1. Gemvax Announces ₩248.6B Rights Offering: What’s Happening?

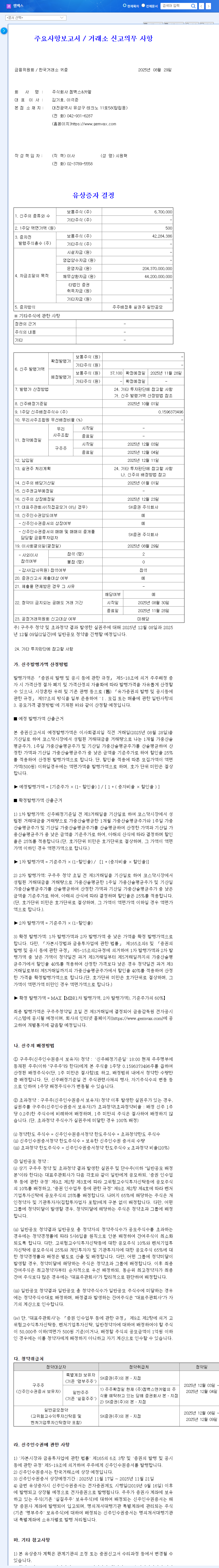

Gemvax is conducting a rights offering of ₩248.6 billion through a rights issue followed by a public offering of unexercised rights. The allocation ratio is 0.16 shares per existing share. The funds raised will be used for operating expenses (₩204.4 billion) and debt repayment (₩44.2 billion).

2. Why the Rights Offering?

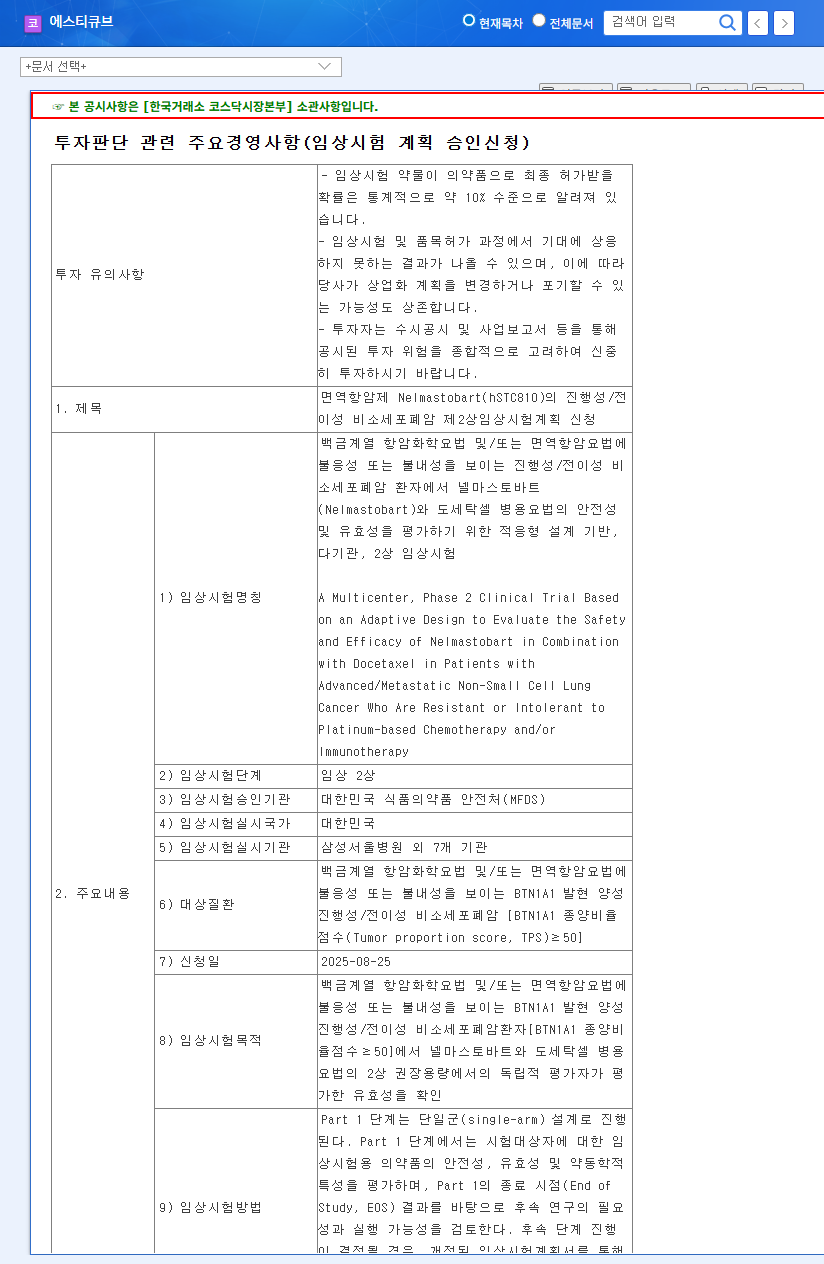

Gemvax operates in the environmental pollution control and biopharmaceutical businesses (GV1001 drug development). Currently facing a high debt-to-equity ratio, improving its financial structure is a pressing issue. This rights offering aims to secure operating funds, reduce debt, and strengthen financial health. Furthermore, Gemvax plans to actively invest in its future growth engine, the biopharmaceutical business, specifically GV1001 drug development, to accelerate clinical trials.

3. Rights Offering: Opportunity or Risk?

- Positive Aspects:

- Enhanced business operating stability

- Improved financial structure

- Accelerated GV1001 drug development (Alzheimer’s, Progressive Supranuclear Palsy)

- Negative Aspects:

- Potential stock dilution

- Increased fundraising costs

- Short-term stock price decline risk

- Uncertainty in return on investment

4. What Should Investors Do?

This rights offering could be a crucial step for Gemvax’s long-term growth, but investors should also be mindful of potential short-term stock price volatility. Careful investment decisions should be made based on close monitoring of the following: GV1001 clinical trial results, transparency in fund allocation, and management’s decision-making.

What is the purpose of Gemvax’s rights offering?

The purpose is to improve the financial structure by securing operating funds (₩204.4 billion) and repaying debt (₩44.2 billion), and to invest in the biopharmaceutical business (GV1001 drug development) to secure growth momentum.

How will the rights offering affect the stock price?

In the short term, there is a possibility of stock dilution due to the increase in the number of shares. However, in the long term, if the funds secured through the rights offering lead to positive business performance, stock price appreciation can be expected.

What are Gemvax’s main businesses?

Gemvax operates in environmental pollution control (Chemical Air Filter) and biopharmaceuticals (GV1001 drug development).