1. What is GRT’s Rights Offering?

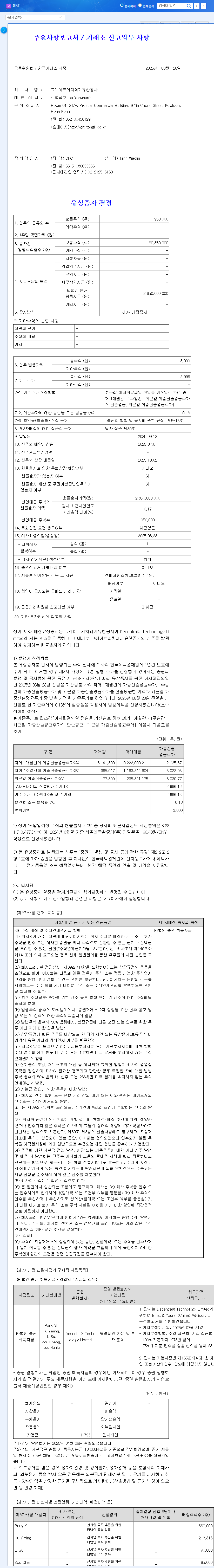

GRT announced on August 28, 2025, a rights offering of 950,000 shares, totaling KRW 2.85 billion. The new shares are expected to be listed on October 2nd, with an offering price of KRW 3,000 per share. This represents approximately 1% of the total existing shares.

2. Why is GRT Conducting a Rights Offering?

GRT plans to use the proceeds from the rights offering to expand R&D investments, enter new businesses, and invest in facilities. The recent surge in sales and increased R&D spending (revealed after the Q3 earnings correction) signal positive growth momentum. The rights offering can be interpreted as a strategic move to improve the company’s financial structure and secure growth drivers, ultimately enhancing corporate value.

3. What are the Implications for Investors?

- Positive Impacts: Securing future growth drivers through business expansion and R&D investment, anticipated improvement in financial structure.

- Negative Impacts: Potential stock dilution due to new share issuance, uncertainty surrounding the use of funds.

Investors should consider both the short-term potential for stock dilution and the long-term growth potential. A thorough review of the feasibility of GRT’s growth roadmap and its fund management plan is crucial.

4. Investment Action Plan

GRT’s rights offering can be a stepping stone for growth, but investment always carries risks. The following investment strategies can be considered:

- Short-term Investment: Approach with caution regarding stock volatility before and after the listing of new shares, aiming for short-term profit realization.

- Mid-to-Long-term Investment: Invest in GRT’s growth story with a mid-to-long-term perspective, continuously monitoring future performance and transparency in fund execution.

How will the GRT rights offering affect the stock price?

In the short term, there is a possibility of stock dilution due to the issuance of new shares. However, in the long term, the funds secured through the rights offering could act as a growth driver, leading to a rise in stock price. Continuous monitoring of fund usage plans and actual performance is crucial.

How will the funds from the GRT rights offering be used?

The funds are planned to be used for expanding R&D investment, entering new businesses, and investing in facilities. It’s important to review the specific details of the investment plan and monitor the actual execution of the funds.

Should I invest in GRT?

GRT has shown recent performance improvements and growth potential, but investment always carries risks. Before making an investment decision, thoroughly analyze GRT’s business model, financial status, and market conditions, and consider your own investment goals and risk tolerance.