1. What Happened?

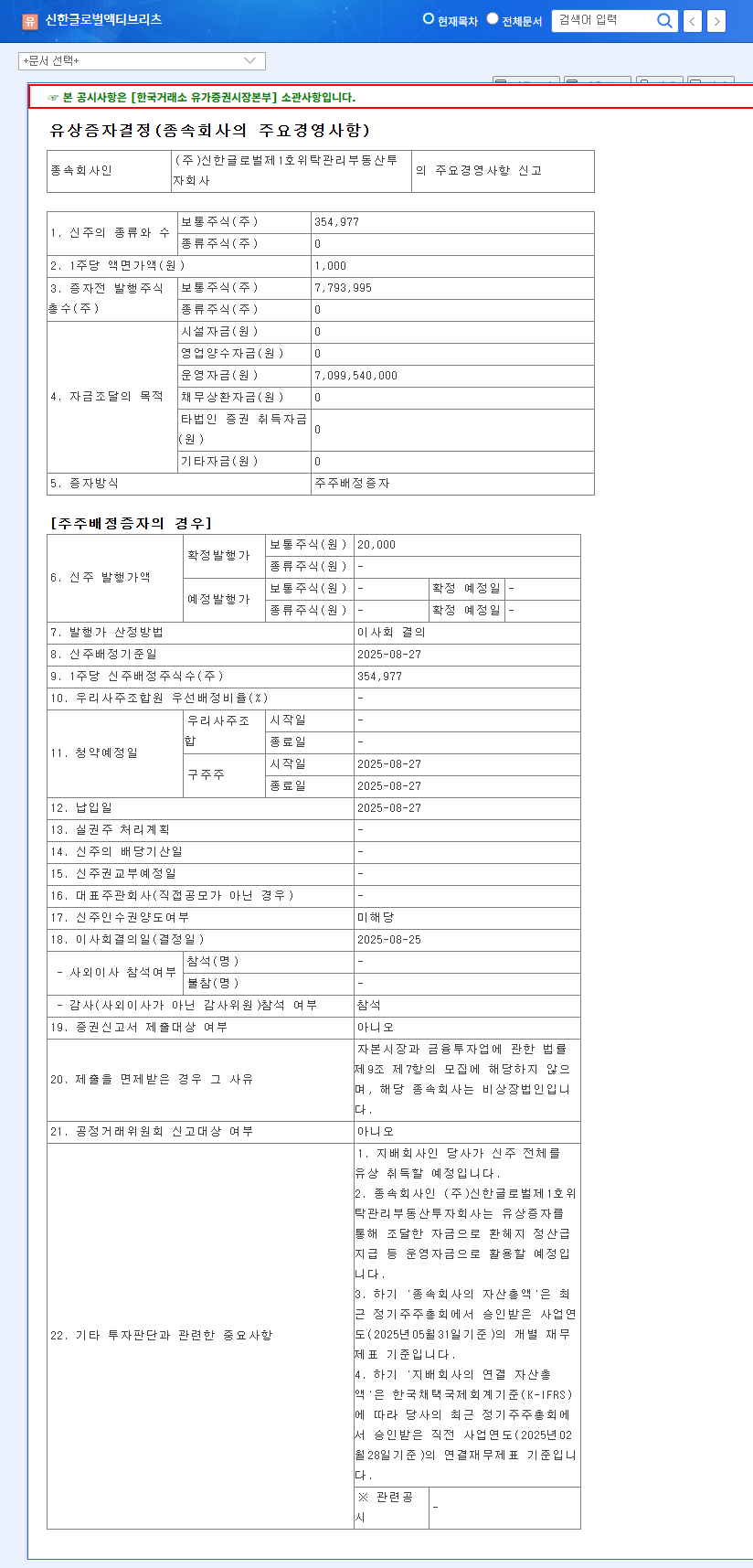

Shinhan Global Active REIT invested 7.1 billion KRW to acquire 100% of Shinhan Global No. 1 Consignment Management Real Estate Investment Company. The acquisition was made in cash, and the funds will be used for operating expenses and foreign exchange hedge settlements.

2. Why the Acquisition?

The company aims to expand its business and strengthen its control through this acquisition. The capital raised through the rights offering is intended to secure financial stability by serving as operating funds.

3. What are the Potential Outcomes? – Opportunities and Risks

- Opportunities:

- Full control over the subsidiary enables consistent management strategies.

- Increased financial stability through secured operating funds.

- Risks:

- The 7.1 billion KRW acquisition cost could be a financial burden, potentially exacerbating financial pressures if additional funding is required.

- Increased dependence on the subsidiary’s performance, potentially impacting the parent company’s results.

- Lack of transparency regarding the use of foreign exchange hedge settlement funds increases market uncertainty.

4. What Should Investors Do? – Action Plan

Shinhan Global Active REIT currently faces significant challenges with declining profitability. It remains uncertain whether this acquisition will yield positive results in the short term. Investors should consider the following cautious approach:

- Short-term Investors: Maintain a wait-and-see approach, carefully analyzing market reactions, earnings announcements, and disclosures before making investment decisions.

- Long-term Investors: Monitor the acquired subsidiary’s business plans and actual performance, as well as the turnaround potential of the existing business, over the long term.

Q: What is the purpose of Shinhan Global Active REIT’s acquisition?

A: The acquisition aims to expand the business, strengthen control over the subsidiary, and secure operating funds.

Q: Will this acquisition positively impact Shinhan Global Active REIT?

A: While there are potential benefits like full control over the subsidiary and increased operating funds, there are also risks such as the financial burden of the acquisition and increased dependence on the subsidiary’s performance.

Q: How should investors react to this news?

A: Short-term investors should wait and see, while long-term investors should monitor the performance of the acquired subsidiary and the potential turnaround of the existing business.