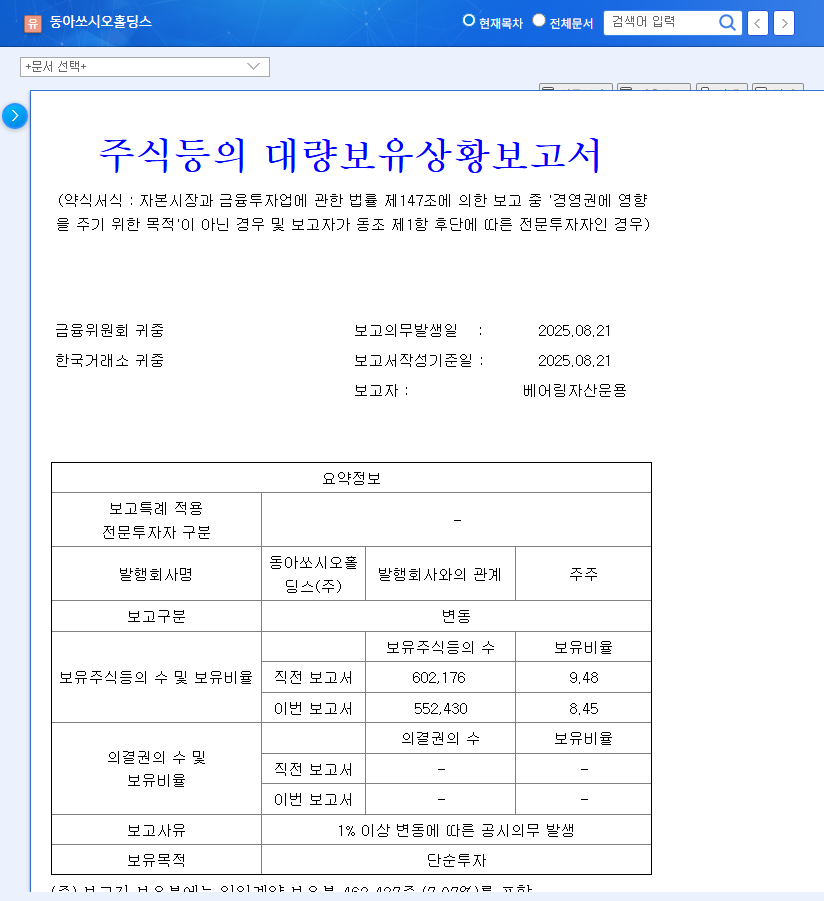

What Happened? Bearing Asset Management Reduces Dong-A Socio Holdings Stake

Bearing Asset Management decreased its stake in Dong-A Socio Holdings from 9.48% to 8.45%, a reduction of approximately 1%. While the stated purpose was ‘simple investment,’ this significant change triggered mandatory disclosure requirements.

Sell-off Background and Fundamental Analysis: Opportunity or Crisis?

This sell-off could reflect Bearing Asset Management’s internal investment strategy changes or concerns about Dong-A Socio Holdings’ fundamentals. While the company has positive factors such as growth in the biosimilar sector and shareholder return policies, there are also negative factors like declining consolidated revenue and legal risks related to Dong-A ST. The current macroeconomic environment also presents challenges, including the rising USD/KRW exchange rate, which could negatively impact the company.

Future Stock Outlook and Investment Strategies: How Should Investors Respond?

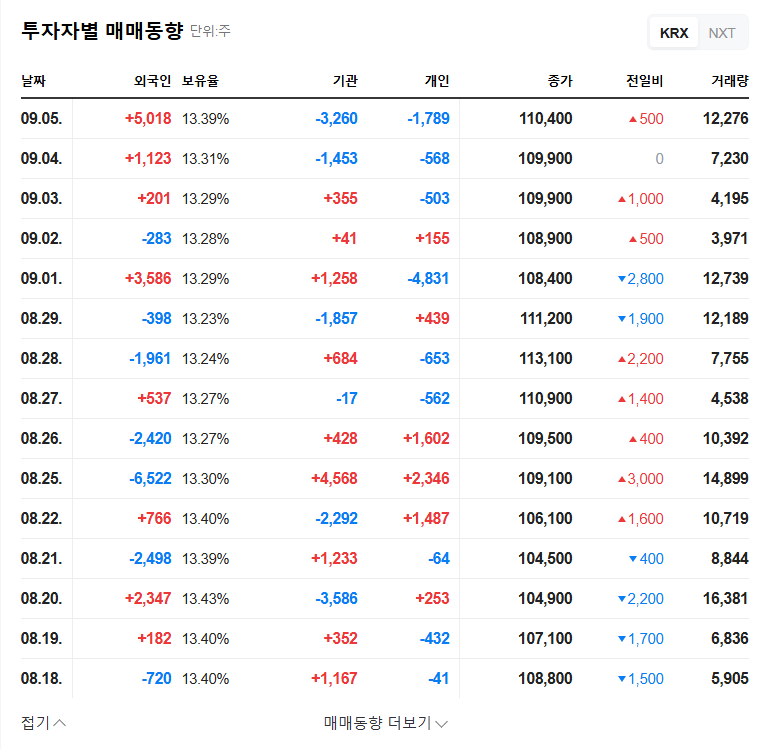

This large-scale sell-off is likely to exert downward pressure on the stock price in the short term. However, from a long-term perspective, it’s crucial to consider the growth potential of the biosimilar business, the stabilization of Dong-A ST’s business, and macroeconomic variables.

- Short-term investors: It’s advisable to remain cautious and observe whether further sell-offs occur.

- Long-term investors: Pay attention to future earnings announcements and business updates, and carefully analyze the company’s fundamentals.

Frequently Asked Questions (FAQ)

How will Bearing Asset Management’s stake sale affect Dong-A Socio Holdings’ stock price?

In the short term, it’s likely to put downward pressure on the price. However, the long-term impact will depend on the company’s fundamentals and market conditions.

How should investors respond?

Short-term investors should wait and see, while long-term investors should analyze the company’s fundamentals and macroeconomic variables to make investment decisions.

What is the future outlook for Dong-A Socio Holdings?

There is growth potential in the biosimilar sector, but uncertainties remain, including legal risks related to Dong-A ST. Investors should monitor future earnings and business developments.