1. What Happened? Yulho Announces Rights Offering

On August 25, 2025, Yulho announced that it is considering a rights offering to raise capital for investments in new businesses, such as battery recycling, waste treatment, and AI.

2. Why the Rights Offering? Yulho’s Current Situation and Funding Needs

Beyond its existing IT infrastructure business, Yulho is pursuing various new ventures for future growth. These investments require substantial capital, and the company’s net loss of 4.5 billion won and debt-to-equity ratio of 167.60% in the first half of 2025 pose financial challenges. The rights offering aims to improve Yulho’s financial structure and secure funding for these new ventures.

3. What’s Next? Potential Benefits and Risks of the Rights Offering

- Potential Benefits: Improved financial structure, increased investment in new businesses.

- Potential Risks: Stock dilution, uncertainty of funding success.

The rights offering is a double-edged sword. Successful funding can pave the way for growth, while failure could lead to stock price decline and increased financial burden.

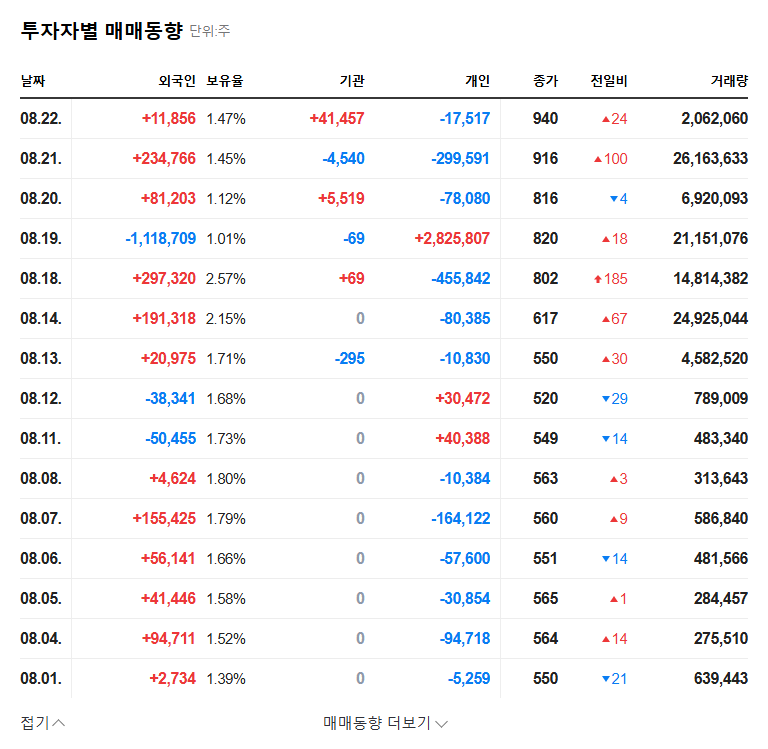

4. What Should Investors Do? Key Investment Considerations

- Review the terms of the rights offering (offering price, size, participants).

- Monitor the performance of new businesses (e.g., operation of the battery recycling plant, progress of waste treatment projects).

- Track improvements in financial health (debt-to-equity ratio, operating cash flow).

- Analyze the impact of macroeconomic indicators (interest rates, exchange rates, commodity prices).

Frequently Asked Questions

What is a rights offering?

A rights offering allows existing shareholders to purchase newly issued shares at a discounted price. This provides companies with a way to raise capital.

When will Yulho’s rights offering be finalized?

The rights offering is currently under review, and no details have been finalized. Further announcements will be made through official disclosures.

How will the rights offering affect Yulho’s stock price?

While the increased number of shares could lead to dilution, the anticipated business expansion from the funding could also positively influence the stock price.