Corpus Korea’s Convertible Bond Exercise: What Happened?

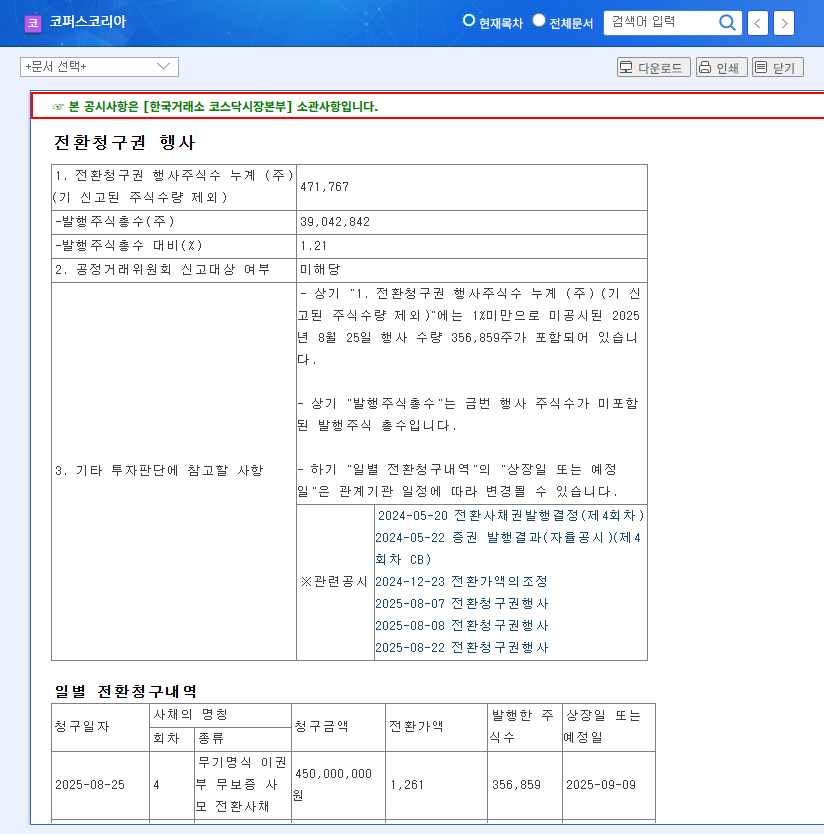

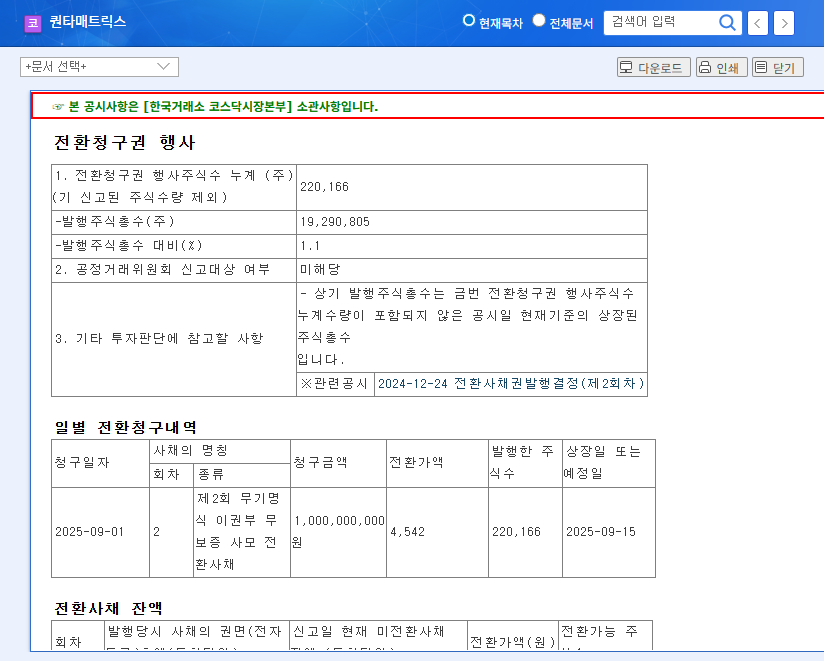

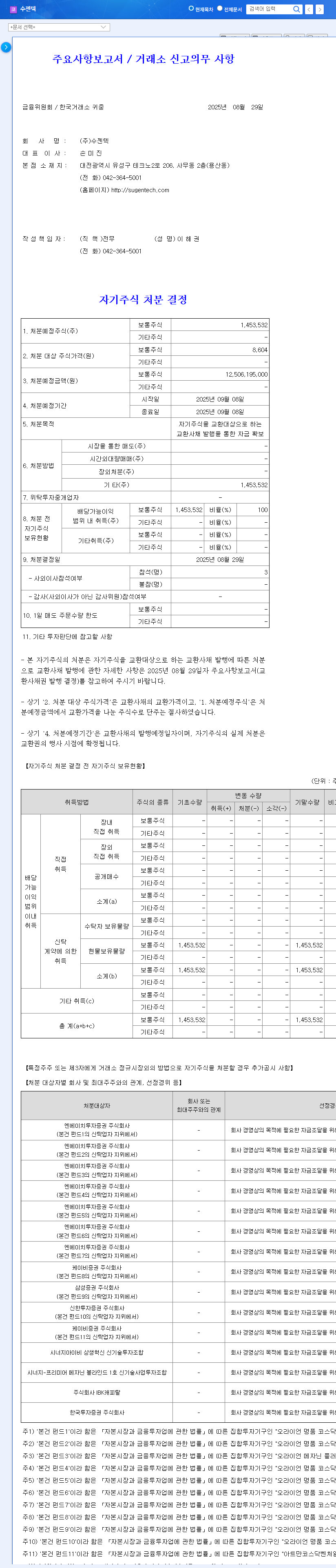

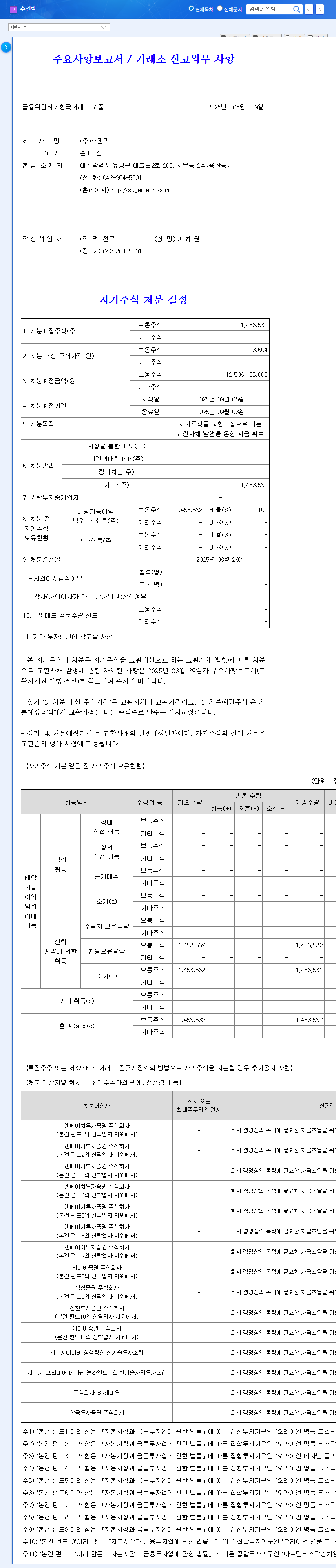

