1. Hugel’s Q2 2025 Performance: Record Revenue and Growth

Hugel achieved significant milestones in the first half of 2025, surpassing ₩200 billion in revenue. The impressive 44.2% increase in operating profit demonstrates the company’s strong operational capabilities and the continued success of its flagship products, ‘Botulax’ and ‘Wellage’.

2. Growth Drivers: US FDA Approval and European Expansion

Hugel’s growth is not limited to the domestic market. The US FDA approval and expansion into the European market are key drivers of Hugel’s global competitiveness. Exports account for approximately 60% of total revenue, further emphasizing the company’s potential for stable growth. The launch of the new skin booster, ‘Byryzn’, is expected to contribute positively to future growth.

3. Potential Risks: Currency Fluctuations and Competition

Investors should also consider potential risks. Currency fluctuations, ongoing litigation related to the toxin business, and intensifying market competition are important factors to consider when making investment decisions.

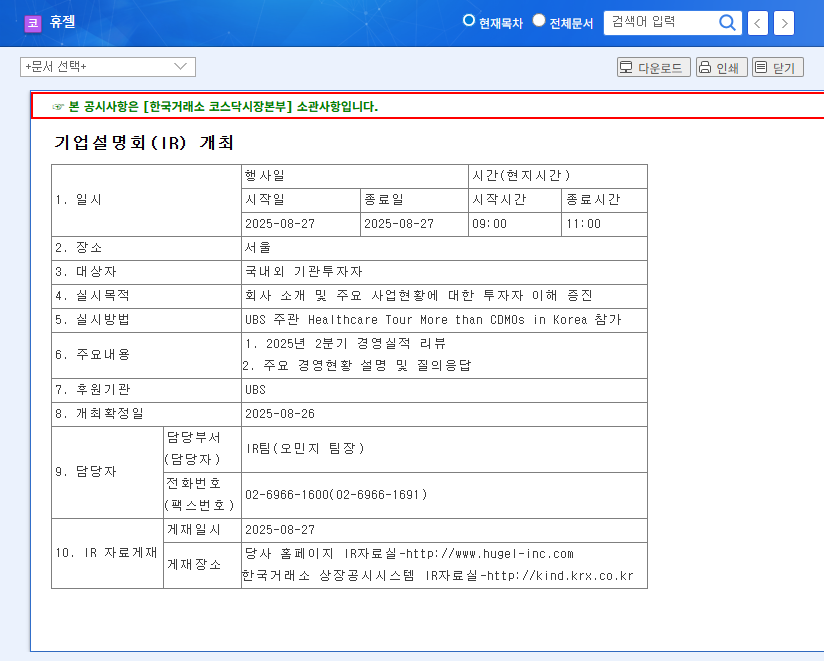

4. Key Takeaways from the Upcoming IR and Investment Strategies

The IR presentation on August 27th will provide detailed Q2 results and outline Hugel’s plans for the second half of 2025. Investors should pay close attention to their expansion strategies for overseas markets and the development of new pipelines. Hugel presents a compelling investment opportunity given its robust fundamentals and growth potential. However, investors should consider the macroeconomic environment and competitive landscape when making investment choices.

What are Hugel’s main businesses?

Hugel is a biopharmaceutical company that develops, manufactures, and sells botulinum toxin ‘Botulax’, HA fillers, and cosmetic brand ‘Wellage’.

How was Hugel’s performance in Q2 2025?

Hugel achieved outstanding results in Q2 2025, exceeding ₩200 billion in revenue and a 44.2% increase in operating profit.

What are the key points to consider when investing in Hugel?

Potential risks include currency exchange rate fluctuations, ongoing litigation related to the toxin business, and intensifying market competition.