1. What Happened? Q2 Earnings Decline

Korea PI&M’s Q2 2025 results showed a decline in sales, a sharp drop in operating profit, and a net loss. Compared to the same period last year, sales decreased, operating profit plummeted, and the company swung to a net loss.

2. Why Did This Happen? Analyzing the Causes

The reasons for this decline are multifaceted. Temporary impacts from the Vietnam factory expansion and relocation, increased R&D investment, higher SG&A expenses, increased financial costs and foreign exchange losses all contributed. External factors such as rising exchange rates and shipping costs also played a role.

3. What’s Next? Korea PI&M’s Future Outlook

There are positive aspects. The KOSDAQ listing strengthened the company’s financial health, and the solid technological foundation in its core automotive and medical parts businesses, along with the growth potential of its new smart device components business, remain promising. However, sustained efforts are needed to overcome short-term profitability challenges and realize this growth potential.

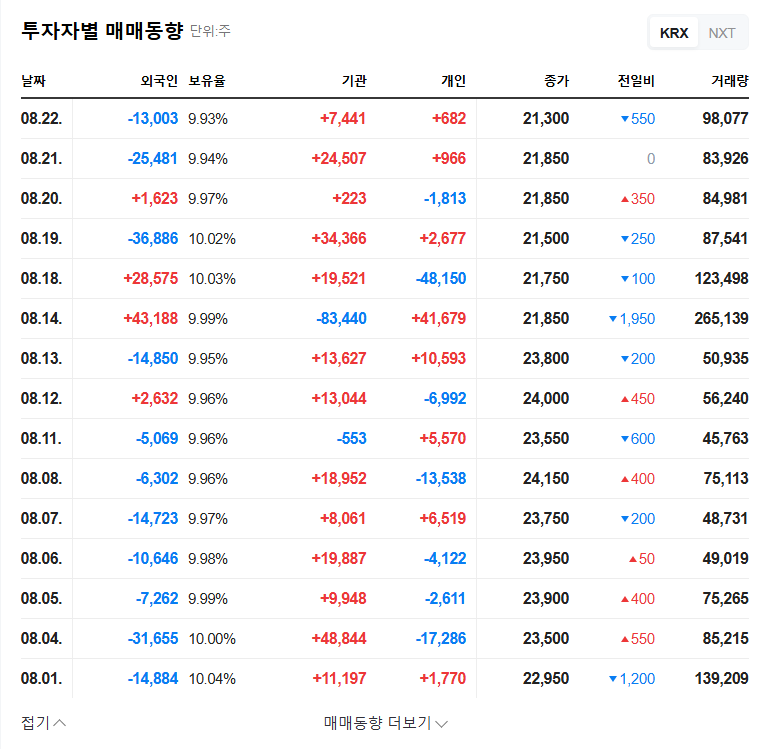

4. What Should Investors Do? Investment Strategy

The current investment recommendation for Korea PI&M is ‘Neutral’. While the long-term growth potential is acknowledged, the short-term earnings decline and macroeconomic uncertainties must be considered. Investors should closely monitor future earnings trends, the company’s exchange rate risk management strategy, and the performance of its new businesses before making investment decisions.

Q: How was Korea PI&M’s Q2 2025 performance?

A: The company reported weak results with declining sales, a sharp drop in operating profit, and a net loss.

Q: What are the reasons for the decline?

A: Factors include Vietnam factory expansion, increased R&D investment, higher SG&A expenses, increased financial costs and FX losses, rising exchange rates, and higher shipping costs.

Q: What is the outlook for Korea PI&M?

A: The solid technology in core businesses and the growth potential of new businesses are positive, but short-term profit decline needs to be addressed. The investment recommendation is ‘Neutral’.