1. What Happened? : The LH Contract and its Significance

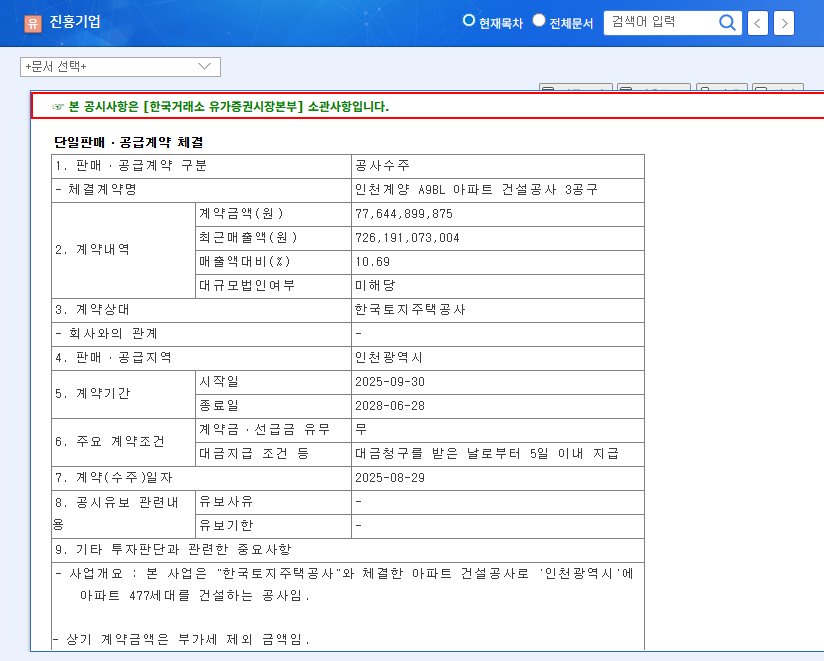

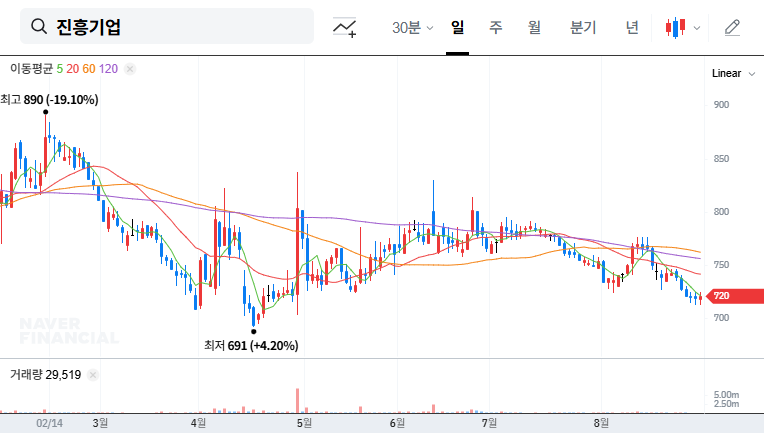

Jinheung Engineering & Construction faced challenges in the first half of 2025, marked by a sharp decline in sales and a net loss. However, the recent 77.6 billion won contract with LH for the ‘Incheon Gyeyang A9BL Apartment Construction Project Phase 3’ presents a potential opportunity for improvement. This contract represents 10.69% of the company’s first-half 2025 revenue and is expected to contribute to future sales growth and business stabilization.

2. Why is it Important? : Analyzing the Positives and Negatives

Positives:

- · Expected short-term performance improvement

- · Enhanced credibility through securing a public sector contract

- · Decreased debt-to-equity ratio in the first half of 2025

Negatives:

- · Potential for continued downturn in the construction market

- · Litigation costs and deteriorating operating cash flow

- · Macroeconomic uncertainties such as high interest rates and volatile raw material prices

3. What Should Investors Do? : Key Checkpoints

Investors considering Jinheung Engineering & Construction should carefully evaluate the following factors:

- · Progress and profitability of the LH contract

- · New order pipeline and contract details

- · Progress and final rulings of ongoing lawsuits

- · Outlook for the construction market and the impact of government policies

- · Changes in operating cash flow and financial soundness indicators

4. Conclusion: A Cautious Approach is Necessary

While the LH contract provides positive momentum for Jinheung Engineering & Construction, uncertainties persist. Investors should carefully consider both the positive and negative factors before making investment decisions.

FAQ

Will the LH contract lead to a rebound in Jinheung’s performance?

While the LH contract is positive, it’s important to avoid undue optimism given the downturn in the construction market. Closely monitor the contract’s progress and market conditions.

What is the extent of Jinheung’s litigation risk?

The outcome of pending lawsuits could significantly impact the company’s financial health. Continuous monitoring of the legal proceedings is essential.

What are the key considerations for investing in Jinheung?

Investors should carefully assess the construction market environment, the company’s financial condition, and litigation risks before making any investment decisions.