1. Why Did Alux Acquire a Vietnamese Company?

Alux, primarily focused on drones and education, has been grappling with declining sales and losses. To overcome these challenges and secure future growth, Alux acquired ER VINA, a Vietnamese electronics manufacturer. This move aims to diversify their business portfolio, tap into the Vietnamese market, and establish a new production base.

2. What Does Alux Stand to Gain?

Alux anticipates several benefits from the ER VINA acquisition:

- Diversification: Offsetting the struggles of existing business segments and building a more stable revenue stream.

- Production Base: Leveraging Vietnamese manufacturing to enhance cost competitiveness and establish a foothold for global expansion.

- Synergies: Integrating ER VINA’s electronics expertise into their drone operations for improved component sourcing and cost reduction.

3. What Should Investors Consider?

Despite the potential upsides, investors should consider the following risks:

- Investment Amidst Financial Difficulties: Making a substantial investment during a period of financial strain poses a significant risk.

- Integration Challenges: Unforeseen difficulties can arise during the integration of a new business segment.

- ER VINA’s Performance Uncertainty: ER VINA’s performance may not meet Alux’s expectations.

4. Action Plan for Investors

If considering an investment in Alux, carefully assess the following:

- ER VINA’s financials and business plan

- Alux’s short-term recovery potential

- Post-acquisition cash flow and financial management

- Potential synergies with existing businesses

- Market reaction and stock price predictions

Making informed investment decisions based on this information is crucial.

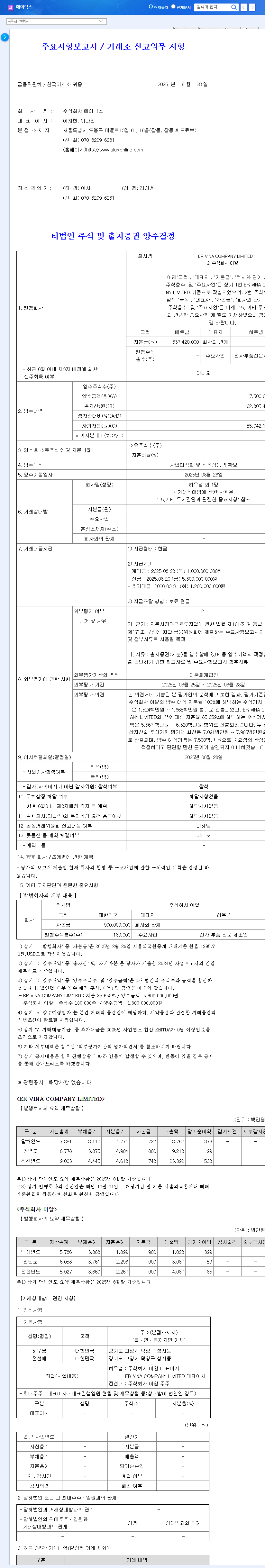

What is ER VINA, the company Alux acquired?

ER VINA is a Vietnamese electronics component manufacturer.

What was the acquisition price?

₩7.5 billion.

What is the purpose of this acquisition?

To diversify Alux’s business and secure new growth engines.

What are the key risks for investors?

Investors should consider Alux’s current financial difficulties, integration challenges, and the uncertainty surrounding ER VINA’s performance.