1. What to Expect from LG Uplus’s IR?

LG Uplus will announce its first-half 2025 earnings and future business strategies at the IR on September 2nd. The focus will likely be on detailing plans for future growth drivers like 5G, AI, data centers, and EV charging, along with plans to enhance market competitiveness. Updates on shareholder return policies are also anticipated.

2. Why is this IR Important?

This IR offers a valuable opportunity to evaluate LG Uplus’s growth potential and refine your investment strategy. It provides insights into their competitive advantages in a dynamic market and how they plan to secure future revenue streams.

3. Key Takeaways for Investors

- Growth Drivers: Pay close attention to 5G subscriber growth trends, returns on AI/data infrastructure investments, EV charging business expansion plans, and data center competitiveness.

- Risk Management: Consider potential risks, including intensified competition in the telecom market, cost burdens from new business investments, and macroeconomic fluctuations.

- Shareholder Return: Evaluate the sustainability of shareholder-friendly policies, such as dividend payout ratios and share buyback/cancellation plans.

4. Investor Action Plan

Carefully analyze the IR announcements, assess the company’s fundamentals and future growth prospects, and make informed investment decisions. Focus on long-term investment value rather than short-term stock price fluctuations.

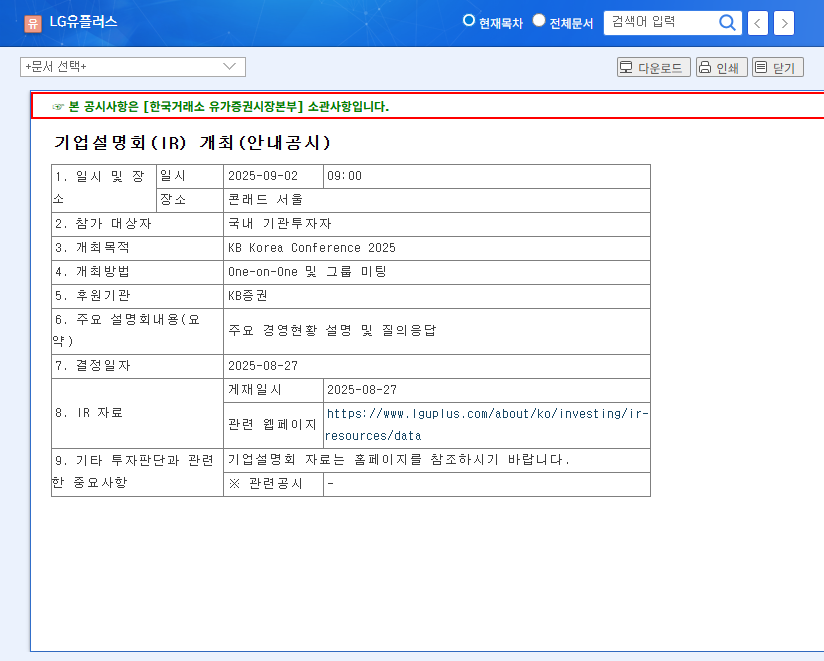

When and where is the LG Uplus IR taking place?

It’s scheduled for September 2, 2025, at the KB Korea Conference 2025.

What are the key topics of this IR?

The IR will cover LG Uplus’s H1 2025 earnings, future growth strategies for 5G, AI, data centers, and EV charging, and potential updates on shareholder return policies.

What information can investors gain from the IR?

Investors can gain valuable insights into LG Uplus’s current business performance, future growth strategies, market competitiveness, potential risk factors, and other essential information for investment decision-making.