What Happened?

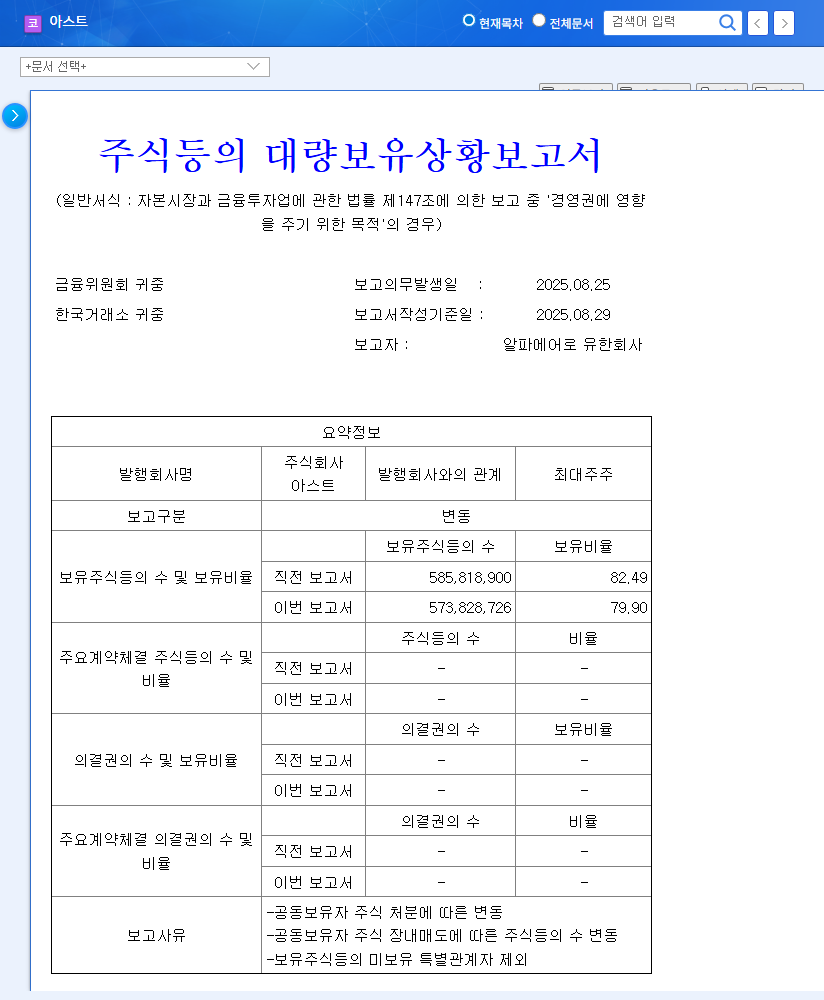

Several major shareholders of AST, including Smilegate Hwatong A-Jin Fund, Shinbo 2021 5th ABS, Shinhan Bank, IBK, Hana Bank, and Korea Investment Partners, have sold their shares through block deals. This resulted in a decrease in the largest shareholder Alpha Aero’s stake from 82.49% to 79.90%.

Why the Sell-Off and What’s the Impact?

This large-scale sell-off is likely to put downward pressure on AST’s stock price in the short term due to potential market imbalances and weakened investor sentiment. However, with Alpha Aero still holding 79.90% of the shares, the likelihood of management instability is low. The medium to long-term impact depends on the motivations of the selling shareholders. It’s crucial to determine whether the sales were driven by financial reasons or a negative outlook on the company’s future. Furthermore, AST faces challenges such as a high debt burden from large-scale fundraising and potential stock dilution from convertible bond exercises.

What Should Investors Do?

A cautious approach is recommended in the short term. Investors should closely monitor the selling shareholders’ intentions and market reactions, preparing for potential further declines. In the medium to long term, focus on AST’s fundamental improvements, the impact of the Securities and Futures Commission’s actions, and the company’s efforts to restore trust. Staying informed about Alpha Aero’s future shareholding plans, financial restructuring, and new business developments through official disclosures is crucial.

Why did the major shareholders sell their AST stock?

The exact reasons for the sell-off have not been disclosed. It could be due to financial reasons or a negative outlook on the company’s future. Further information is needed.

Is AST’s management stable?

With Alpha Aero holding 79.90% of the shares, the likelihood of short-term management instability is low.

What should investors consider before investing in AST?

Investors should consider the high debt burden from large-scale fundraising, potential stock dilution from convertible bond exercises, and the impact of the Securities and Futures Commission’s actions.