1. Key Takeaways from the IR: What Was Announced?

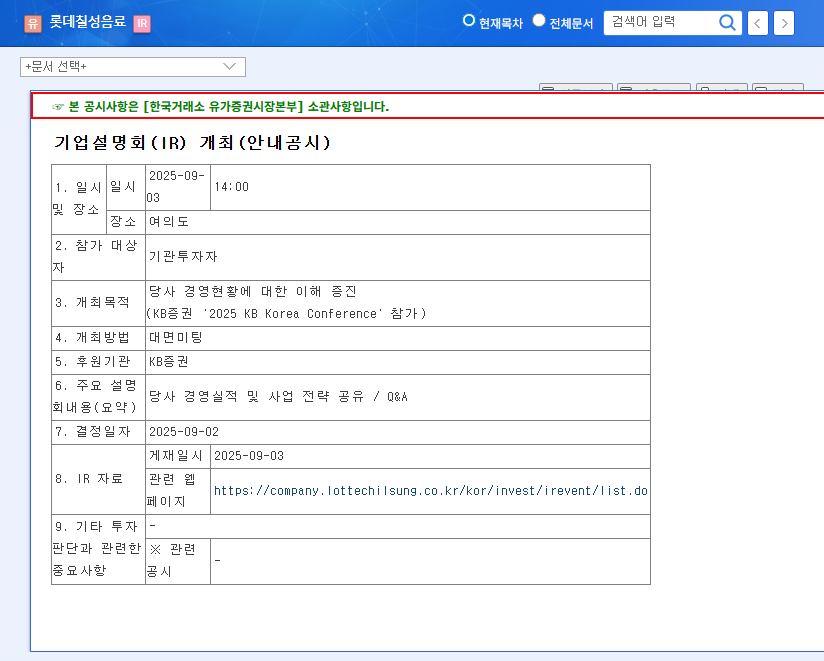

On September 9, 2025, Lotte Chilsung Beverage participated in the Korea Exchange/Korea IR Association online IR event, presenting its first-half business performance and future business strategies. Key takeaways include strengthening its product portfolio reflecting the ‘healthy pleasure’ trend, expanding overseas markets, and securing growth engines through new business investments.

2. Why Should Investors Pay Attention to Lotte Chilsung?

- Leading the Healthy Pleasure Trend: Expanding market share with zero-calorie and health-functional products like ‘Tams Zero’, ‘Milkis Zero’, and ‘Saero’ soju.

- Accelerating Global Market Penetration: Increasing exports of beverages and alcoholic beverages in overseas markets such as Russia, China, the US, and Europe.

- Securing New Growth Engines: Diversifying business through investments in food-grade liquefied carbon dioxide manufacturing and subsidiaries.

- Robust ESG Management: Strengthening sustainable management through initiatives like label-free bottled water and RE100 membership.

3. Action Plan for Investors

This IR provides a valuable opportunity to assess Lotte Chilsung Beverage’s growth potential. Investors should pay attention to the following:

- Specific payback period and profitability outlook for new business investments.

- Effectiveness and competitiveness analysis of overseas market expansion strategies.

- Measurement of ESG management performance and future plans.

- Risk management measures for potential risks such as fluctuations in raw material prices and exchange rates.

It is crucial to make investment decisions by comprehensively considering the IR content and market conditions.

Q: What are the main growth drivers for Lotte Chilsung Beverage?

A: The main growth drivers are zero-calorie beverages and alcoholic beverages reflecting the ‘healthy pleasure’ trend, active expansion into overseas markets, and business diversification through new business investments.

Q: What should investors be aware of when investing in Lotte Chilsung Beverage?

A: Investors should consider factors such as volatility in raw material prices, exchange rate fluctuation risks, intensifying competition, and dependence on major subsidiaries. Furthermore, efforts to improve factory utilization rates and differentiated product development and marketing strategies are also crucial.