What Happened?

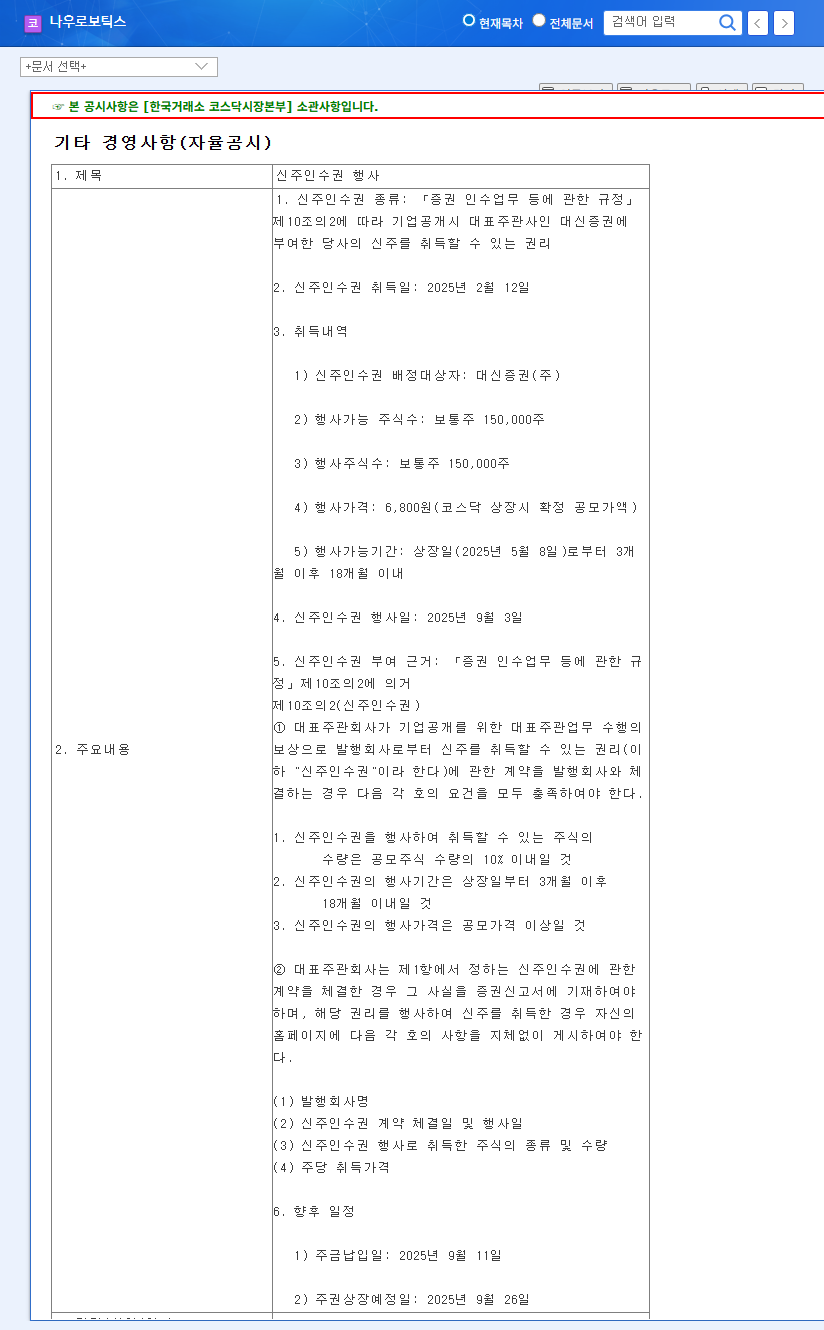

Daishin Securities exercised 150,000 warrants of Now Robotics at the exercise price of KRW 6,800 per share. The new shares are expected to be listed on September 26th.

Why Does It Matter?

This exercise can be interpreted as a positive signal, indicating Daishin Securities’ confidence in Now Robotics’ growth potential. However, the possibility of Daishin Securities selling the new shares for profit realization cannot be ruled out, which could lead to short-term downward pressure on the stock price.

- Positive Aspects: Improved financial soundness and increased investment capacity due to KRW 1.02 billion in funding.

- Negative Aspects: Potential selling pressure from Daishin Securities and increased short-term stock volatility.

What Should Investors Do?

Short-term investors should carefully monitor Daishin Securities’ selling timing and market reactions. Long-term investors should continuously monitor changes in the company’s fundamentals, particularly the utilization rate of the new factory, market response to new products, R&D achievements, and profitability improvement trends.

Investor Action Plan

- Short-term Investors: Be mindful of stock volatility, understand Daishin Securities’ selling trends.

- Long-term Investors: Monitor fundamentals and performance improvement indicators.

FAQ

What are warrants?

Warrants are rights to buy newly issued shares at a specified price within a certain period.

How will this warrant exercise affect Now Robotics’ stock price?

In the short term, selling pressure from Daishin Securities may cause downward pressure on the stock price. However, in the long term, securing growth momentum through funding may have a positive impact.

What is the outlook for Now Robotics?

Positive growth is expected along with the growth of the robot and automation market, but the challenge of improving profitability must be addressed. Continuous monitoring of new factory utilization rates, new product launches, and R&D achievements is necessary.