1. What Happened with Avion’s Rights Offering?

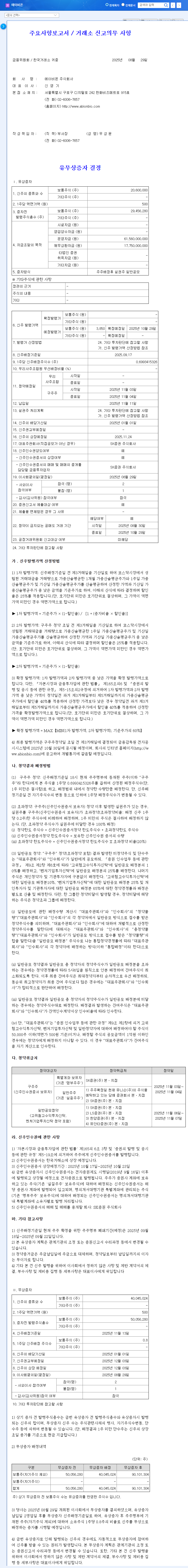

Avion decided on a rights offering totaling ₩79.4 billion to secure operating funds (₩61.6 billion) and repay debt (₩17.8 billion). 20,600,000 new common shares will be issued. A bonus share issue of 0.8 shares per existing share will also take place.

2. Why the Rights Offering?

Avion is actively pursuing R&D, including Phase 2 clinical trials for ABN401 (Bavamekimab) and the development of the ABN501 pipeline. These activities require substantial funding. The proceeds from the rights offering will be used to expand R&D investment and improve the company’s financial structure. The bonus share issue aims to enhance shareholder value and increase the number of outstanding shares, promoting liquidity.

3. How Does the Rights Offering Affect Investors?

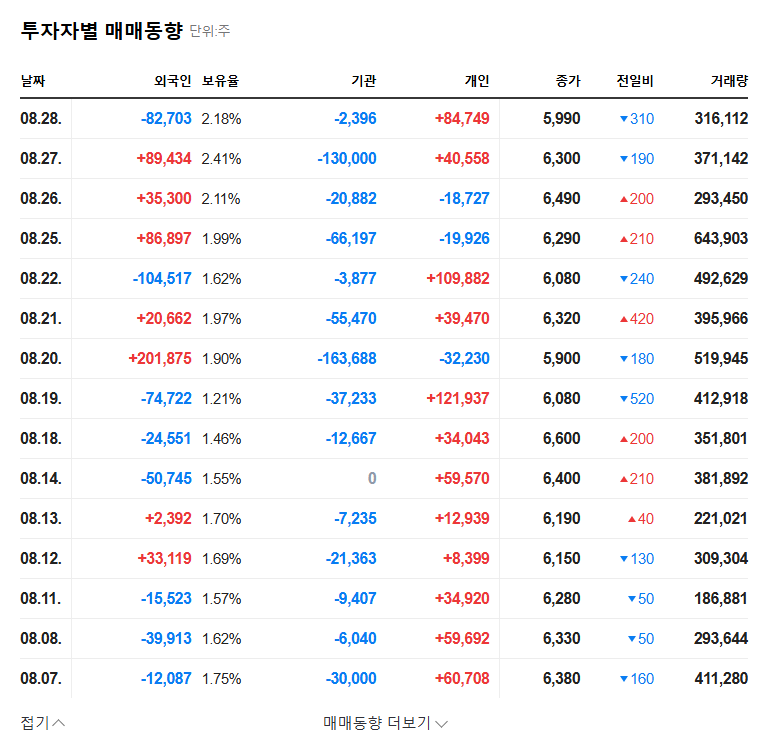

- Positive aspects: Increased potential for new drug development and commercialization due to secured funding, strengthened financial stability.

- Negative aspects: Potential stock dilution due to the rights offering, risk of failure in new drug development, possibility of needing further fundraising.

Careful consideration should be given to the offer price of the new shares and Avion’s plans for utilizing the raised capital. A low offer price could dilute existing shareholders’ value.

4. What Should Investors Do?

Investors considering Avion should pay attention to the following:

- Make investment decisions after the offer price is finalized.

- Continuously monitor clinical trial results and business development progress.

- Acknowledge the high risks associated with investing in the biopharmaceutical industry.

Frequently Asked Questions

What is the offer price for Avion’s rights offering?

The offer price has not yet been finalized. It will be announced in future public disclosures.

Does a bonus share issue decrease the value of my shares?

The bonus share issue itself doesn’t directly affect the value of existing holdings, but it can lead to stock dilution due to the increased number of shares outstanding.

What is Avion’s future outlook?

While the secured funds can accelerate R&D, risks such as the uncertainty of new drug development and intensified market competition exist. Closely monitor clinical trial results and technology transfer achievements.