What Happened?

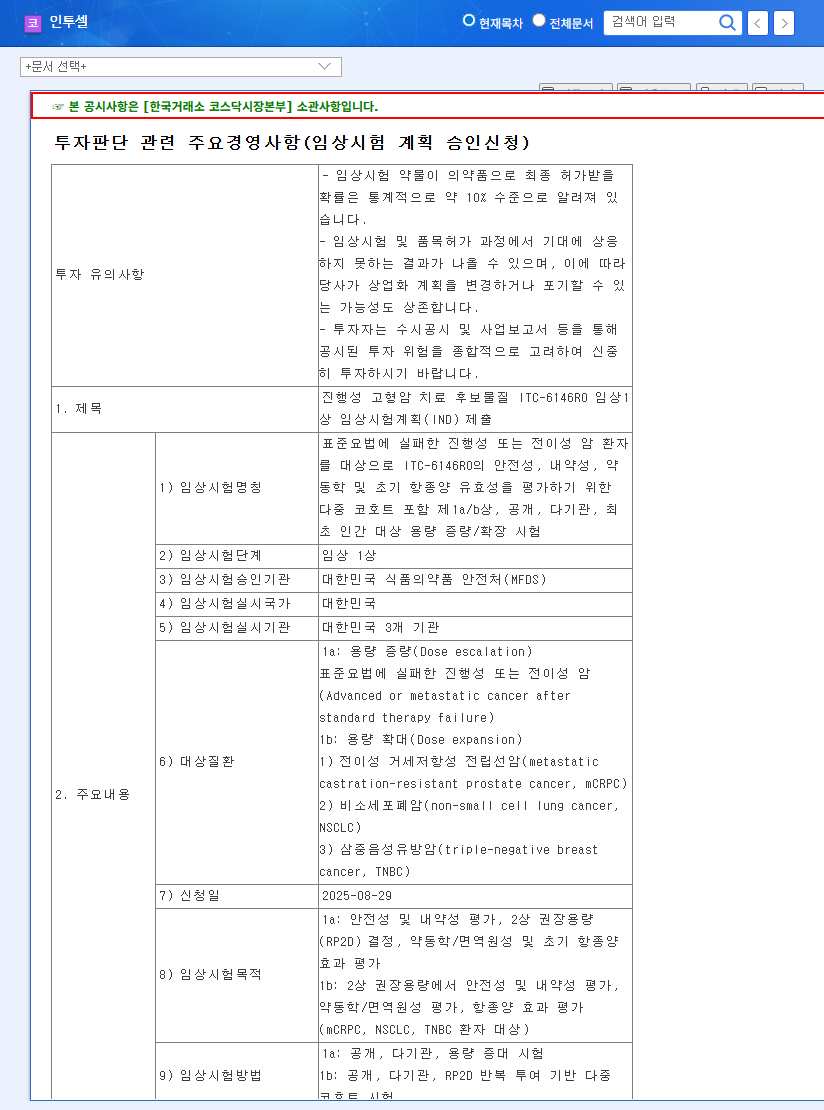

Intocell announced on August 29, 2025, that it had completed the application for Investigational New Drug (IND) approval for a Phase 1 clinical trial of its anti-B7-H3 antibody-drug conjugate (ADC), ITC-6146RO, in Korea. ITC-6146RO is Intocell’s core pipeline, and this IND application is a significant milestone marking the entry into the clinical stage.

Why is it Important?

This IND application is a significant event showcasing Intocell’s differentiated ADC platform technology and growth potential. ITC-6146RO, developed based on OHPAS linker and PMT technology, is expected to demonstrate high efficacy and safety compared to existing anticancer treatments and contribute to securing a competitive edge in the global ADC market.

What’s Next?

Once the IND is approved and the Phase 1 clinical trial verifies safety and efficacy, the possibility of technology transfer and partnership agreements is expected to increase, positively impacting Intocell’s future revenue generation. Furthermore, successful clinical results are likely to enhance market confidence and act as a momentum for stock price increases.

What Should Investors Do?

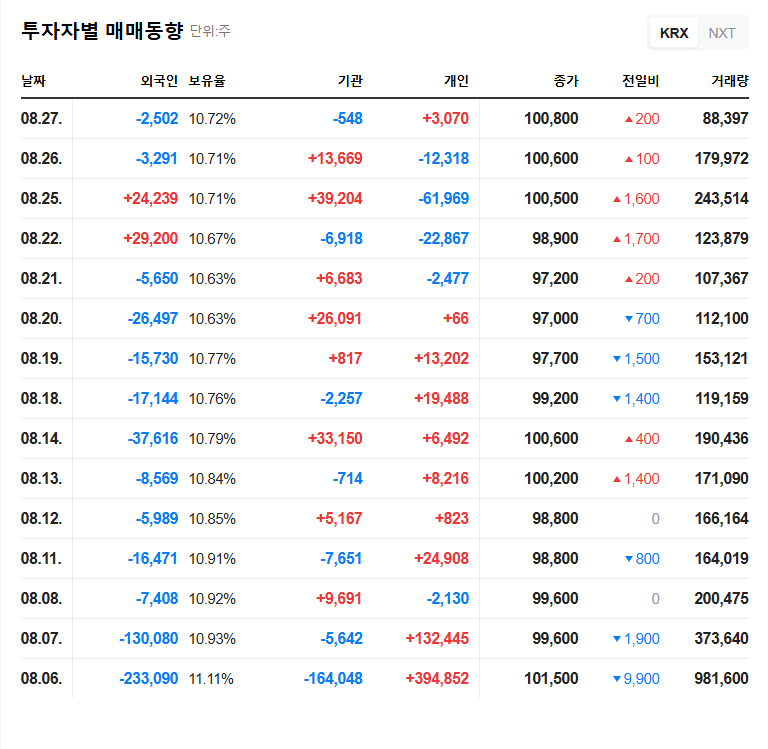

- Monitor Clinical Progress: After IND approval, investors should closely watch the results of Phase 1 clinical trials and the progress towards subsequent clinical phases.

- Check for Technology Transfer and Partnership Opportunities: Successful clinical results can lead to technology transfer and partnerships, so pay attention to related news.

- Analyze Competitors: Analyze the competitive landscape of the ADC market and evaluate Intocell’s relative competitiveness.

- Check Financial Soundness: It is crucial to confirm funding plans for continued R&D and the company’s financial stability.

- Consider Risk Factors: Make informed investment decisions by considering potential risks such as the possibility of clinical trial failure, regulatory approval uncertainty, and intensifying competition.

What are Intocell’s core technologies?

Intocell’s core competencies are its OHPAS linker platform and PMT technology. The OHPAS linker has advantages in drug applicability, blood stability, and drug release rate, while PMT technology aims to improve the therapeutic index (TI) by minimizing normal cell entry.

What is ITC-6146RO?

ITC-6146RO is Intocell’s core pipeline anti-B7-H3 ADC. B7-H3 is a protein expressed in various cancer cells, and ITC-6146RO targets it for anticancer effects.

When will the IND be approved?

The timing of IND approval depends on the MFDS’s review schedule and is difficult to predict accurately.