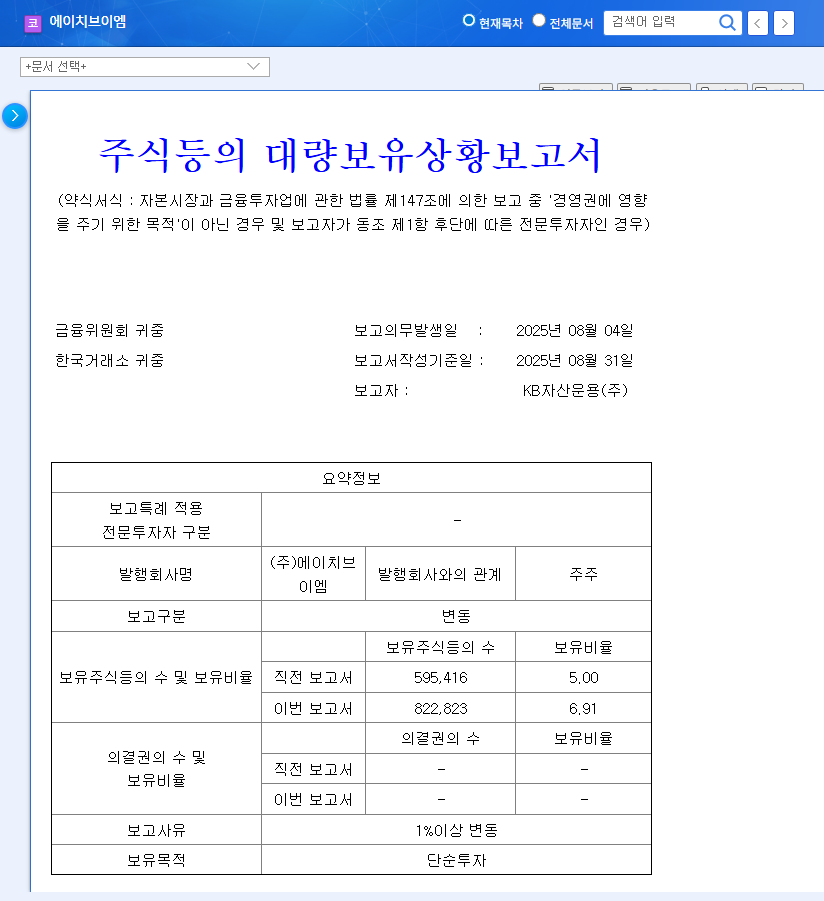

KB Asset Management Acquires 6.91% Stake in HVM: What Happened?

KB Asset Management increased its stake in HVM from 5.00% to 6.91% through on and off-market purchases between August 21 and 29, 2025. While the stated purpose is simple investment, the market sees it as a factor raising expectations for HVM’s growth potential.

Why the Stake Increase Matters: HVM’s Growth Potential

HVM supplies high-value-added metal materials essential for future growth industries such as aerospace, semiconductors, and displays. According to the 2025 semi-annual report, HVM is solidifying its growth foundation by increasing orders and diversifying its customer base based on its advanced materials technology. It is also expanding production capacity through the construction of a second plant and facility investment.

Impact of KB’s Investment on the Market

- Improved Supply and Demand, Strengthened Investor Sentiment: Institutional investors’ buying can attract market attention and provide upward momentum for stock prices.

- Reinforced Positive Outlook: KB Asset Management’s investment can be interpreted as a positive assessment of HVM’s growth potential.

- Enhanced Long-Term Stability: KB Asset Management’s increased influence can enhance management transparency and stability.

Action Plan for Investors

- Short-Term Investors: Focus on the continuation of improved supply and demand and short-term stock price trends.

- Long-Term Investors: Closely monitor the implementation of HVM’s growth strategies, earnings improvement, and securing orders in key industries.

Macroeconomic risks such as global economic slowdown, potential interest rate hikes, exchange rate fluctuations, raw material price volatility, and HVM’s profitability management should also be considered when investing. Before making an investment decision, carefully consider your investment propensity and goals.

FAQ

Why is KB Asset Management’s increased stake in HVM significant?

KB Asset Management’s increased stake can be interpreted as a positive market assessment of HVM’s growth potential. Investments from institutional investors generally increase a company’s value and can provide upward momentum for stock prices.

What is HVM’s main business?

HVM produces high-value-added metal materials used in advanced industries such as aerospace, semiconductors, and displays. They possess differentiated competitiveness based on vacuum melting technology.

What are the key considerations when investing in HVM?

Investors should continuously monitor macroeconomic risks, including a potential global economic slowdown, interest rate hikes, exchange rate fluctuations, raw material price volatility, and HVM’s profitability management.