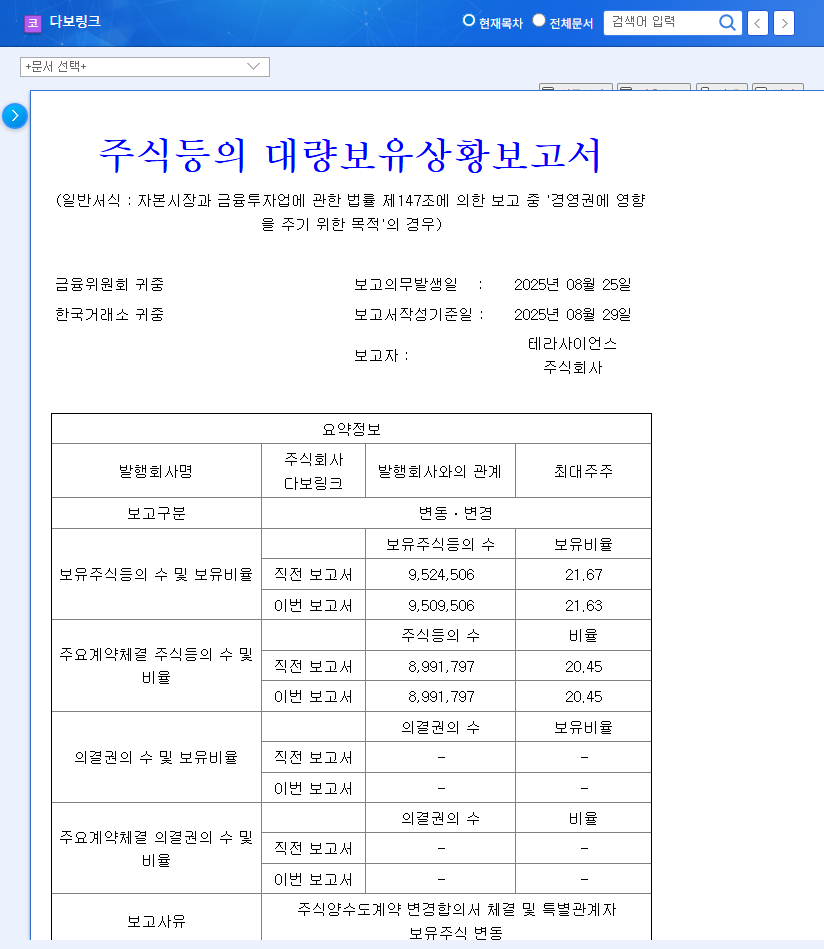

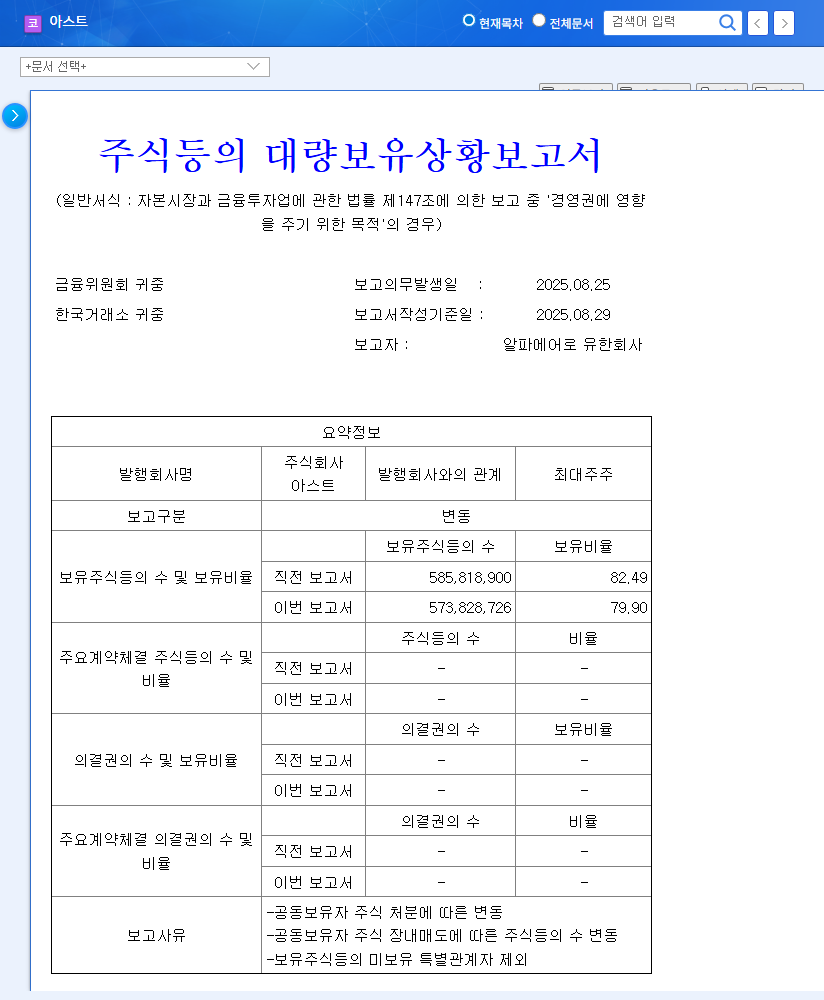

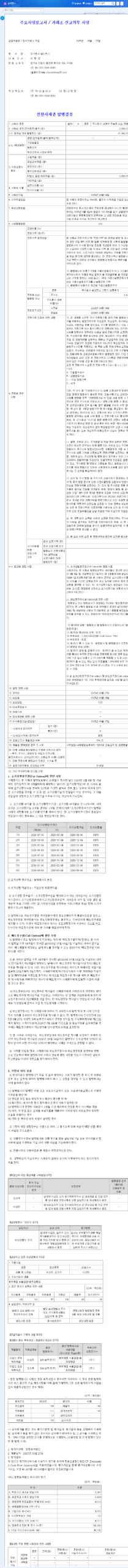

Corpus Korea announced the exercise of convertible bonds for 471,767 shares, leading to the issuance of new shares. This will dilute existing shareholders’ ownership, potentially decreasing the value per share.

Why Exercise Convertible Bonds Now?

Corpus Korea is facing a severe financial crisis. Declining sales, operating losses, and surging debt ratios have created an urgent need for capital. Exercising convertible bonds converts debt into equity, offering a potential improvement to the company’s financial structure.

The Impact: What Does It Mean for Investors?

