1. What Happened? : $1.6 Billion Public Housing Project Awarded

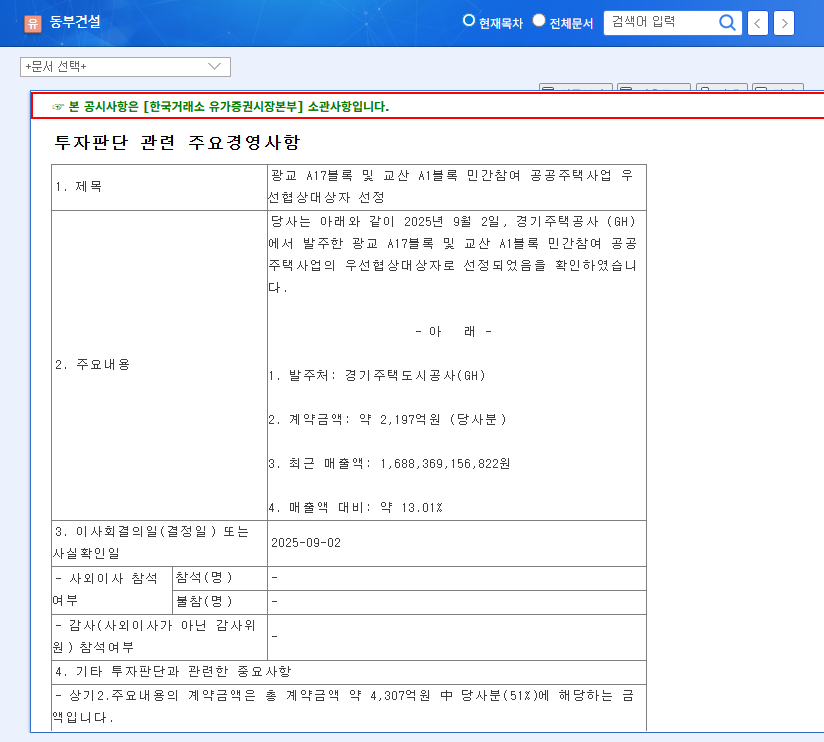

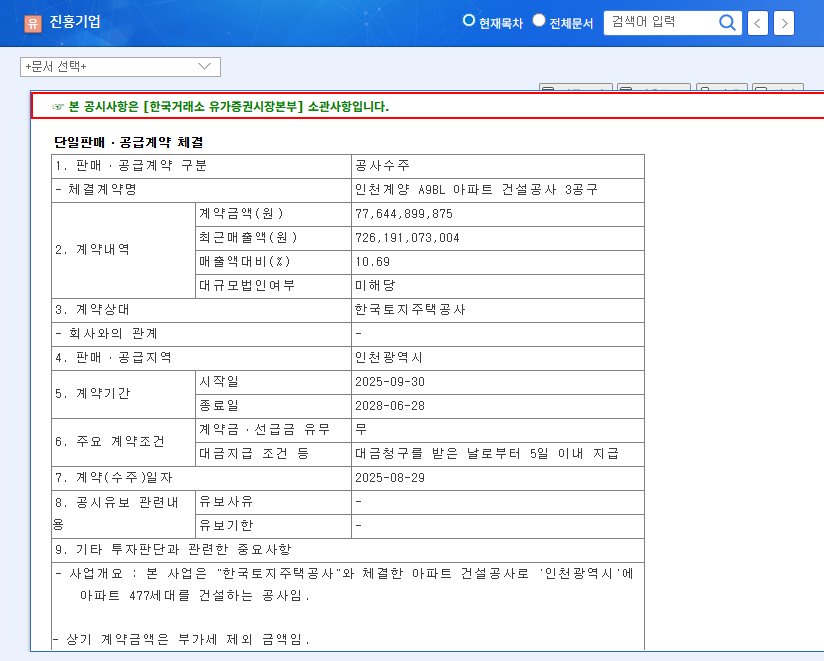

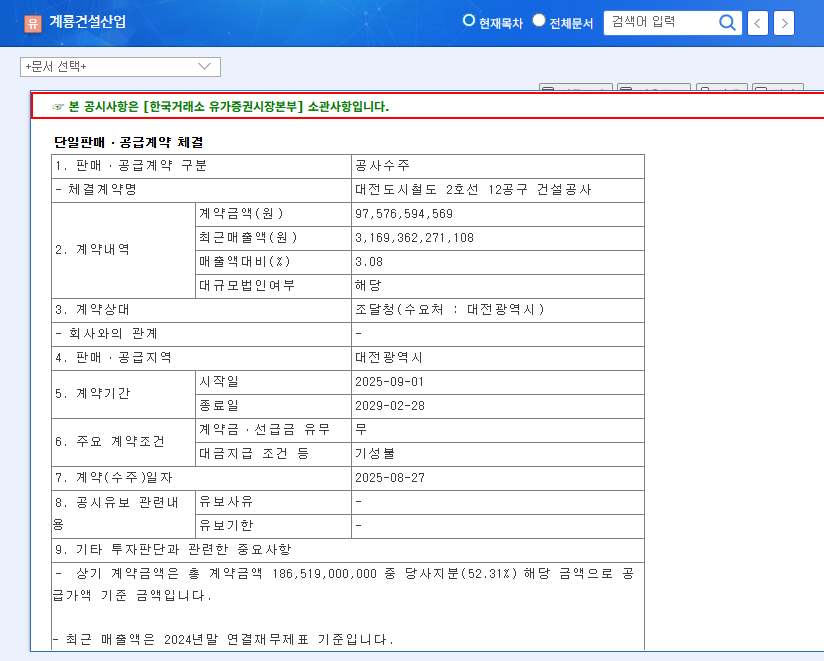

Dongbu Construction has been selected as the preferred bidder for the Gwanggyo A17 block and Gyosan A1 block public housing projects ordered by Gyeonggi Housing & Urban Development Corporation (GH). This large-scale project is worth $1.6 billion, which accounts for approximately 13.01% of Dongbu Construction’s recent revenue.

2. Why Is It Important? : Business Diversification and Expected Earnings Improvement

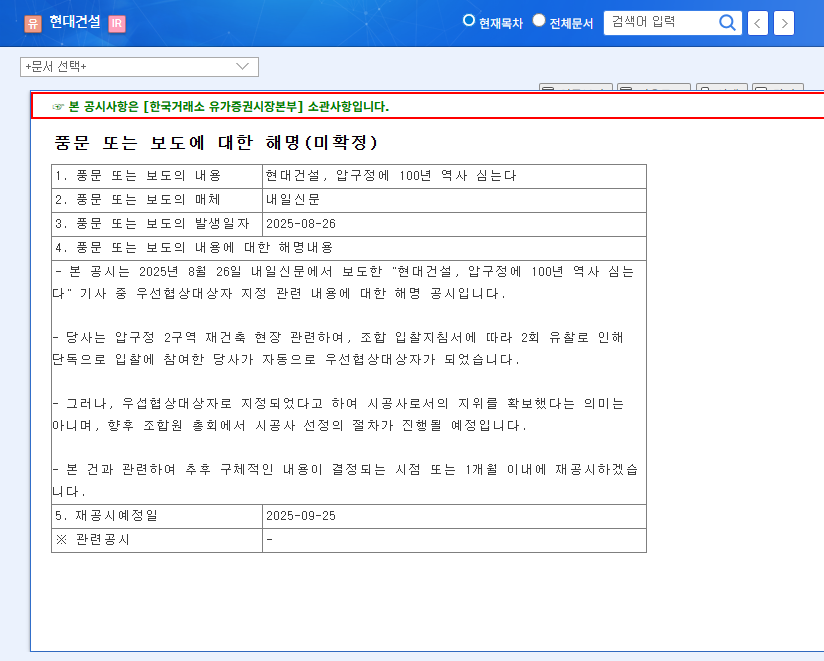

This contract win signifies more than just a new project. First, it is directly linked to increased sales, and is expected to have a positive impact on earnings in the second half of 2025 and beyond. Second, it allows Dongbu Construction to diversify its business portfolio into the public sector, moving beyond its private sector-focused image and strengthening stability. Third, large-scale contract wins serve as a strong signal of a company’s growth potential, potentially leading to stock price increases and improved investor sentiment.

3. So What? : Financial Status and Market Conditions

- Financial Status: As of the 2025 semi-annual report, while the company has returned to profitability, its debt ratio remains high. The increase in inventory assets suggests the potential for increased sales from future housing projects.

- Market Conditions: While growth is expected in the construction market amidst uncertainty, risk factors such as high interest rates and rising raw material prices persist.

