1. What Happened?

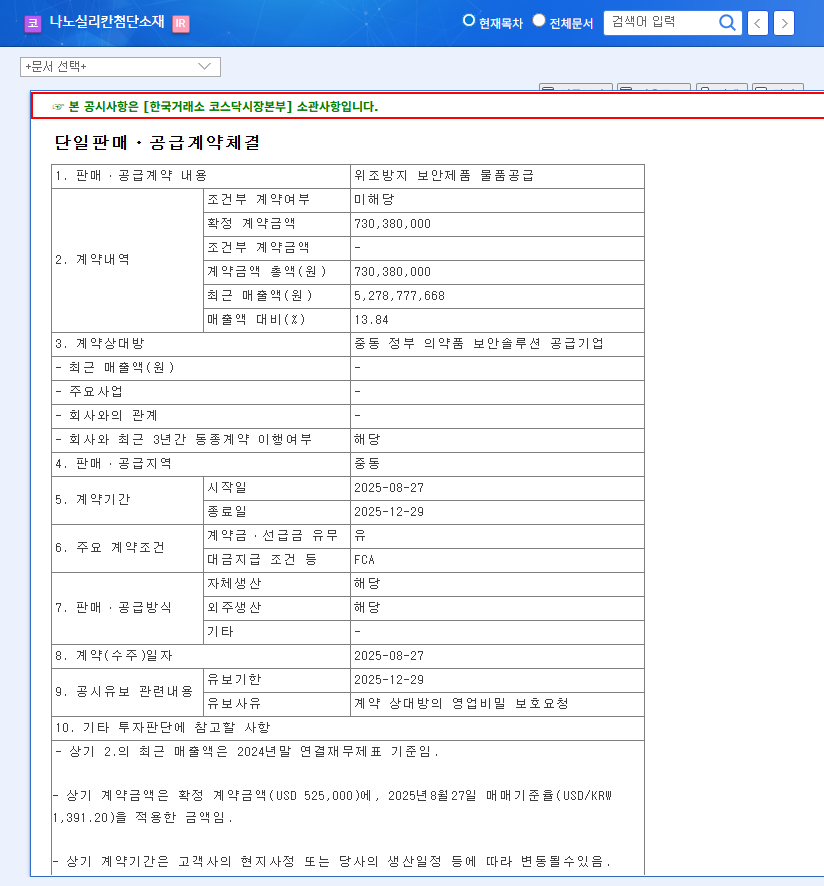

Nano Silicon Advanced Materials signed a $540,000 contract on August 27, 2025, with a Middle Eastern government pharmaceutical security solutions provider to supply anti-counterfeiting security products. The contract runs until December 29, 2025.

2. Why Does It Matter?

This contract is expected to provide a short-term boost to revenue and cash flow for Nano Silicon, which has been experiencing declining sales and widening operating losses. The successful win in the international market can be interpreted as a positive signal regarding the company’s technology and business competitiveness.

3. What’s the Impact?

Positive Aspects:

- Short-term revenue increase and improved cash flow

- Successful entry into the international market and potential for further contracts

- Potential boost to investor sentiment

Negative Aspects:

- Small contract size limits impact on fundamental financial issues

- Continued uncertainty surrounding new businesses (secondary battery anode materials, display materials)

4. What Should Investors Do?

The current investment recommendation is to ‘wait and see.’ While this contract is positive, it’s insufficient to address the company’s underlying problems. Close monitoring of future international contract wins, new business performance, and financial restructuring efforts is crucial. Given the company’s history of inaccurate disclosures, investors should also pay close attention to their efforts to enhance disclosure transparency.

Frequently Asked Questions

Will this contract turn around Nano Silicon’s performance?

While the contract offers a short-term positive impact, its small size limits its ability to resolve the company’s underlying financial challenges. A turnaround will depend on future business developments.

What are Nano Silicon’s main businesses?

In addition to its anti-counterfeiting security business, Nano Silicon is pursuing new ventures in secondary battery anode materials and display materials.

What should investors be cautious about?

Investors should monitor the company’s efforts to enhance disclosure transparency, given its past history, and closely watch for progress in its new business ventures and financial restructuring efforts.