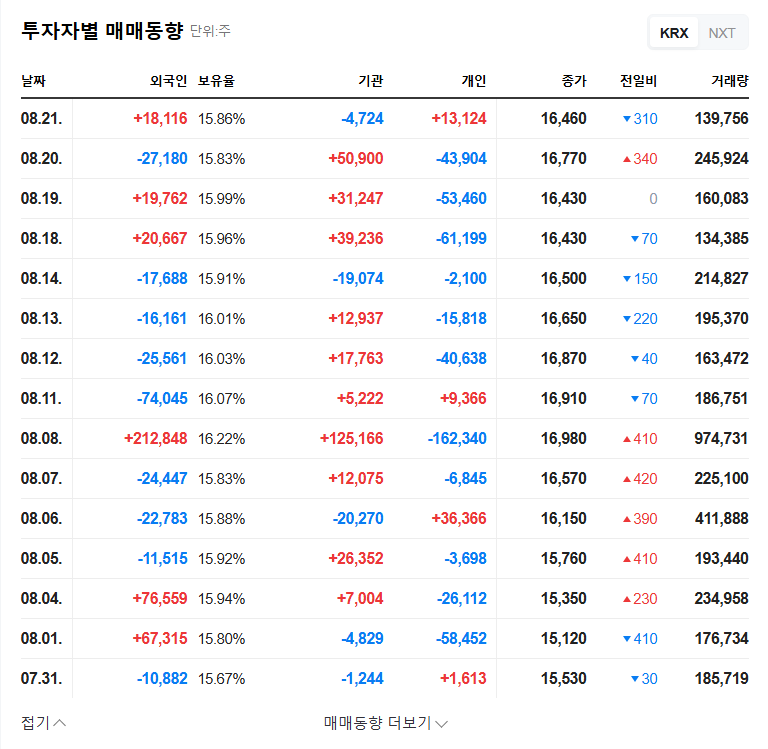

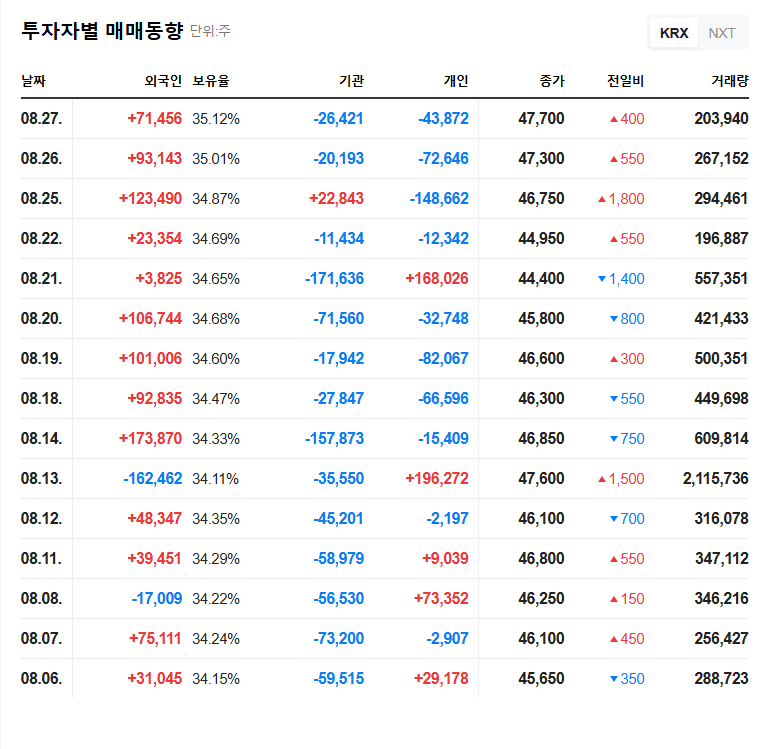

- Downward Pressure on Stock Price: The increased number of shares due to the new issuance is likely to exert downward pressure on the stock price. This pressure can be amplified in the current situation, given the company’s weakened fundamentals.

- Short-Term Liquidity vs. Long-Term Uncertainty: While the exercise provides short-term liquidity, it doesn’t address the underlying operational challenges. Without fundamental business improvements, long-term uncertainty remains.

- Negative Investor Sentiment: Amidst declining performance and financial instability, the convertible bond exercise could further erode investor confidence and negatively impact market sentiment.

Investor Action Plan

Investors should closely monitor Corpus Korea’s turnaround efforts, new business performance, and financial recovery initiatives. It’s crucial to assess the company’s long-term value rather than reacting to short-term price fluctuations. Avoid impulsive investment decisions and proceed with caution.

Frequently Asked Questions

What are convertible bonds?

Convertible bonds are a type of debt security that gives the bondholder the option to convert the bond into a predetermined number of shares of the issuer’s common stock.

Does exercising convertible bonds always negatively impact the stock price?

Not necessarily. If a company has strong fundamentals and growth potential, the funds raised through the exercise can fuel further growth. However, in Corpus Korea’s current situation with weakened fundamentals, the impact is likely to be negative.

Should I invest in Corpus Korea?

Investment decisions should be based on your own judgment. However, Corpus Korea is currently facing financial difficulties, so caution is advised. Carefully monitor the company’s business improvement efforts and financial restructuring progress before making any investment decisions.