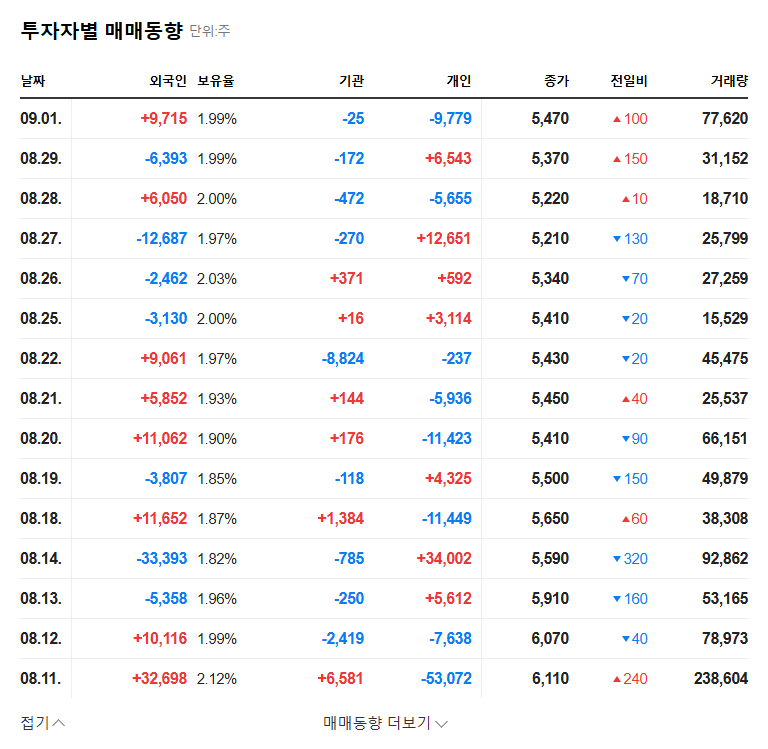

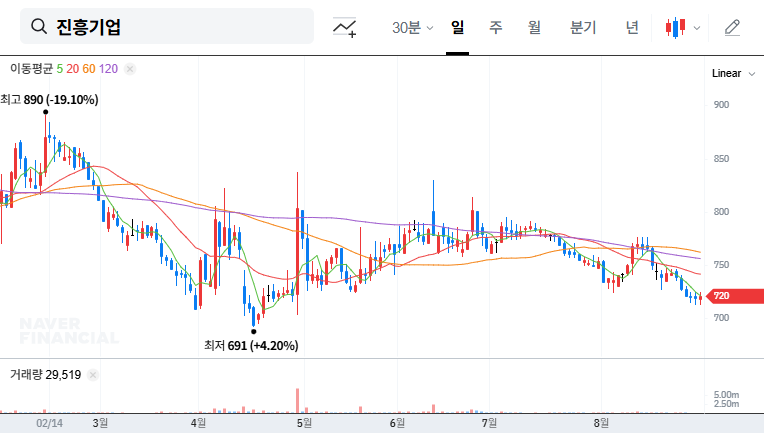

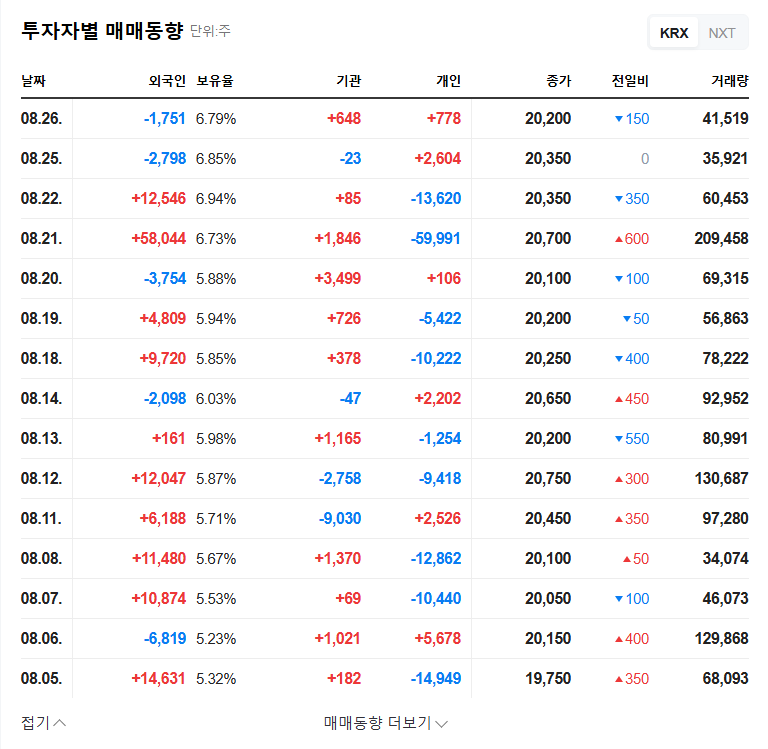

- Investment Indicators: Stock price volatility was high in the first half of 2025, and it will be necessary to monitor stock price movements following this contract announcement.

4. What Should Investors Do? : Investment Considering Both Positive and Negative Factors

While this contract win provides positive momentum for Dongbu Construction, investors should also consider risk factors such as the high debt ratio, low operating profit margin, and uncertainties in the macroeconomic environment. Investors should make careful investment decisions by closely monitoring Dongbu Construction’s future earnings announcements, construction market trends, and interest rate and exchange rate fluctuations.

Frequently Asked Questions

How will this contract win affect Dongbu Construction’s stock price?

A positive short-term impact is expected, but the long-term stock price trend will depend on various factors such as the company’s performance, market conditions, and macroeconomic variables.

Is Dongbu Construction’s financial status stable?

While the company returned to profitability in the first half of 2025, the high debt ratio remains a risk factor. Investors should continuously monitor changes in the company’s financial status.

How can I invest in Dongbu Construction?

Stock investment involves risk. It’s crucial to consult with a financial advisor and thoroughly analyze the company’s financial information and market conditions before making any investment decisions.