What Happened?

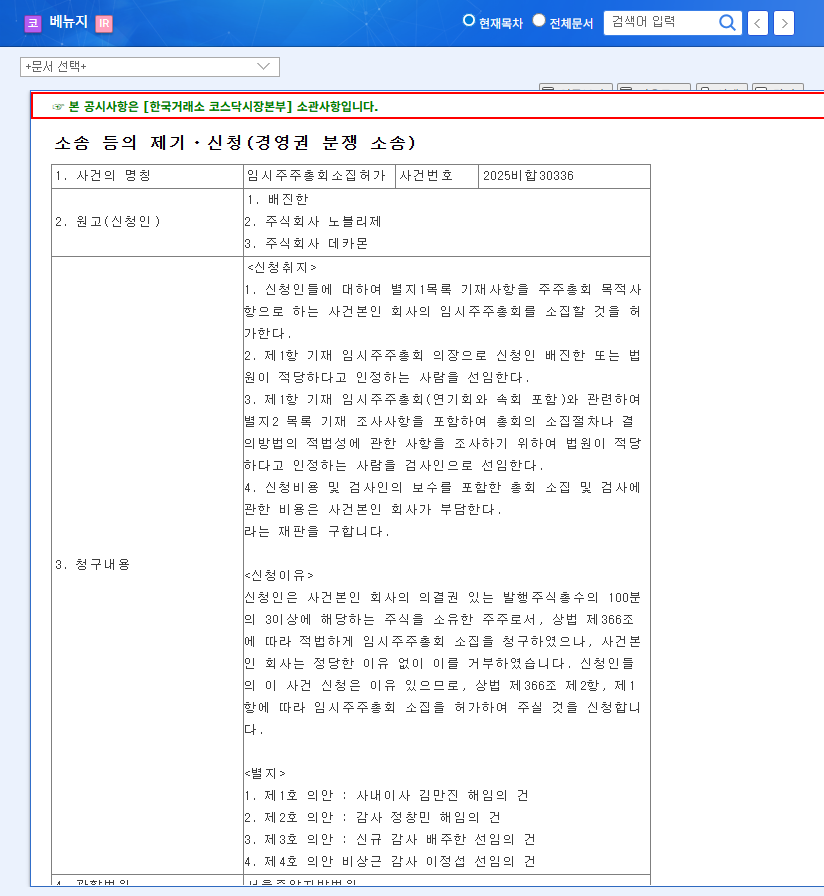

Minority shareholders (Bae Jin-han and two other companies) requested a temporary shareholders’ meeting, but VenueG refused, leading to the shareholders filing a lawsuit with the court. The shareholders propose motions including the dismissal of current directors and auditors, and the appointment of new auditors.

Why Did This Happen?

The minority shareholders are expressing dissatisfaction with the current management and are demanding improvements in corporate governance and shareholder value. Their previous requests for increased dividends and share buybacks suggest this lawsuit is not merely a dispute but a concerted effort to gain management control. VenueG is currently restructuring its business, including closing its unprofitable Ilsan department store, but faces financial challenges such as net loss and high debt ratio. In this context, the minority shareholders appear to be seeking management changes to improve the company’s fundamentals.

What’s Next?

This lawsuit could be a critical turning point for VenueG’s future. The court’s decision on the meeting request and the outcome of the shareholder’s meeting could lead to substantial changes in corporate governance.

- Positive Scenario: Improved corporate governance and enhanced transparency could lead to increased corporate value.

- Negative Scenario: Prolonged disputes and management uncertainty could negatively impact corporate value.

What Should Investors Do?

Investors should closely monitor the situation, considering the court’s decision, the shareholder meeting results, and any management changes when adjusting their investment strategies. It’s crucial to carefully analyze the arguments of both sides and reassess the investment value of VenueG.

Frequently Asked Questions

How will this lawsuit affect VenueG’s stock price?

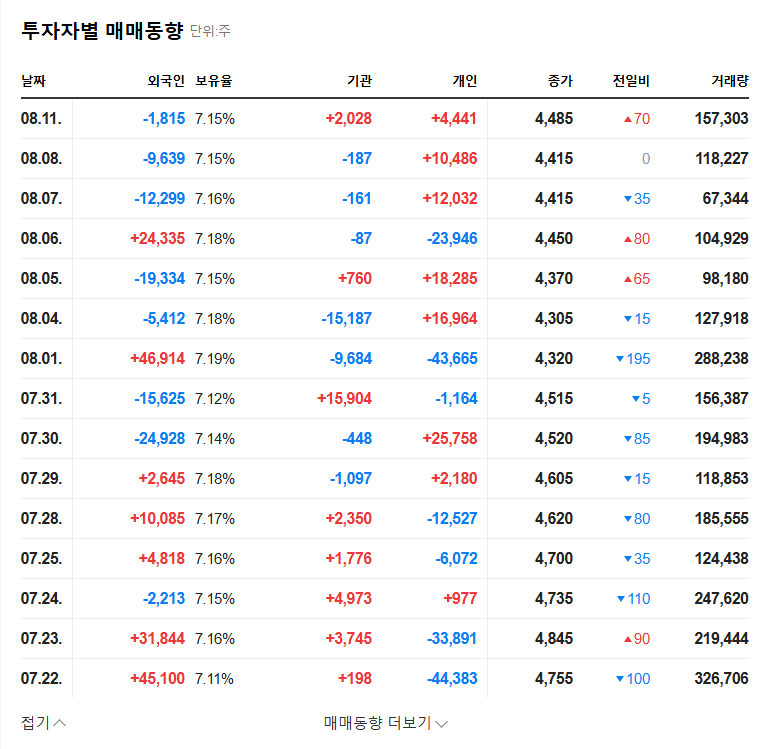

In the short term, increased stock volatility is likely. The long-term impact depends on the lawsuit’s outcome and subsequent changes in corporate governance.

Why did the minority shareholders file the lawsuit?

They appear to be aiming to improve management efficiency and enhance shareholder value by changing the management team. They have previously voiced concerns about various management decisions, including dividend payouts and share buybacks.

What is the outlook for VenueG?

The outlook for VenueG is highly dependent on the outcome of the lawsuit, any resulting management changes, and the company’s efforts to improve its financial health.