1. K-Merstone Sells 0.69%p Stake in SamPyo Cement

On August 29, 2025, K-Merstone sold 0.69%p (236,579 shares) of its stake in SamPyo Cement on the open market. This reduced K-Merstone’s stake in SamPyo Cement from 9.40% to 8.71%. The reason for the sale was reportedly the termination of a stock-backed loan agreement.

2. Background of the Sale and Impact Analysis

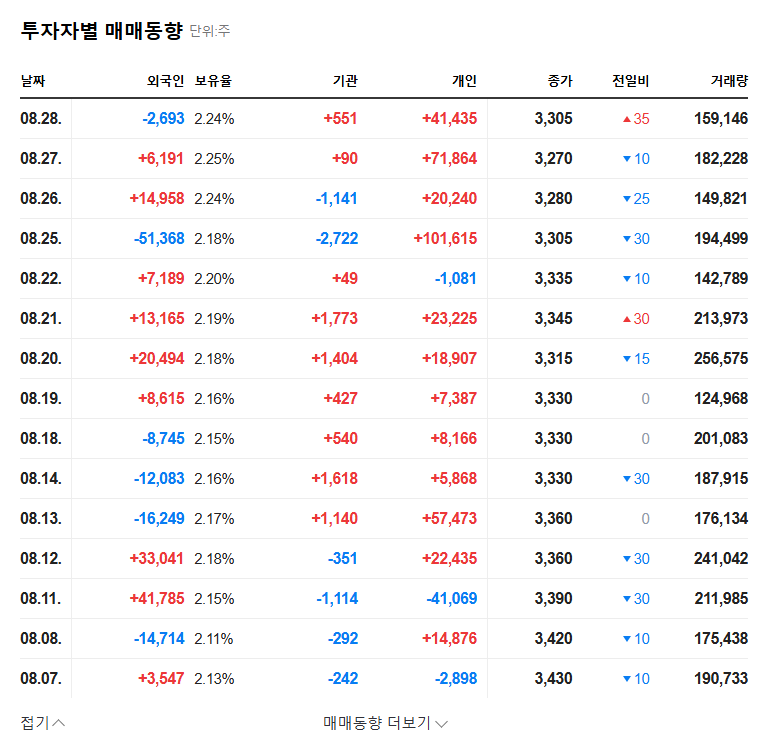

K-Merstone held a stake in SamPyo Cement for the purpose of ‘management influence’. While the possibility of a short-term change in management control is low due to this sale, the possibility of further stake changes cannot be ruled out. The market may interpret this sale as a negative signal, which could impact investor sentiment.

3. SamPyo Cement Fundamentals and Future Outlook

As of the first half of 2025, SamPyo Cement maintained solid operating profit despite a decline in sales in the cement sector. However, deterioration in profitability of the ready-mixed concrete division, volatility in coal prices and exchange rates could negatively impact future earnings. Positive factors include the government’s expansion of SOC investment and expansion of eco-friendly businesses.

4. Investor Action Plan

- Investors should continuously monitor K-Merstone for any further stake changes.

- It is important to understand management’s position on this stake sale and their efforts to secure future management stability.

- Investment decisions should be made by comprehensively considering the impact of this event along with fundamental analysis results.

Frequently Asked Questions

Will K-Merstone’s stake sale significantly impact SamPyo Cement’s stock price?

The possibility of an immediate stock price crash is low due to the small volume of the sale, but it could lead to a deterioration in investor sentiment. Future trends need to be monitored.

Is it okay to invest in SamPyo Cement?

SamPyo Cement maintains a solid fundamental, but there are also risks associated with external variables. Careful analysis is required before making investment decisions.

What is the future outlook for SamPyo Cement’s stock price?

Stock prices can fluctuate depending on various factors such as construction market conditions, raw material prices, and interest rate and exchange rate volatility. Continuous monitoring of expert analysis and market conditions is necessary.