1. What Happened?

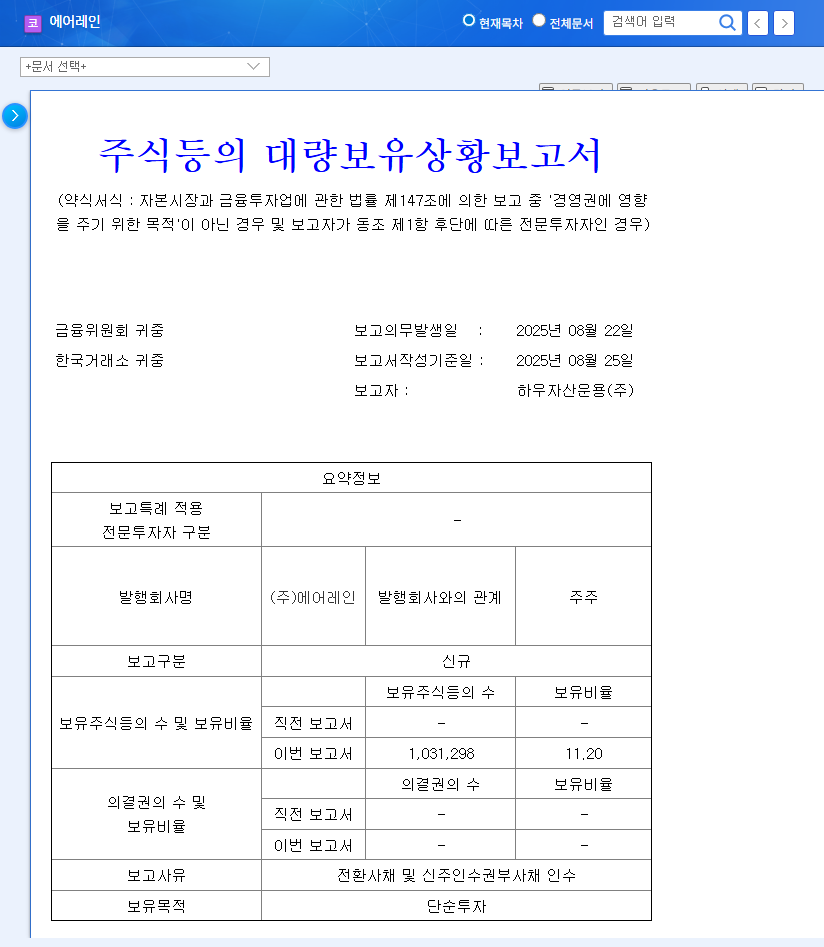

How Asset Management acquired 11.20% of AirRain’s shares through Convertible Bonds (CB) and Bonds with Warrants (BW). Although stated as a simple investment, the market interprets this as a positive signal for AirRain’s growth potential.

2. Why Should You Pay Attention?

AirRain possesses a robust business portfolio, including nitrogen generation modules, nitrogen generation devices for hydrogen charging stations, and biogas upgrading projects. In particular, the Carbon Capture, Utilization, and Storage (CCUS) project is attracting attention as a future growth driver following successful demonstration with Lotte Chemical. As of the first half of 2025, AirRain achieved sales of KRW 14.88 billion and operating profit of KRW 2.25 billion, maintaining solid growth. The debt ratio also decreased significantly to 24%.

3. What’s Next?

How Asset Management’s investment is expected to enhance market confidence in AirRain and improve investor sentiment. It’s likely to become a short-term stock price catalyst, and in the mid-to-long term, there’s further upside potential alongside the growth of the CCUS business. However, the possibility of stock dilution due to CB/BW conversion should be noted.

4. Investor Action Plan

- Maintain a Positive Outlook: Considering AirRain’s growth and investment momentum, maintain a positive investment outlook.

- Monitor Stock Price and Related Information: Continuously monitor short-term stock price volatility, How Asset Management’s further actions, and information related to CB/BW conversion.

- Watch Exchange Rate Fluctuations: Given the high proportion of overseas sales, monitor exchange rate trends and analyze their impact on performance.

FAQ

Why is How Asset Management’s investment in AirRain significant?

How Asset Management’s investment is a significant signal of market confidence in AirRain’s growth potential. It can act as both a short-term catalyst for stock price increase and a factor that elevates long-term investment value.

What are AirRain’s key growth drivers?

AirRain operates various businesses including nitrogen generation modules, nitrogen generation devices for hydrogen stations, and biogas upgrading. The Carbon Capture, Utilization, and Storage (CCUS) project is attracting significant attention as a future growth driver.

What are the key considerations when investing in AirRain?

Investors should consider the potential stock dilution from future CB/BW conversion and performance volatility due to exchange rate fluctuations. All investment decisions should be made at the investor’s own discretion and responsibility.