1. The $660M European Deal: What’s It About?

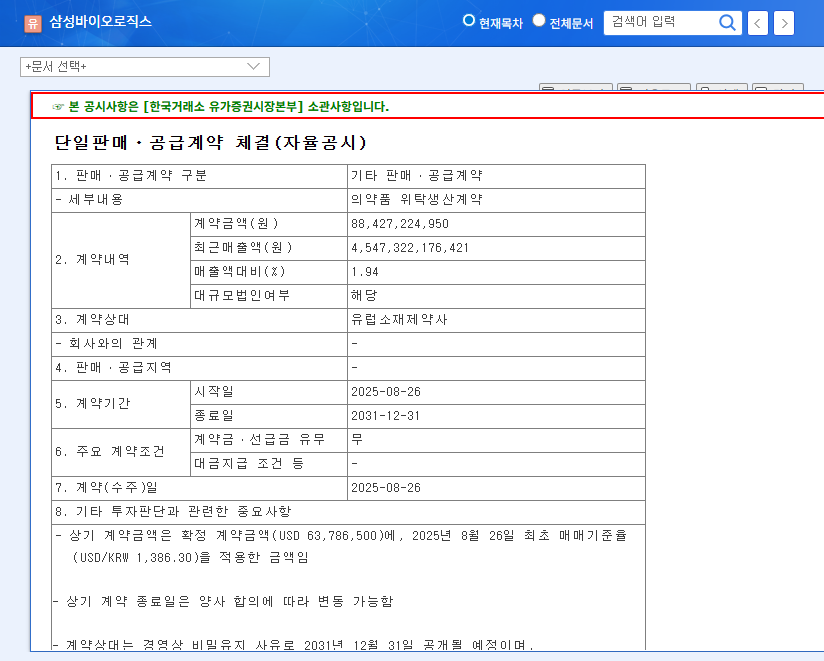

Samsung Biologics has signed a contract with a European pharmaceutical company for pharmaceutical production, valued at $660 million. The contract spans from August 26, 2025, to December 31, 2031 – a substantial period of 6 years and 4 months. This represents 1.94% of Samsung Biologics’ revenue and is expected to significantly contribute to securing stable sales.

2. Why Is This Contract Significant?

This contract holds greater importance than a typical order. Amidst increasing competition in the global CDMO market, it validates Samsung Biologics’ technological prowess and production capabilities. The long-term nature of the contract enhances the predictability of future revenue and strengthens business stability. Recent amendments to the business report further solidify investor confidence by clarifying the contract terms.

3. What Does This Mean for Investors?

This contract is projected to positively impact Samsung Biologics’ stock price. The anticipation of stable revenue and growth potential can stimulate investor sentiment. However, potential risk factors such as fluctuations in the USD/KRW exchange rate and intensified global competition necessitate ongoing monitoring.

4. Investor Action Plan

- Positive Aspects: Considering the competitiveness of Samsung Biologics’ CDMO business and the stability of the long-term contract, it presents a positive outlook for long-term investment.

- Points of Caution: Investors should monitor potential risk factors such as exchange rate volatility, intensifying competition, and macroeconomic variables.

- Key Checkpoints: Evaluate the company’s ability to manage exchange rate risks, its commitment to continuous R&D investment, and its efforts to secure new pipelines.

Q: How will this contract affect Samsung Biologics’ stock price?

A: It is expected to have a positive influence. However, investors should exercise caution due to potential risks like exchange rate fluctuations and intensified competition.

Q: What is the CDMO business?

A: CDMO stands for Contract Development and Manufacturing Organization. It refers to the business of undertaking pharmaceutical development and production on behalf of pharmaceutical companies.

Q: Who are Samsung Biologics’ main competitors?

A: Key competitors include Lonza and WuXi Biologics.