1. What Happened? LB Investment Sells 1.34%p Stake in Protina

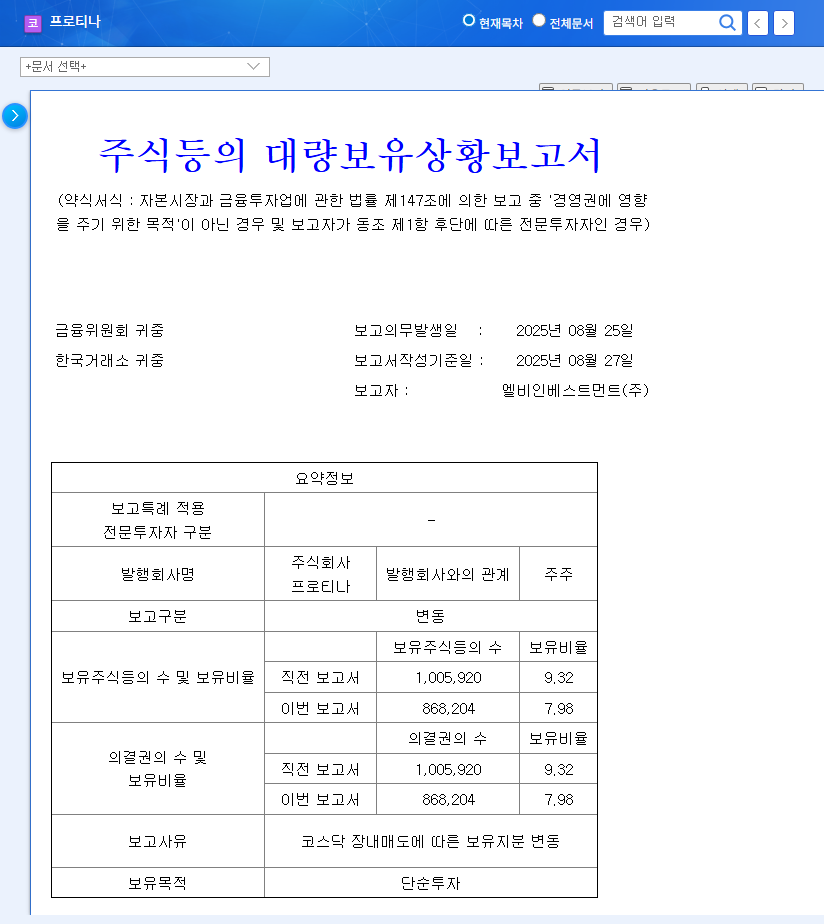

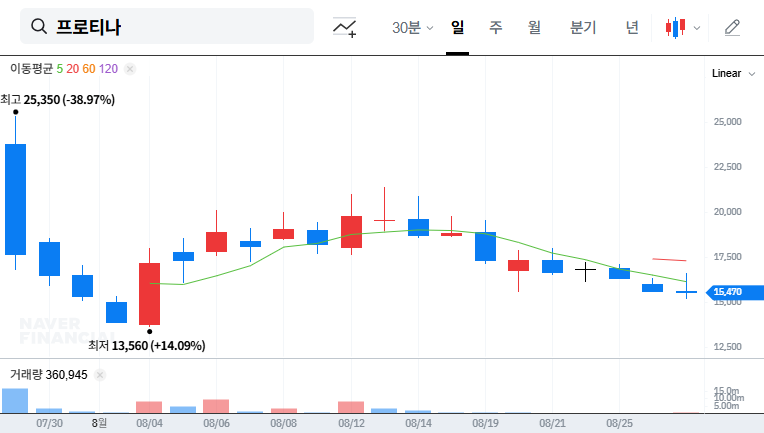

LB Investment sold Protina shares on the market in five separate transactions between August 5th and 27th. This reduced LB Investment’s stake in Protina from 9.32% to 7.98%, a decrease of 1.34%p.

2. Why the Sale? Likely Profit-Taking or Portfolio Adjustment

LB Investment held Protina shares for ‘simple investment’ purposes. Therefore, this sale is likely profit-taking or portfolio adjustment, possibly capitalizing on the stock price increase after the IPO.

3. What is Protina? An Innovative Biotech Company Focused on PPI Analysis

Protina is a bio company with protein-protein interaction (PPI) analysis technology. It was listed on KOSDAQ in July 2025 through a special technology listing. While it has innovative technology and high growth potential, it has not yet secured profitability. High R&D costs continue to result in operating losses, and securing financial soundness is an urgent task.

- Strengths: Innovative technology, growing bio market, potential for increased equipment sales

- Weaknesses: Lack of profitability, accumulated deficit, volatility in sales structure, high R&D costs

4. What Should Investors Do? Cautious Approach, Consider Dollar-Cost Averaging

While Protina has high growth potential, investors should carefully monitor short-term stock price volatility and profitability improvements. The current stock price decline could be a buying opportunity for long-term investors, but it’s advisable to manage risk through a dollar-cost averaging strategy.

- Key Checkpoints: Technology commercialization, operating profit turnaround, institutional investor movements

What does LB Investment’s sale of Protina shares mean?

Since LB Investment held Protina’s shares for ‘simple investment’ purposes, the sale is likely for profit-taking or portfolio adjustment. While it can negatively impact the stock price in the short term, it may not significantly affect the long-term corporate value.

What investment strategy should I consider for Protina?

Protina has high growth potential, but it hasn’t achieved profitability yet. Therefore, a cautious approach is necessary, and a dollar-cost averaging strategy is recommended. It’s crucial to monitor the company’s technology commercialization progress, operating profit turnaround timing, and institutional investor movements.