HD201’s European Entry: What’s the Big Deal?

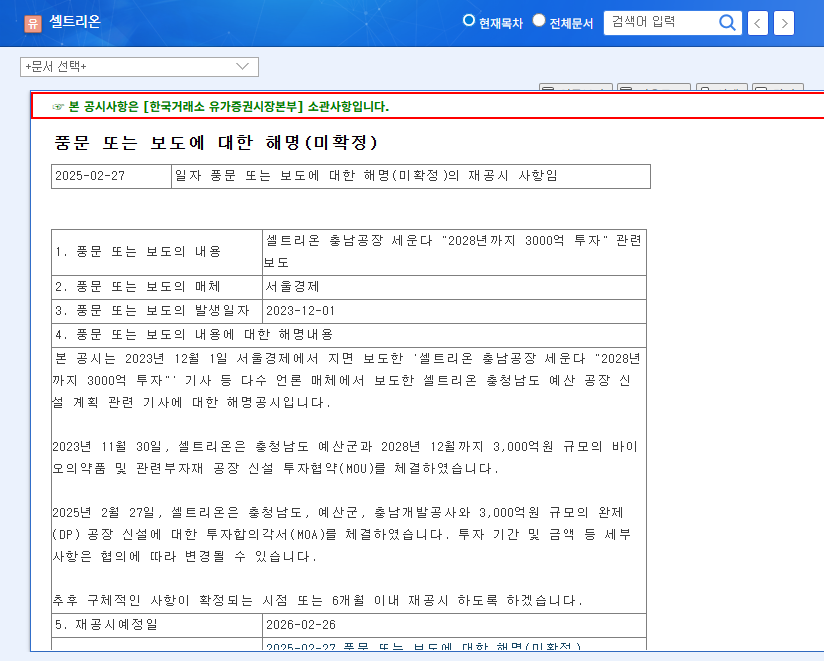

The European approval of HD201 (Herceptin biosimilar) is a major validation of Prestige Biologics’ technological capabilities. Entering the European market is expected to be a key driver of sales growth. Furthermore, the growth of the CDMO business is also noteworthy, showing consistent revenue growth in line with the expanding global biopharmaceutical market.

