3billion Sets Sights on US Expansion with ₩4.2B Investment

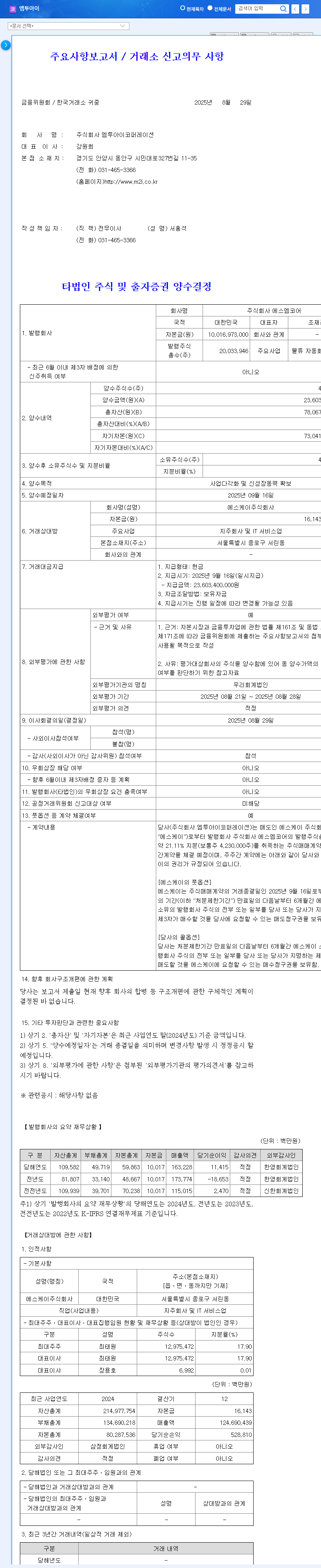

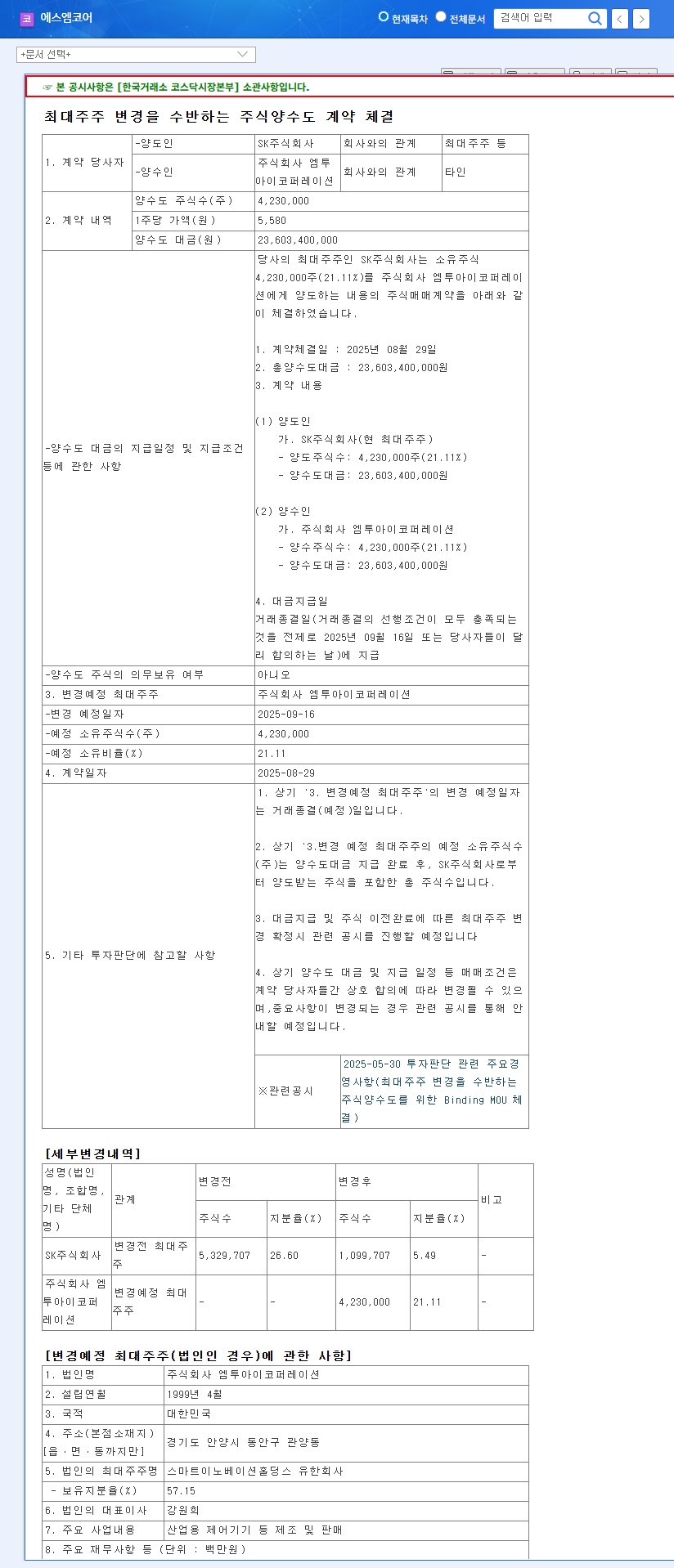

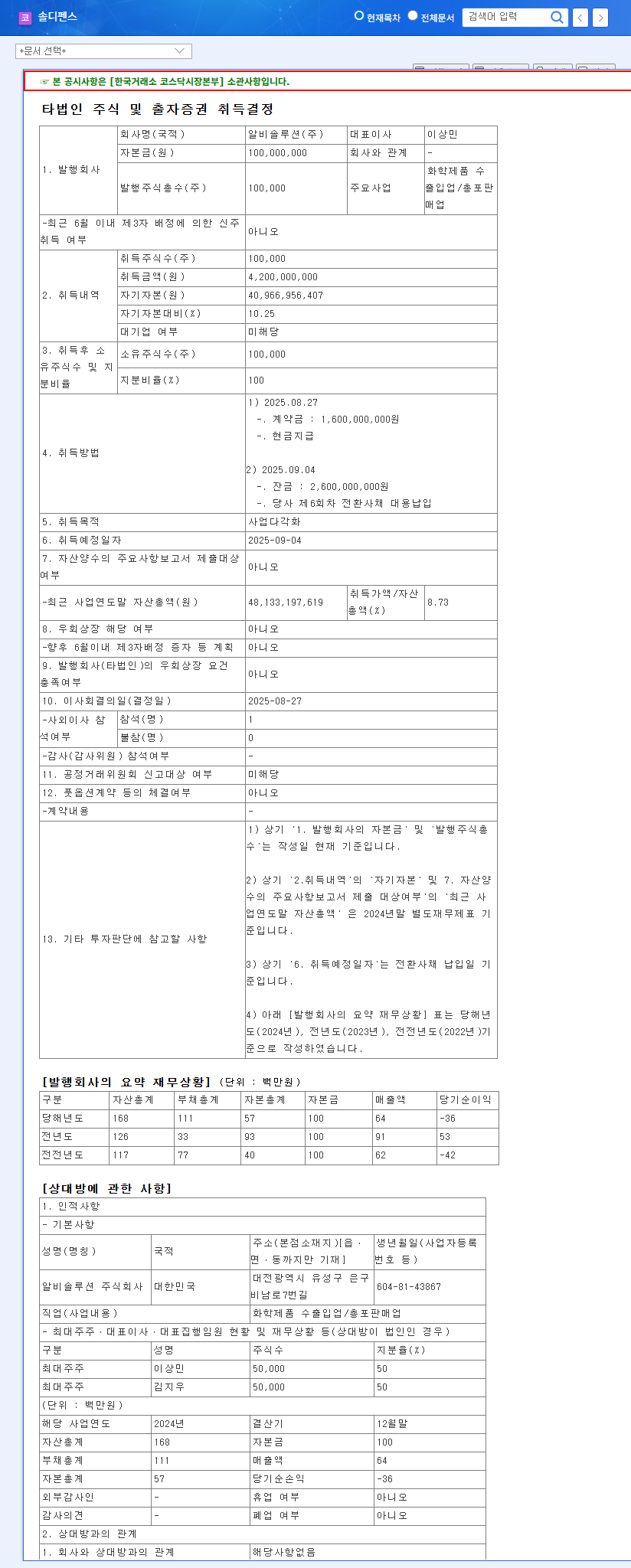

On September 9, 2025, 3billion announced the acquisition of 3billion US, Inc. for ₩4.2 billion. This investment, representing 14.75% of 3billion’s capital, is a strategic move to penetrate the US market. 3billion US, Inc. specializes in WES/WGS-based rare disease genetic testing, creating potential synergy with 3billion’s existing business.

Implications of US Market Entry for 3billion

- Positive Impacts:

- Direct access to the US market, enhancing customer reach and potential market share growth.

- Potential for increased revenue and profitability, with synergy through the SaaS model.

- Strengthened global competitiveness and momentum for further international expansion.

- Enhanced core business capabilities and portfolio diversification.

- Negative Impacts and Risks:

- Short-term liquidity constraints due to the ₩4.2 billion cash outflow.

- Uncertainties and risks associated with US market entry and the post-merger integration (PMI) process.

- Potential profit fluctuations due to USD/KRW exchange rate volatility.

- Uncertainty regarding the profitability of the US subsidiary.

Key Checkpoints for Investors

While this acquisition is viewed as a positive event that enhances 3billion’s growth potential, investors should closely monitor the following:

- The company’s cash flow management.

- The progress and performance of the US subsidiary’s PMI.

- Future trends in earnings improvement.

This analysis is not investment advice, and investment decisions are the sole responsibility of the investor.

Frequently Asked Questions (FAQ)

What is 3billion’s main business?

3billion provides rare genetic disease diagnostic services using AI-driven genomic analysis technology.

Will this acquisition positively impact 3billion’s stock price?

While market entry can boost growth potential, there are risk factors, so careful consideration is necessary before investing.

What should investors pay attention to?

Investors should monitor the company’s financial status, the integration process of the US subsidiary, and exchange rate fluctuations.