What was discussed at the Nextchip IR?

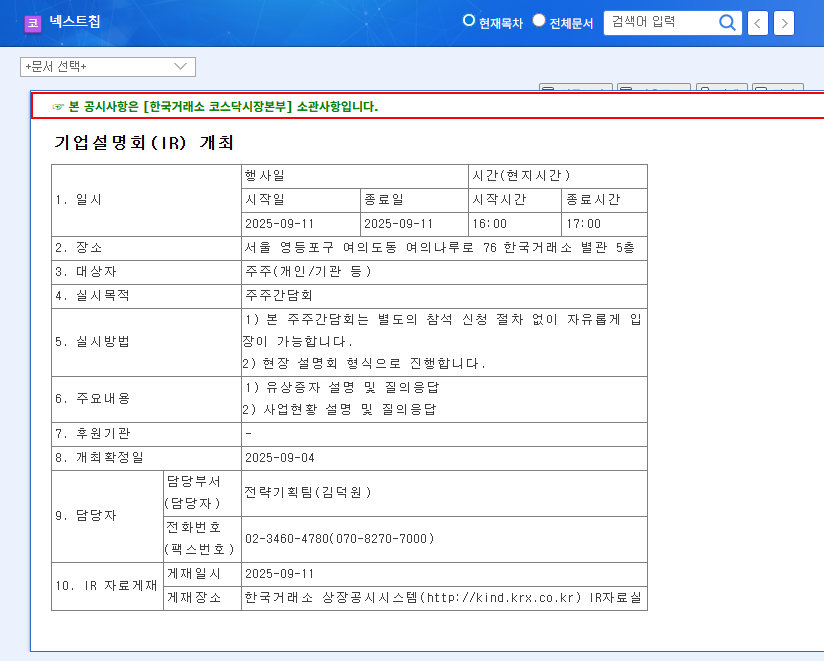

Nextchip held an investor relations (IR) session on September 11, 2025, primarily focused on addressing shareholders and explaining the company’s current situation. The key topics included the announcement of a rights offering aimed at mitigating the severe financial crisis, along with a presentation on business performance and a Q&A session. Facing challenges such as worsening capital impairment, declining sales, and continuous operating losses, Nextchip aimed to alleviate investor concerns and build confidence in their future plans through this IR.

Why is Nextchip in this situation?

- Financial Crisis: As of the first half of 2025, Nextchip is in a state of complete capital impairment (-167.7 billion KRW) with a debt-to-equity ratio of -2,779%.

- Poor Performance: Sales in the first half of 2025 decreased by 43.9% year-on-year, and both operating and net losses are continuing.

- Business Struggles: Intensified competition in their main business, automotive semiconductors, coupled with slow sales in their new robotics/drone ventures have contributed to their difficulties.

So, what’s next for Nextchip?

The success of the rights offering announced during the IR will likely determine Nextchip’s future. The company plans to use the funds raised to improve its financial structure and invest in new businesses. However, the success of the rights offering and the performance of new businesses remain uncertain.

What should investors do?

- Monitor Rights Offering Results: Carefully examine the outcome of the rights offering and the company’s plans for utilizing the funds.

- Analyze Business Recovery Potential: Assess Nextchip’s strategies for regaining competitiveness in the automotive semiconductor market, along with the projected timeline for revenue generation and growth potential of its new businesses.

- Utilize IR Information: Thoroughly review the IR materials and Q&A content to evaluate management’s vision and execution capabilities.

Frequently Asked Questions (FAQ)

What is Nextchip’s current financial status?

As of the first half of 2025, Nextchip is in a state of complete capital impairment, with a very high debt-to-equity ratio. Refer to the IR materials and public disclosures for detailed information.

Why is Nextchip conducting a rights offering?

The rights offering is being conducted to raise capital to address the severe financial crisis and invest in new business ventures.

Should I participate in the rights offering?

Investment decisions are personal. Carefully consider the terms of the rights offering and Nextchip’s future prospects before making a decision. Seeking professional advice is also recommended.

What does the future hold for Nextchip?

The company’s future depends on the success of the rights offering and the performance of its new businesses. Review IR materials and market analysis to make informed decisions.