Nextchip Announces 243 Billion Won Rights Offering: What Happened?

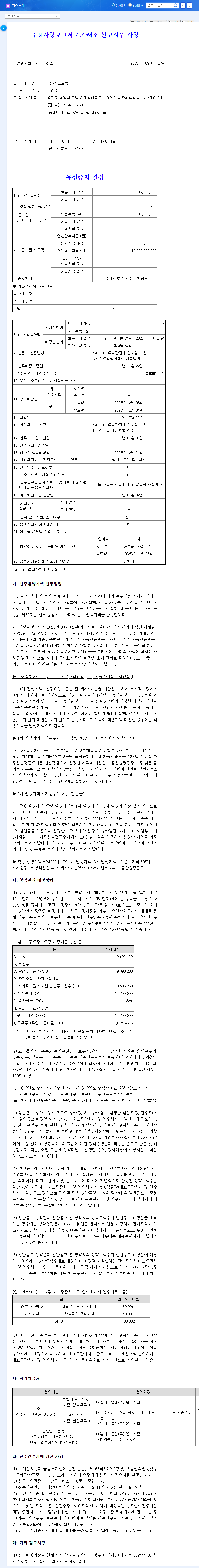

On September 2, 2025, Nextchip announced a rights offering to raise 243 billion won. The funds will be used for operating expenses (51 billion won) and debt repayment (192 billion won). Market attention is focused on whether this rights offering will be a lifeline for Nextchip, which is on the brink of collapse.

Why Did Nextchip Decide on a Rights Offering?

Nextchip is currently facing a severe financial crisis, with complete capital impairment. In the first half of 2025, sales decreased by 44% year-on-year, and the company recorded an operating loss of 74 billion won. The rights offering appears to be an unavoidable measure to resolve the liquidity crisis caused by soaring current liabilities and alleviate the pressure of repaying maturing convertible bonds.

What Impact Will the Rights Offering Have on Nextchip?

Positive aspects: In the short term, the influx of 243 billion won will alleviate the liquidity crisis and reduce debt burden. It can also help maintain business continuity and R&D investment.

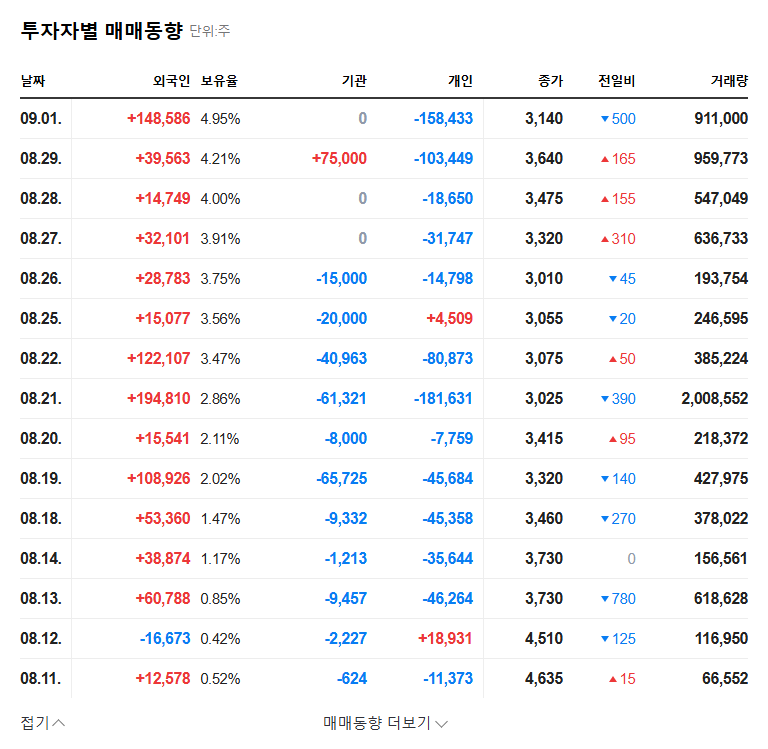

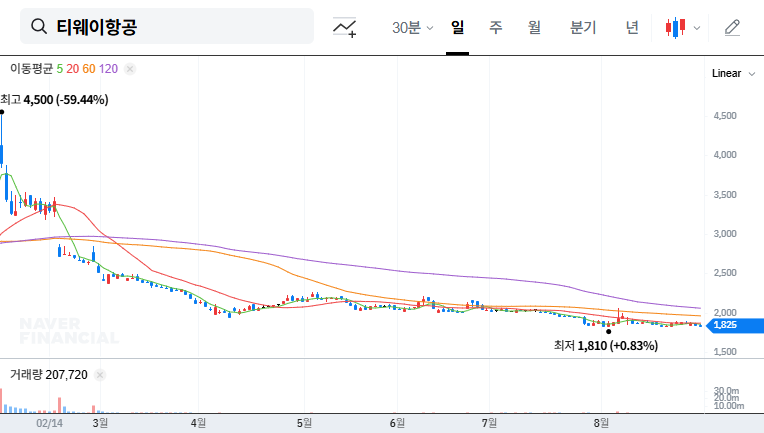

Negative aspects: Share dilution due to the increase in the number of outstanding shares is inevitable. Also, a rights offering in a state of capital impairment can lead to a decline in investor confidence. If the funds raised are not used efficiently or if the new business fails, the financial crisis could deepen.

What Should Investors Check?

- Use of funds plan: Closely monitor whether the funds are efficiently used for operating expenses and debt repayment.

- Convertible bond risk management: Check for countermeasures against the maturity of convertible bonds and the possibility of early redemption requests.

- New business performance: Continuously check the performance of new businesses, such as entry into the automotive semiconductor, robot, and drone markets.

- Financial structure improvement: Continuously monitor the improvement trend in the financial structure after the rights offering.

Nextchip’s rights offering may help secure short-term liquidity, but it has limitations in solving fundamental problems. Investors should carefully consider the risk factors and make a prudent judgment on the possibility of the company’s turnaround.

Frequently Asked Questions (FAQ)

How will Nextchip’s rights offering affect the stock price?

Generally, a rights offering leads to a share dilution effect due to the increased number of outstanding shares. There is a high possibility of a short-term stock price decline, but the long-term impact will depend on the use of the funds raised and the company’s performance improvement.

Should I invest in Nextchip’s rights offering?

Currently, Nextchip is in a state of complete capital impairment, carrying high investment risks. Investment decisions should be made carefully, considering the use of funds plan, the possibility of financial structure improvement, and the performance of new businesses.

Is there a possibility of Nextchip’s recovery?

The possibility of Nextchip’s recovery depends on how efficiently the funds raised are used and whether visible results can be achieved in new businesses. Although there are positive factors such as the growth of the automotive semiconductor market, the situation is highly uncertain.