1. WeMade’s Treasury Stock Disposal: What Happened?

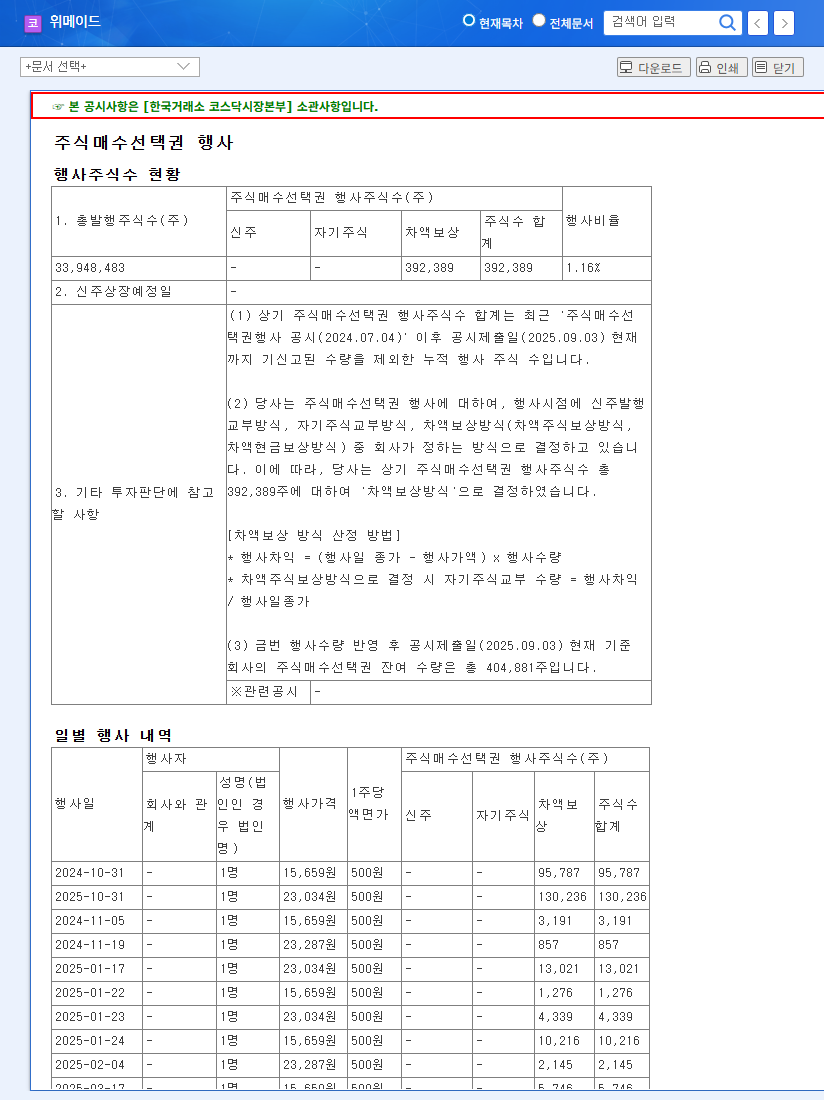

WeMade has decided to dispose of 21,666 common shares (approximately KRW 400 million) to facilitate the exercise of stock options. This represents a negligible portion (0.00%) of the total outstanding shares.

2. Why the Disposal?

The disposal is a procedural measure related to the exercise of stock options granted to employees. It’s a pre-planned event, distinct from raising new capital or a treasury stock buyback.

3. What Does This Mean for Investors?

The direct impact on fundamentals is expected to be minimal in the short term. The small scale of the disposal can be interpreted as a shareholder-friendly policy and a move to motivate employees.

4. WeMade’s Present and Future: Investor Action Plan

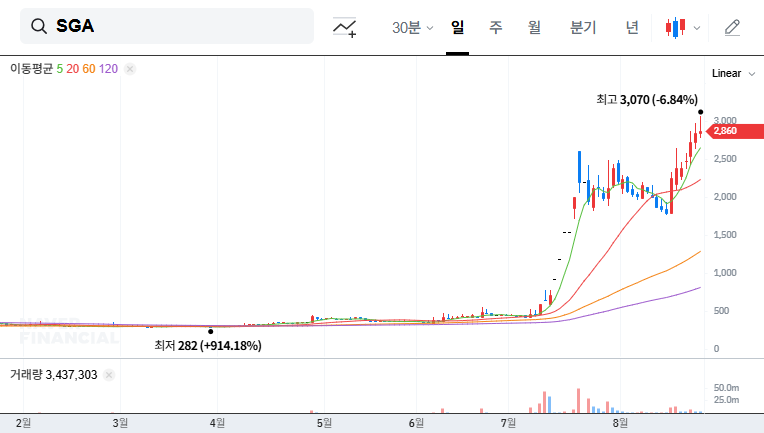

- Weak H1 2025 Performance: Decline in revenue, operating and net loss. Impacted by intensified competition in the gaming market and increased investment in blockchain business.

- Positive Factors: Efforts to improve financial soundness, competitive strength of the ‘Legend of Mir’ IP, growth potential of the blockchain gaming market.

- Key Variables: Utilization of ‘Legend of Mir’ IP, performance of the blockchain business, outcome of the lawsuit with Actoz Soft.

- Investment Strategy: Focus on long-term growth strategy and earnings improvement rather than short-term volatility. Consider business competitiveness, new game launches, blockchain business performance, and legal risk management capabilities comprehensively.

Investors should focus on WeMade’s business competitiveness and growth potential rather than the treasury stock disposal itself. Continuous monitoring is crucial to identify investment opportunities.

FAQ

Will WeMade’s treasury stock disposal negatively impact the stock price?

No. The disposal is related to the exercise of stock options and is too small to significantly impact the stock price.

What is the outlook for WeMade’s blockchain business?

While the blockchain gaming market has high growth potential, it is still in its early stages. It remains to be seen whether WeMade’s blockchain ventures will translate into substantial profits.

What should investors consider when investing in WeMade?

Factors to consider include intensifying competition in the gaming market, uncertainty surrounding the blockchain business, and the ongoing lawsuit with Actoz Soft. A long-term perspective focused on business competitiveness and growth potential is crucial.