1. What Happened at DB Securities?

DB Securities announced its progress report on its Corporate Value Enhancement Plan on August 29, 2025. This report provides important information on the company’s financial performance and future strategic direction.

2. Why Does It Matter?

This announcement is a key indicator of DB Securities’ future growth strategy and commitment to enhancing shareholder value. Understanding management’s intentions and the company’s direction can inform investment decisions. This is an opportunity to assess DB Securities’ diversification strategy and its effectiveness amidst intensifying competition, interest rate fluctuations, and other external factors.

3. What’s the Impact?

- Positive Impacts:

- Increased Transparency and Trust

- Confirmation of Commitment to Shareholder Value

- Presentation of Future Growth Drivers

- Potential Negative Impacts:

- Disappointment if Implementation Lags

- Limited Impact if Plan Lacks Specificity

- Financial Analysis Summary:

- Positive growth in S&T and Investment Banking divisions

- Need for improvement in Wealth Management division

- Overall stable growth maintained

4. What Should Investors Do?

This announcement provides an opportunity to assess DB Securities’ growth potential. However, uncertainties remain due to external factors. Before making investment decisions, consider the following:

- Monitor the specific implementation of the Corporate Value Enhancement Plan.

- Keep an eye on external factors such as market volatility, competition, and interest rate changes.

- Assess whether the company can improve competitiveness and market share in the Wealth Management division.

Frequently Asked Questions

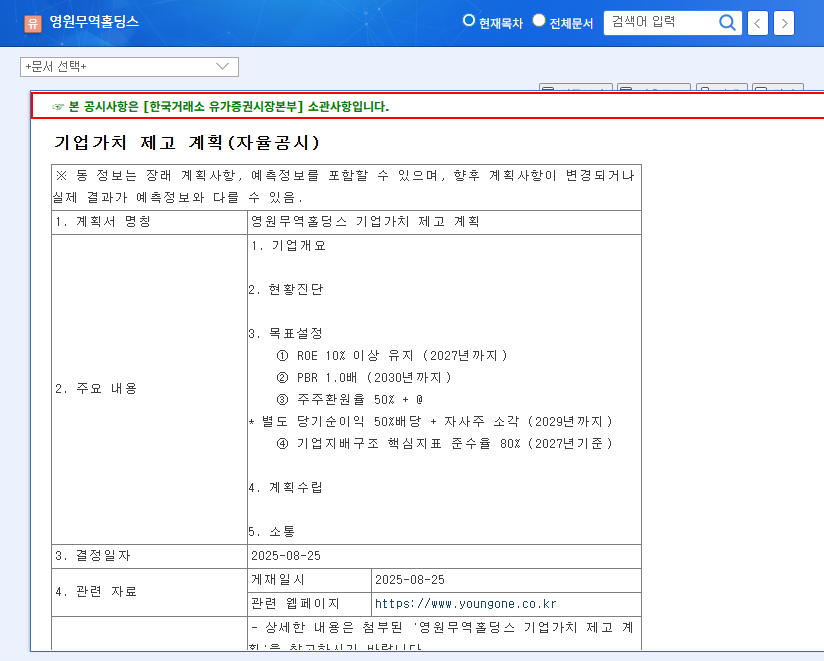

What is the Corporate Value Enhancement Plan?

It’s a strategic plan to increase a company’s intrinsic value. This can include various methods like shareholder return programs and business restructuring.

Will this announcement positively affect the stock price?

While the plan’s details and implementation may have a positive influence, various factors, including market conditions, can affect the stock price.

What is the outlook for DB Securities?

The growth in S&T and DB Asset Management is positive, but strengthening the Wealth Management division is crucial. Continuous monitoring of external market changes is necessary.