1. What Happened?

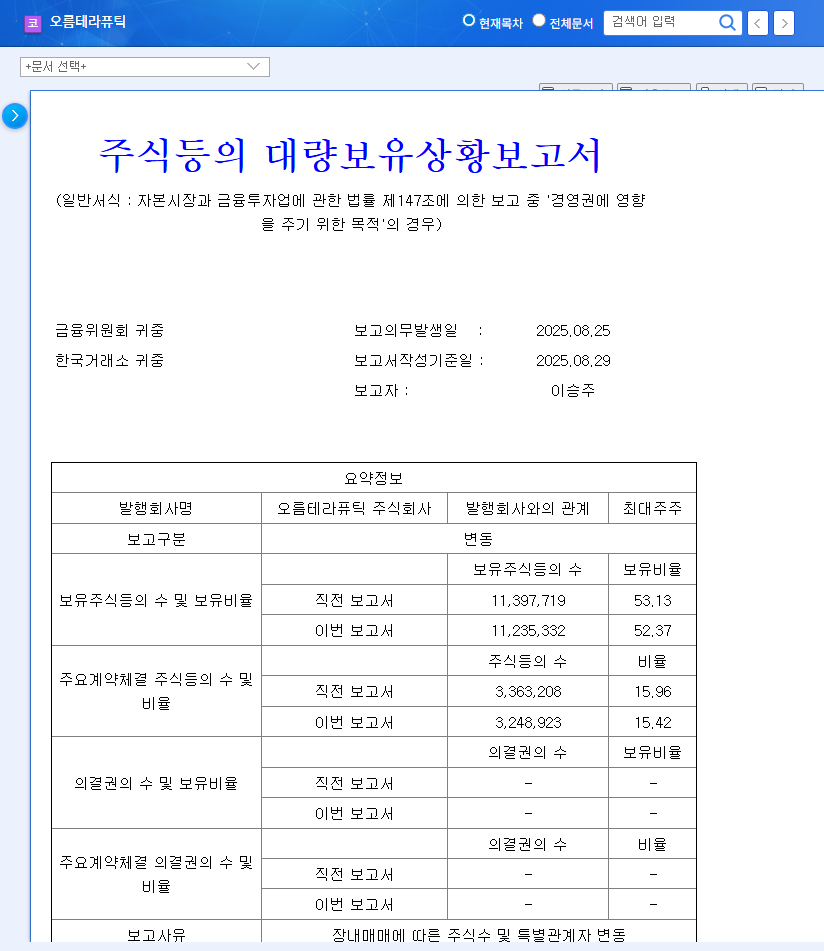

The combined stake of Lee Seung-ju and related parties in Orum Therapeutics decreased from 53.13% to 52.37%, a 0.76%p drop. This was mainly due to over-the-counter sales by various investors.

2. Why the Sell-off?

Several factors could be at play, including fund maturity, portfolio rebalancing, or early investment recovery by investment partnerships. It’s likely unrelated to the company’s direct fundraising plans.

3. How Will This Impact the Stock Price?

- Short-term Impact: Increased selling pressure may lead to a short-term decline in the stock price.

- Long-term Impact: While management control remains unaffected for now, continued stake sales could raise concerns about management stability. The report itself doesn’t directly impact the company’s fundamentals. The progress of ORM-6151 clinical trials and the fulfillment of the Vertex Pharmaceuticals contract terms will likely be more influential factors.

4. What Should Investors Do?

Instead of reacting to short-term price fluctuations, investors should monitor the company’s technological development, clinical results, partnership performance, and fundraising plans from a long-term perspective. The growth potential of DAC technology and key pipelines, as well as partnerships with BMS and Vertex, are positive factors. However, accumulated losses, high R&D costs, the possibility of designation as a managed stock and delisting, and foreign exchange risks are negative factors to consider.

What does the Orum Therapeutics large shareholding report mean?

This report discloses changes in the stakes of major shareholders. It provides investors with clues about changes in the company’s governance structure and potential future stock price movements.

What is Orum Therapeutics’ core technology?

Orum’s core technology is DAC (Degrader-Antibody Conjugates), which combines ADC and TPD technologies, particularly the TPD² platform. It’s gaining attention as a next-generation anticancer therapy with the potential for high therapeutic efficacy and low side effects.

What are the key investment considerations?

As a technology growth company, high R&D expenses and accumulated losses can pose financial risks. Also, the success of clinical trials and technology transfer agreements can significantly impact the future stock price, requiring continuous monitoring. The possibility of being designated as a managed stock and subsequent delisting should also be considered.