1. Raontec Returns to Profitability! Riding the Wings of XR Market Growth

Raontec achieved a turnaround in the first half of 2025, recording sales of KRW 4.945 billion and operating profit of KRW 303 million. In particular, sales in the microdisplay business segment surged 218% year-on-year, driving overall growth. This is a result of the synergy between the rapid growth of the XR market and Raontec’s technological competitiveness in LCoS, Micro-OLED, and Micro-LED. As Raontec’s technology is adopted in various fields such as AR/VR glasses and automotive HUDs, its future growth is expected to further accelerate.

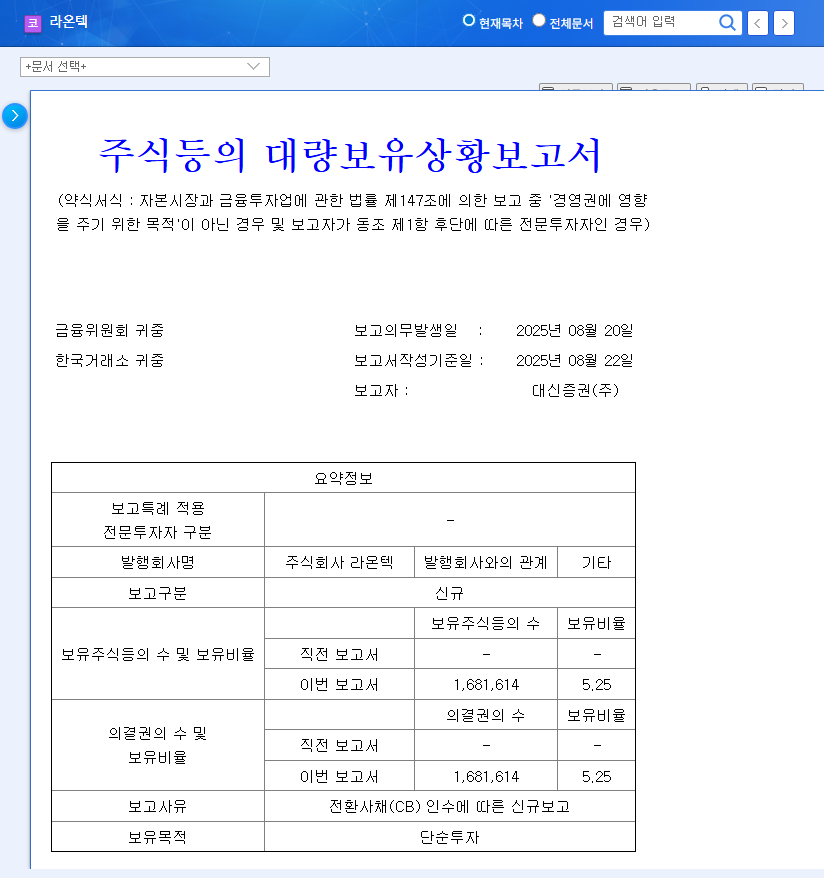

2. Daishin Securities’ Investment: A Vote of Confidence in Raontec’s Growth Potential?

Daishin Securities acquired a 5.25% stake in Raontec in August 2024 by acquiring convertible bonds (CBs). Although stated as a simple investment, Daishin Securities’ investment is interpreted as reflecting the market’s positive assessment of Raontec’s future growth potential. Through this investment, Raontec is expected to secure funds for R&D and mass production investment and enhance market credibility.

3. Risk Factors to Consider Before Investing

- Financial soundness: The rising trend in debt ratio and net debt-to-equity ratio is a point to note when investing.

- High R&D costs: While continuous R&D investment is essential, efficient cost execution for profitability management is important.

- Intensifying market competition: As competition in the XR market intensifies, Raontec’s differentiated technology and customer acquisition strategy are crucial.

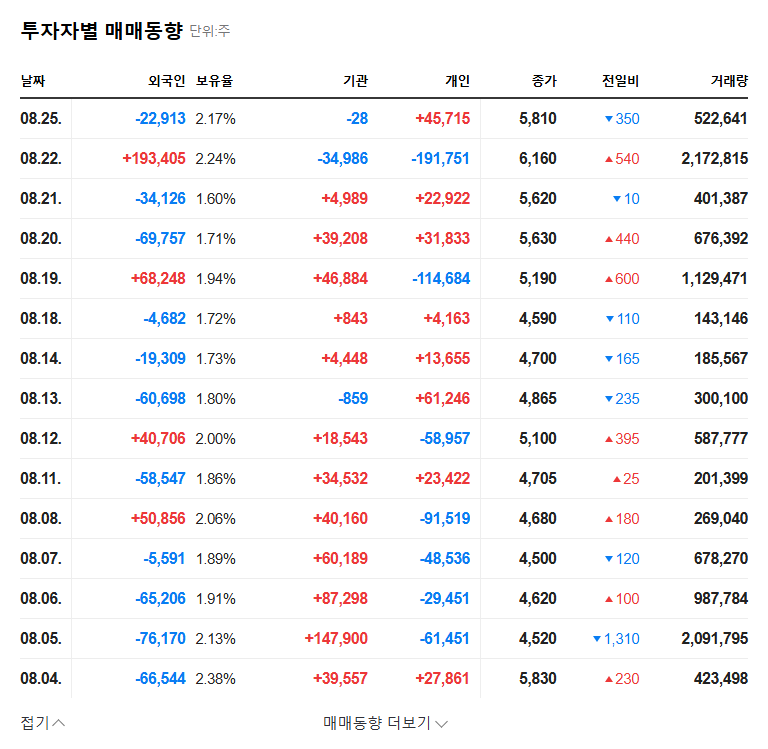

- CB conversion risk: The possibility of stock dilution due to an increase in the number of issued shares upon future CB conversion should be considered.

4. Action Plan for Investors

Raontec has high growth potential along with the growth of the XR market. However, before making an investment decision, it is important to carefully check the risk factors mentioned above and closely monitor the future mass production performance of the microdisplay business and the trend of profitability improvement.

What is Raontec’s core business?

Raontec’s core business is microdisplays. It possesses LCoS, Micro-OLED, and Micro-LED technologies used in AR/VR glasses, automotive HUDs, etc.

What is the significance of Daishin Securities’ investment in Raontec?

Daishin Securities’ investment is a case that shows the market’s positive evaluation of Raontec’s growth potential. Raontec is expected to expand R&D and mass production investments and enhance market credibility through the investment.

What are the points to note when investing in Raontec?

Considerations should be given to high R&D costs, financial soundness management, intensifying market competition, and the possibility of stock dilution due to CB conversion.