1. What’s Happening with Celltrion?

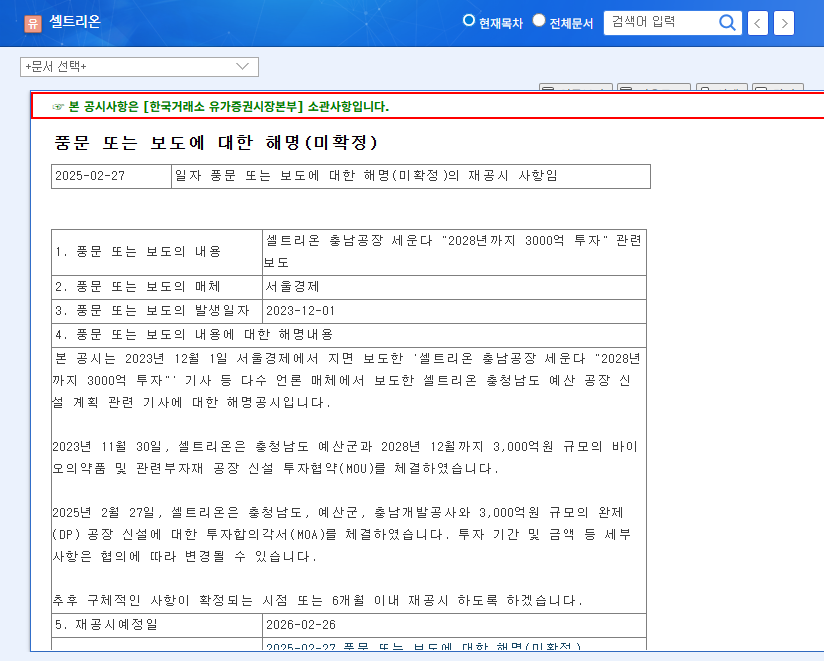

Celltrion recorded sales of ₩1.8034 trillion and operating profit of ₩391.9 billion in Q2 2025. Although these figures decreased year-on-year due to one-off costs related to the merger, both sales and operating profit showed growth on a standalone basis. The most notable news is the ₩300 billion investment agreement for the construction of a new biopharmaceutical and related materials plant in Yesan, Chungcheongnam-do.

2. Why the Investment?

This investment has two main objectives. First, it aims to expand production capacity to meet the growing global demand for biosimilars and secure the stable supply of new drugs. Second, it seeks to strengthen Celltrion’s CDMO (Contract Development and Manufacturing Organization) capabilities to create new revenue streams and diversify its business portfolio.

3. What Does the Future Hold?

The new Yesan plant will allow Celltrion to increase production and enter the CDMO business, securing future growth engines. The expansion of direct sales of Remsima SC (CT-P13 SC) in the US market, the launch of subsequent biosimilars, and R&D investments in new modalities such as ADCs will support long-term growth. However, global interest rate and exchange rate volatility, as well as intensifying competition in the biosimilar market, require continuous monitoring.

4. What Should Investors Do?

While Celltrion has solid fundamentals and growth potential, investors should carefully consider the financial burden of the new plant investment, the market performance of Remsima SC and subsequent biosimilars, the potential for commercialization of the R&D pipeline, and the intensity of market competition before making investment decisions. Experts are considering upgrading Celltrion’s investment rating from ‘Neutral’ to ‘Buy’.

Frequently Asked Questions

What are Celltrion’s main products?

Key products include biosimilars like Remsima, Truxima, and Herzuma, as well as Remsima SC (CT-P13 SC), the first FDA-approved subcutaneous formulation of infliximab.

What is the significance of the new plant in Yesan?

It is expected to secure future growth momentum by expanding production capacity and enabling entry into the CDMO business, strengthening future profitability.

What should investors consider when investing in Celltrion?

Investment decisions should be made considering changes in the global economic environment and intensifying competition in the biosimilar market.