Cosmax’s Hair Loss Patent: What’s the Big Deal?

Cosmax has secured a patent for a hair loss treatment utilizing the ‘Bifidobacterium animalis subsp. lactis strain (DS008)’. This strain has shown promising results in strengthening hair roots, improving hair elasticity and texture, increasing shine and thickness, and repairing damaged hair.

What Does This Patent Mean for Cosmax BTI?

This patent is expected to bolster Cosmax BTI’s core skincare and haircare business by providing a technological advantage and enhancing product competitiveness. It also opens doors to expanding their high-value-added product line based on biotechnology, securing future growth engines. Furthermore, it reinforces the company’s R&D capabilities and positively impacts brand image.

Key Analysis and Action Plan for Investors

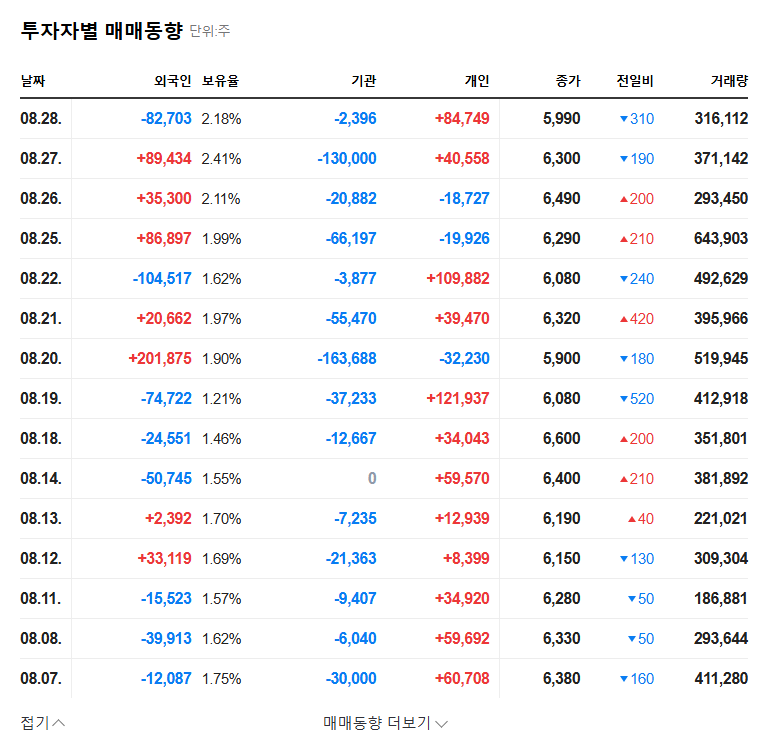

While the patent acquisition is positive in the long term, translating it into immediate financial gains will take time. Investors should closely monitor the following:

- Development and launch schedule of products based on the patented technology

- Market response and sales performance of new products

- Competitors’ technological advancements

Post-launch market response and sales performance will be crucial for adjusting investment strategies.

Frequently Asked Questions

Will this patent immediately impact Cosmax BTI’s stock price?

The patent acquisition itself might not have a significant immediate impact on the stock price. The actual product launch and market reception are expected to be the key drivers.

Who are Cosmax BTI’s competitors?

Key competitors include Kolmar Korea and Cosmecca Korea.