1. What Happened?

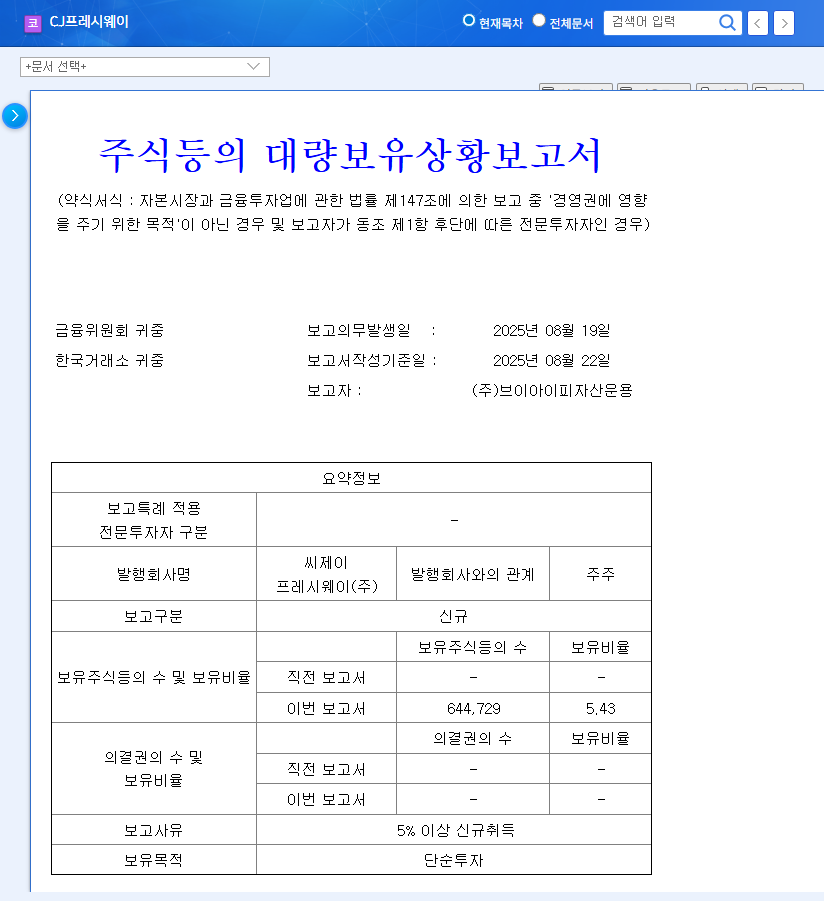

A ‘Report on the Status of Large Shareholdings of Stocks, etc. (Simplified)’ was publicly announced, stating that VIP Asset Management acquired a 5.43% stake in CJ Freshway. This is a public disclosure of large shareholdings exceeding 5% for simple investment purposes.

2. Why Did VIP Asset Management Invest in CJ Freshway?

CJ Freshway has shown robust sales growth and is strengthening its B2B market position in food distribution and food services. It’s also exploring future growth engines through business diversification, such as freight transportation and alcoholic beverage sales. VIP Asset Management likely made this investment based on this growth potential.

3. How Will This Investment Impact CJ Freshway?

This investment is expected to positively impact CJ Freshway’s stock price. Increased stake by an institutional investor can be interpreted as a positive signal by market participants, potentially improving investor sentiment. It can also highlight the valuation attractiveness compared to fundamentals, raising expectations for stock price increases.

4. What Should Investors Do?

Investors should consider this investment from a long-term perspective rather than focusing on short-term stock fluctuations. It’s crucial to carefully monitor factors such as improvement in financial soundness, earnings growth trends, interest rate cuts, and exchange rate stabilization when making investment decisions. Risks such as high debt ratio, macroeconomic variables, and intensifying competition should also be thoroughly examined.

Frequently Asked Questions

Why is VIP Asset Management’s acquisition of a stake in CJ Freshway significant?

Increased stake by an institutional investor can be interpreted as a positive market signal and reflects confidence in CJ Freshway’s growth potential.

What are the investment risks associated with CJ Freshway?

Risks include a high debt ratio, changes in the macroeconomic environment (exchange rates, interest rates, oil price fluctuations), intensifying market competition, and fair trade-related risks.

What should investors be aware of when investing in CJ Freshway?

Consider investments from a long-term perspective rather than focusing on short-term stock price fluctuations, and carefully monitor improvements in fundamentals and actual profit growth.