What Happened? – Samsung’s Stake Change

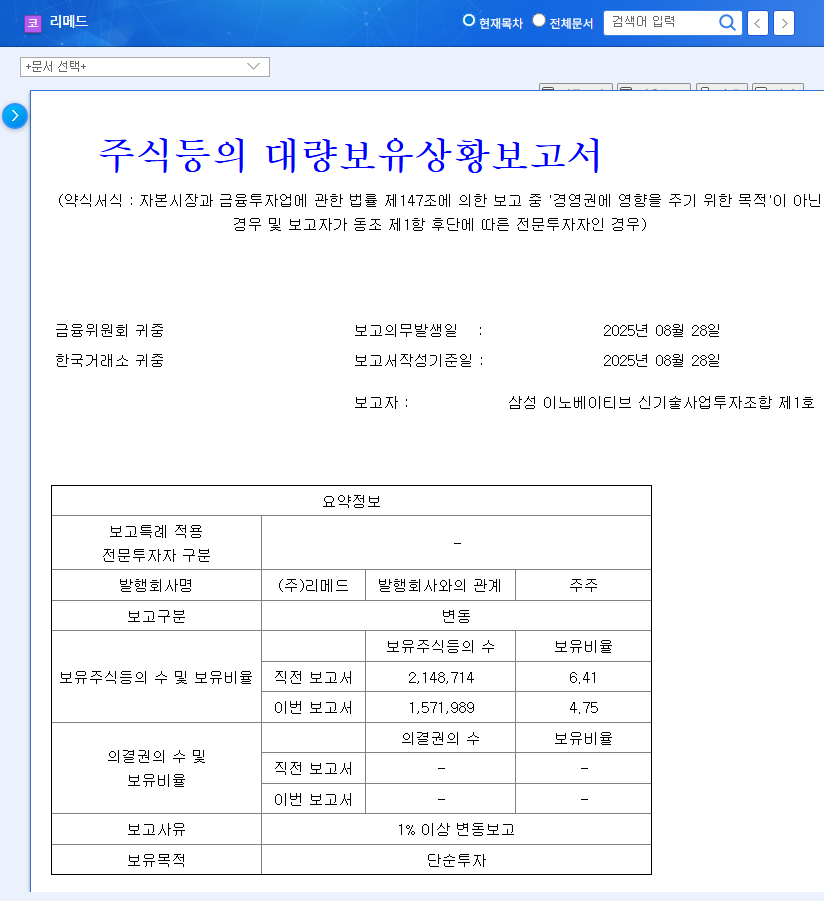

On September 3, 2025, Samsung Innovative New Technology Investment Association No. 1 reduced its stake in Remed (302550) from 6.41% to 4.75%, a decrease of 1.66%. This follows the conversion of convertible bonds into common stock on August 28th and is likely due to profit-taking or portfolio rebalancing.

Why Does It Matter? – Implications and Fundamental Analysis

While the stake change may cause short-term stock volatility, it doesn’t directly impact Remed’s fundamentals. The bond conversion is positive for Remed, strengthening its financial structure through increased capital.

However, Remed’s H1 2025 results show declining sales and operating profit, which could negatively impact investor sentiment. Decreased exports in the chronic pain treatment business are the primary cause, coupled with increased selling, general, and administrative expenses.

Positive aspects include FDA approval for a brain rehabilitation product, ongoing clinical trials for Alzheimer’s/stroke, collaboration with Zimmer in chronic pain treatment, and new product launches in the aesthetics business, all pointing to growth potential. However, FX volatility and rising logistics costs pose risks.

What Should Investors Do? – Investment Strategies

In the short term, investors should be mindful of potential selling pressure due to the stake change and monitor stock movements closely.

Long-term investors should focus on fundamental improvements, particularly sales recovery in the chronic pain treatment business and the performance of the aesthetics business. It’s crucial to distinguish between the effects of the bond conversion and actual value growth.

Key Monitoring Points:

- H2 2025 and full-year earnings (sales recovery, operating profit improvement)

- Overseas sales performance of chronic pain treatment and Zimmer collaboration

- Expansion of new indications for brain rehabilitation and market response to BrainStim

- New product launches and market competitiveness in the aesthetics business

- FX and macroeconomic trends

Frequently Asked Questions

What are Remed’s main businesses?

Remed operates in brain rehabilitation, chronic pain treatment, and aesthetics. Each area holds growth potential based on innovative technology.

How will Samsung’s stake change affect Remed’s stock price?

It may cause short-term volatility, but the long-term impact depends on fundamental improvements. The bond conversion is positive for Remed’s financial structure.

What should investors consider when investing in Remed?

Consider risk factors like weak H1 results and macroeconomic uncertainty. Continuously monitor future earnings improvements and new business performance.