1. What Happened?

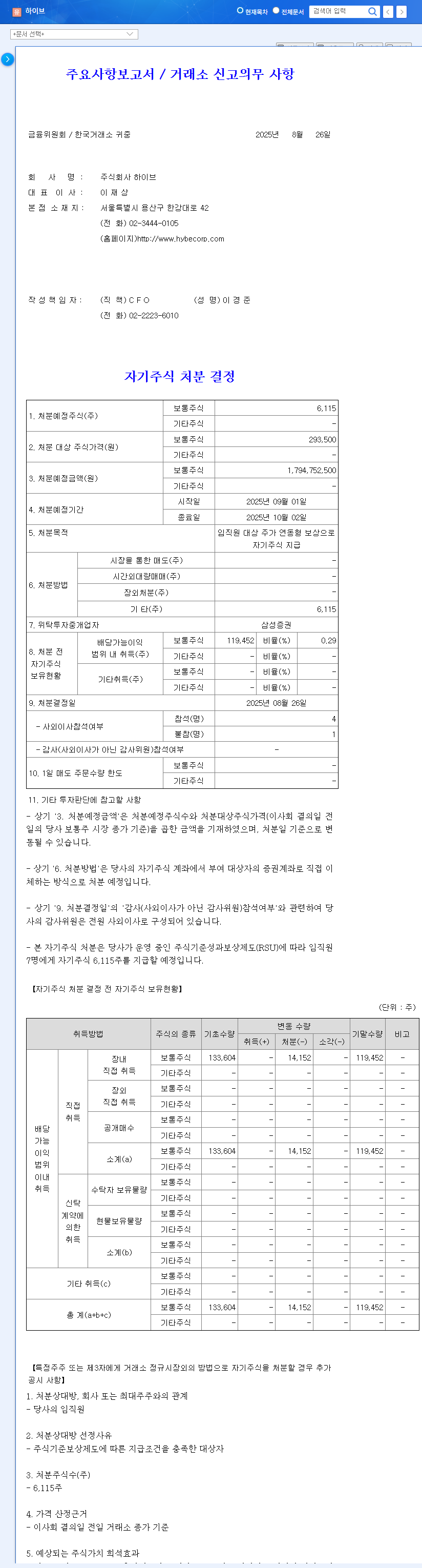

On August 26, 2025, HYBE announced that it would grant 6,115 shares of treasury stock (worth approximately ₩1.8 billion) to its employees as performance-based compensation. This will be handled through Samsung Securities.

2. Why the Stock Grant?

HYBE aims to boost employee motivation and link long-term performance with shareholder value. Stock-based compensation, such as stock options or RSUs, is an effective way to incentivize employees and foster a sense of ownership in the company’s growth and future.

3. How Will This Affect the Stock Price?

The size of the treasury stock disposal is relatively small compared to the total number of outstanding shares, so the short-term impact on the stock price is expected to be minimal. However, it could positively affect employee morale and long-term performance, ultimately contributing to increased corporate value.

- Positive Factors: Increased employee motivation, potential for long-term performance improvement

- Negative Factors: Minimal short-term stock price fluctuation expected, recent revenue slowdown and declining profitability, macroeconomic uncertainties

4. What Should Investors Consider?

Rather than focusing solely on the stock grant itself, investors should consider HYBE’s fundamentals, future growth strategy, and macroeconomic conditions. Careful consideration of new artist debuts, platform business expansion, and new business investment performance is crucial for making informed investment decisions.

Will HYBE’s stock grant positively affect its stock price?

Short-term price fluctuations are expected to be minimal, but long-term positive effects can be expected through increased employee motivation and improved performance.

What is HYBE’s current financial status?

Despite a decrease in sales and operating profit, net profit has turned positive, maintaining a stable financial structure.

What should investors be aware of when investing in HYBE?

Investors should consider macroeconomic changes, intensifying competition in the entertainment industry, and the performance of new businesses.