1. What Happened?

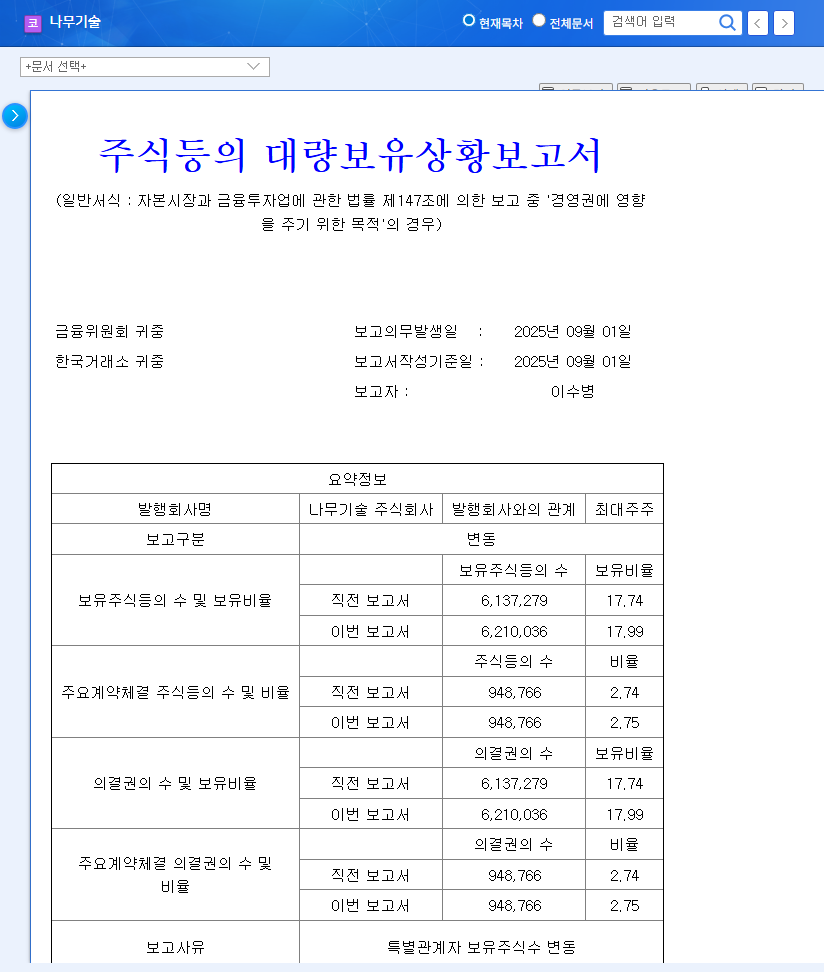

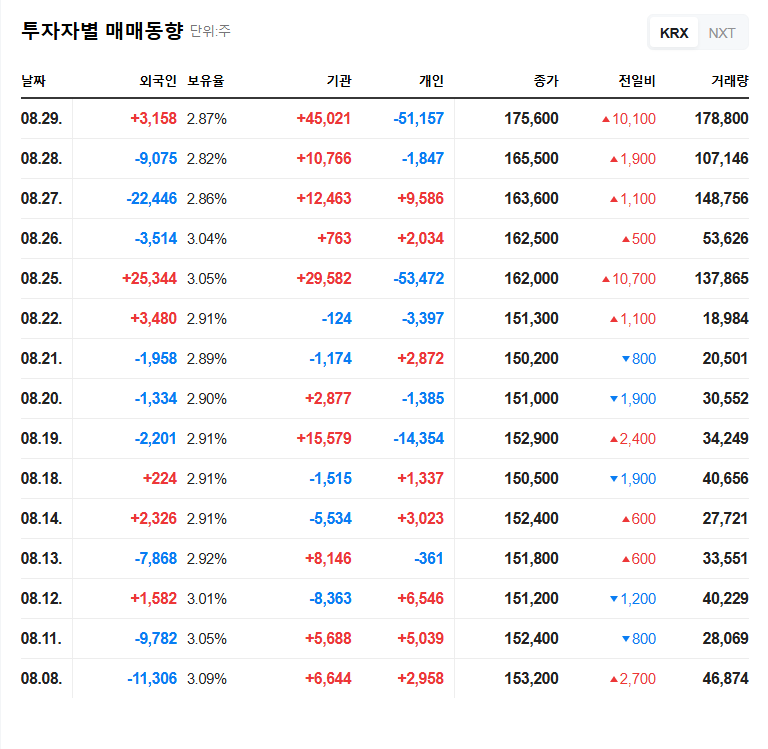

On September 1, 2025, a major shareholder of NAMUTECH increased their stake from 17.74% to 17.99% through open market purchases. This move is interpreted as an attempt to strengthen their influence over the company’s management.

2. Why the Increased Stake?

While the exact reasons remain undisclosed, the increased stake could be a strategic move to solidify control and demonstrate commitment to the company. It might also be an attempt to alleviate investor concerns regarding recent poor financial performance.

3. Assessing NAMUTECH’s Current State

Financial Instability

As of the first half of 2025, NAMUTECH’s revenue decreased by 8.5% year-over-year, with both operating and net income showing losses. The debt-to-equity ratio also increased to 135.1%. While the cloud business division shows potential, the packaging equipment division needs urgent restructuring.

Market Environment: Opportunities and Threats

Positive factors include government policies supporting cloud-native technologies, AI market growth, and smart factory expansion. However, macroeconomic uncertainties and high container shipping costs pose challenges.

4. What’s Next for NAMUTECH?

While the increased stake might provide a short-term boost to the stock price, sustained growth hinges on fundamental improvements. The performance of the cloud and AI business segments, as well as improvements in operating margins, will be key drivers of future stock performance.

5. What Should Investors Do?

- Avoid reacting to short-term price fluctuations and adopt a long-term perspective.

- Carefully analyze the company’s upcoming earnings reports for signs of fundamental improvement.

- Monitor the performance and monetization strategies of the cloud and AI business segments.

- Keep an eye on any further changes in shareholdings by major stakeholders.

Why did the major shareholder increase their stake?

It’s likely a strategic move to strengthen control and demonstrate commitment, potentially addressing concerns about recent financial performance.

How is NAMUTECH performing financially?

As of H1 2025, the company faces declining revenue, operating and net losses, and a high debt-to-equity ratio.

Should I invest in NAMUTECH?

While the cloud and AI segments hold potential, the current financial situation is unstable. Carefully consider fundamental improvements before investing, focusing on the long-term outlook rather than short-term price movements.