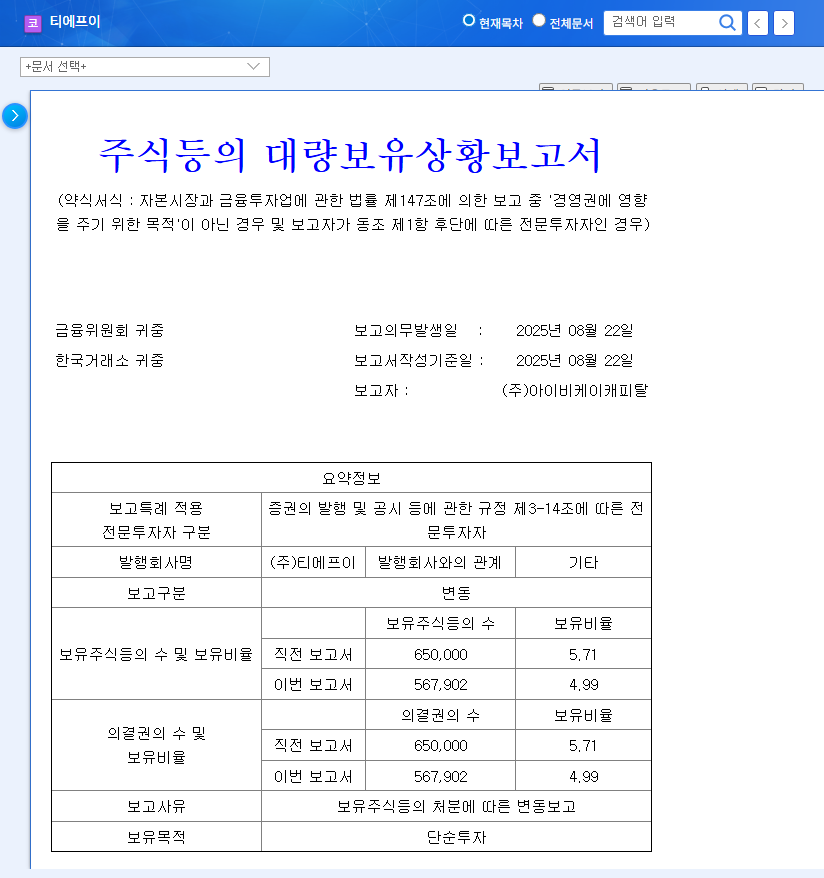

On August 25, 2025, IBK Capital sold 82,098 shares of TFE through Petriko-IBKC No. 1 New Technology Business Investment Association. This reduced IBK Capital’s stake in TFE from 5.71% to 4.99%. As the shares were held for simple investment purposes, the market is interpreting this move in various ways.

Why Does IBK Capital’s Divestment Matter?

The actions of institutional investors like IBK Capital can significantly impact the market. This divestment could put downward pressure on TFE’s stock price in the short term. It’s also important to be mindful of the potential negative impact on investor sentiment. However, the key takeaway is that this sale doesn’t directly affect TFE’s underlying fundamentals.

How Are TFE’s Fundamentals?

TFE experienced a decline in earnings in the first half of 2025. Sales decreased by 36.1% year-on-year, and operating profit and net income also fell by 56.8% and 44.4%, respectively. However, the company is actively investing in new businesses, such as advanced packaging process heat dissipation solutions and high-performance memory testing, and its long-term growth potential remains valid. A new facility investment plan worth KRW 14.3 billion is also underway.

What Should Investors Do?

- Short-term investors: Be aware of the possibility of further selling by IBK Capital and the market’s short-term volatility.

- Long-term investors: Closely monitor changes in TFE’s fundamentals, the performance of new businesses, and the recovery of major clients’ earnings, and develop an investment strategy from a long-term perspective.

The potential dilution of shares due to convertible bond issuance, the semiconductor industry cycle, and changes in the macroeconomic environment are also important factors to consider when investing.

Frequently Asked Questions

How will IBK Capital’s divestment affect TFE?

It could negatively impact the stock price in the short term, but it doesn’t directly affect the company’s fundamentals.

What is the outlook for TFE?

It depends on the semiconductor market, the performance of major clients, and the success of new businesses, but the long-term growth potential remains.

What should investors be cautious about?

Consider the possibility of further selling by IBK Capital, earnings improvements, the impact of convertible bond issuance, and changes in the macroeconomic environment.