Potential Risks to Consider Before Investing

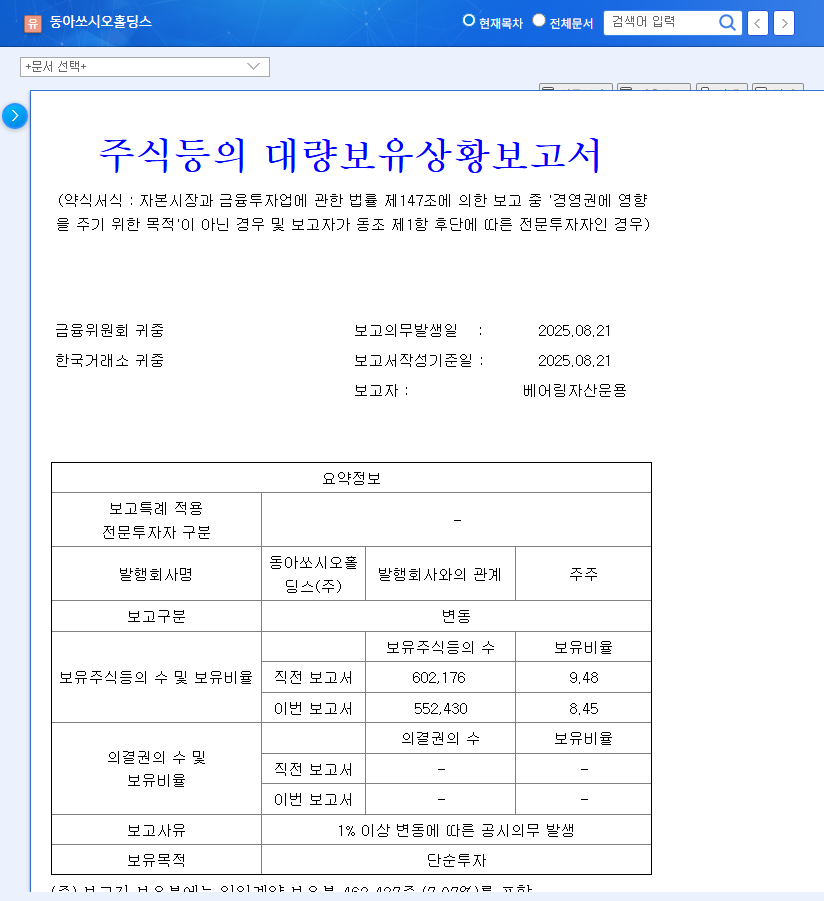

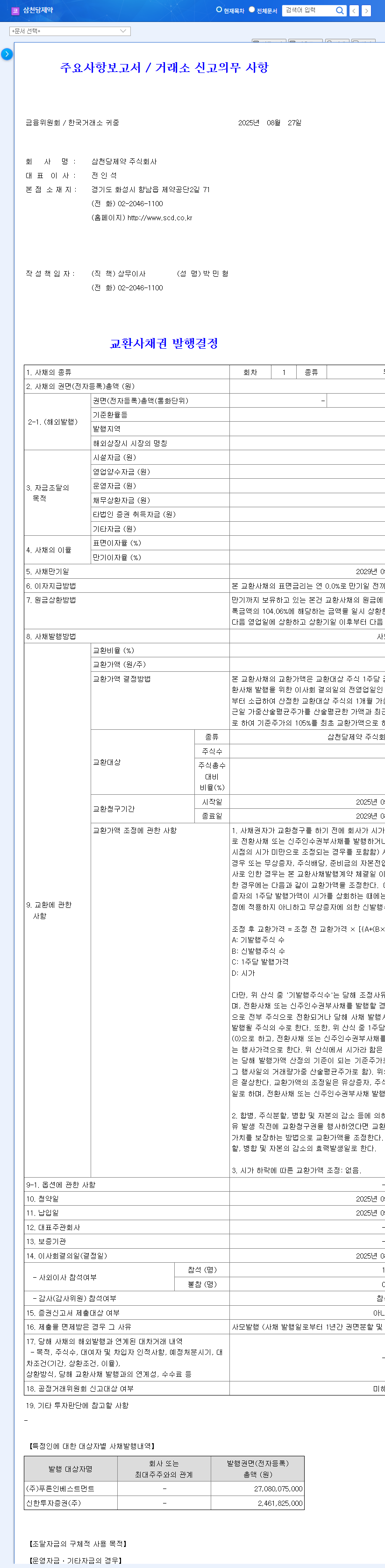

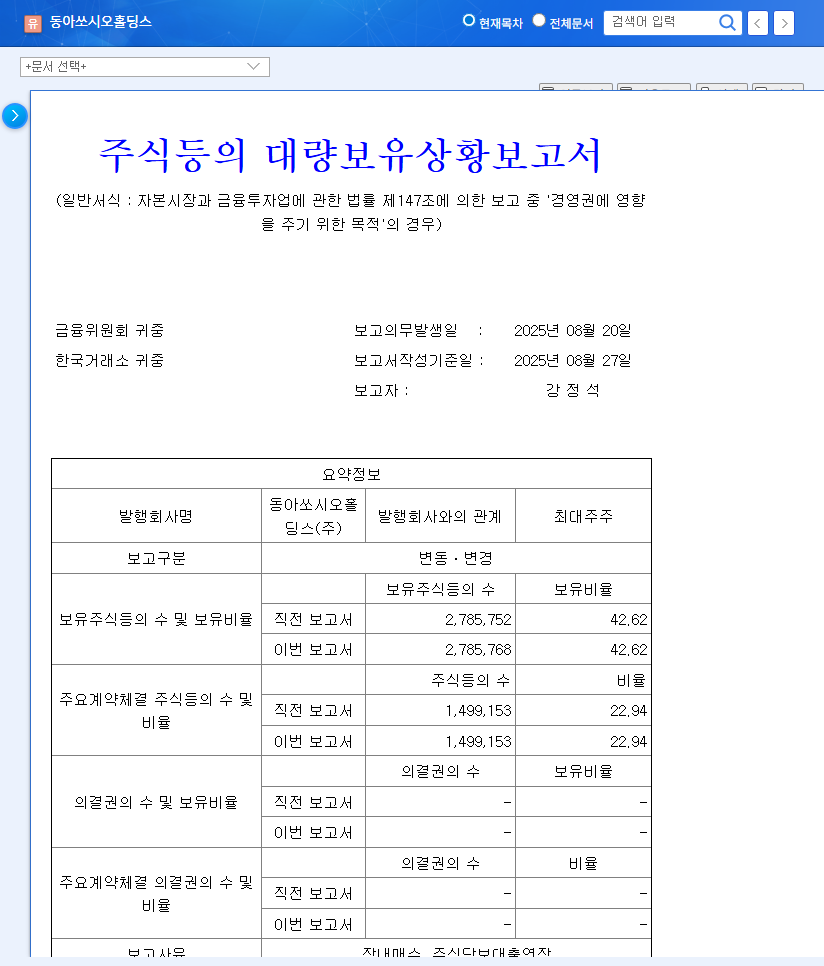

The picture isn’t entirely rosy. Ongoing operating losses and high R&D expenses remain challenges to overcome. High debt-to-equity ratio and convertible bond burdens also raise concerns about financial stability. The current high-interest rate environment and exchange rate volatility are additional external risk factors to consider.

So, Should You Invest in Prestige Biologics Now?

The current investment recommendation is ‘Hold and Cautious Observation’. The success of HD201’s commercialization and the trend of earnings improvement should be closely monitored. The reduction in operating losses and the timing of turning to profit will be important investment indicators.

Action Plan for Investors

- Existing investors: Hold from a medium- to long-term perspective and monitor earnings improvement trends.

- New investors: Make investment decisions after confirming the commercialization performance of HD201 and improvements in profitability. Paying close attention to changes in financial indicators is crucial.

Frequently Asked Questions (FAQ)

Why is the European approval of HD201 significant?

It opens doors to the European market, potentially boosting sales and validating the company’s technological prowess.

What are the main risk factors for Prestige Biologics?

Key risks include ongoing operating losses, high R&D expenses, and concerns about financial soundness.

Is it a good time to invest?

It’s advisable to monitor the success of HD201’s commercialization and profit improvement trends before investing. The recommendation is ‘Hold and Cautious Observation’.