1. What Happened?

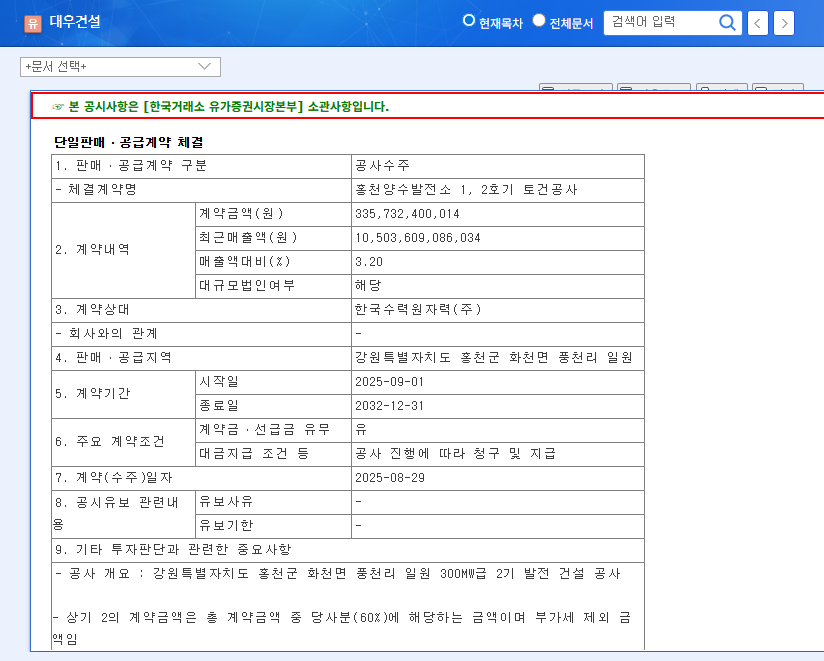

Daewoo E&C secured a $250 million contract from KHNP for the Hongcheon pumped-storage hydroelectric power plant project. The contract period extends from September 2025 to December 2032, spanning 7 years and 4 months.

2. Why Does It Matter?

This contract holds several key implications for Daewoo E&C:

- Stable Order Backlog: Securing a long-term public project ensures stable revenue and profit streams.

- Improved Civil Engineering Performance: It is expected to contribute to improving profitability in the recently underperforming civil engineering division.

- Growth Momentum: This win could pave the way for securing similar projects in the future.

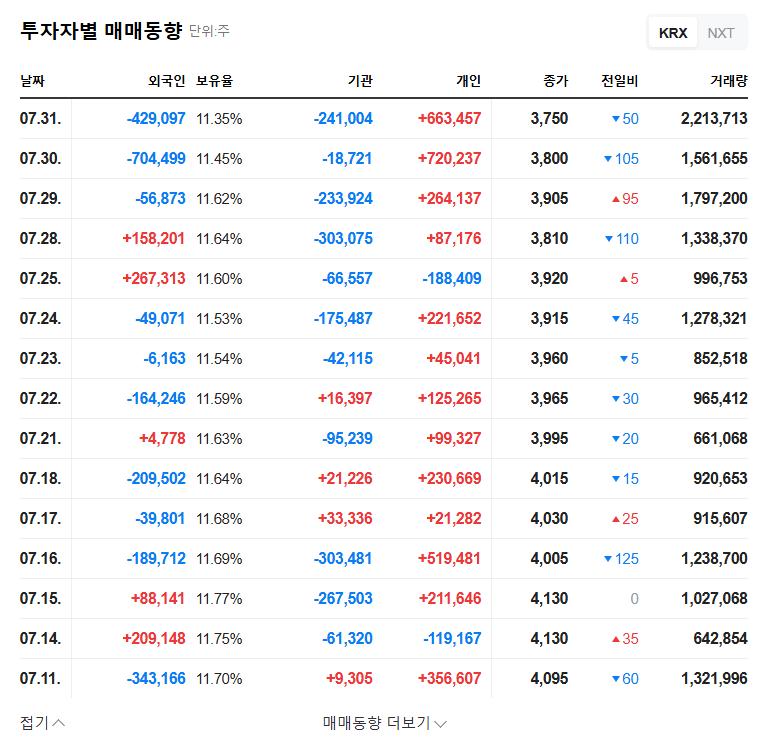

3. How Will This Affect the Stock Price?

This contract is likely to be viewed positively by the market. However, investors need to consider factors like profitability and the overall construction market environment.

- Positive Aspects: Anticipated stable revenue growth and improved profitability.

- Negative Aspects: External factors such as rising raw material prices and interest rate hikes.

While generally positive, potential risk factors need to be monitored.

4. What Should Investors Do?

Investors should consider the following factors when developing their investment strategy:

- Monitor project progress and profitability.

- Keep an eye on macroeconomic conditions, including construction market dynamics and interest rate changes.

- Assess Daewoo E&C’s potential for securing additional contracts and its financial health.

A long-term investment perspective is recommended rather than focusing on short-term stock price fluctuations.

Frequently Asked Questions (FAQ)

How much will this contract contribute to Daewoo E&C’s earnings?

The $250 million contract represents approximately 3.2% of Daewoo E&C’s annual revenue, making it a significant contribution.

What is the contract duration?

The contract spans from September 1, 2025, to December 31, 2032, a total of 7 years and 4 months.

What are the key investment considerations?

Investors should consider project profitability, construction market fluctuations, and external factors like interest rate hikes.