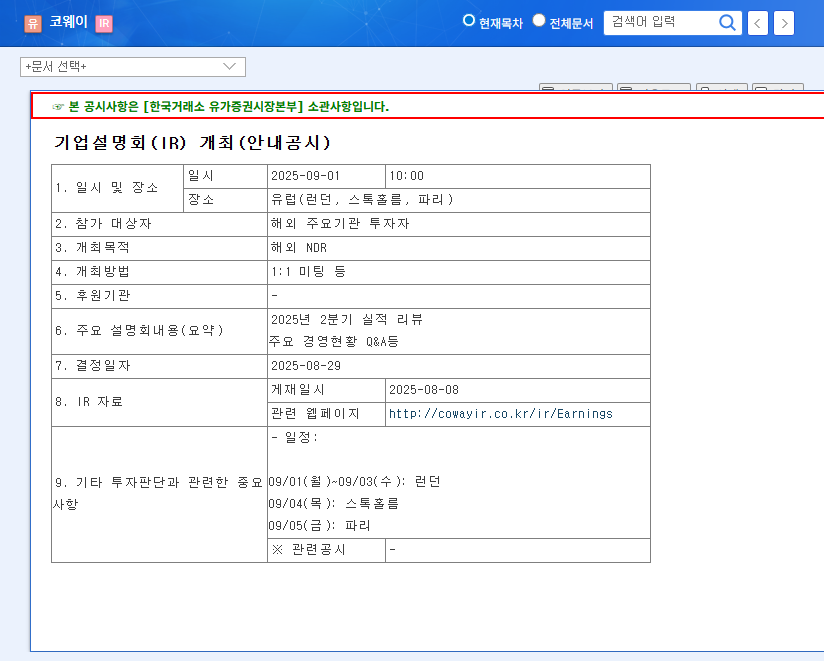

1. What’s Happening? Coway’s NDR on the Horizon

Coway is hosting an NDR for international investors on September 1st. The event will feature a review of Q2 2025 earnings, key management updates, and future strategies, with a particular focus expected on North American market expansion and profitability improvement plans.

2. Why Does It Matter? Impact on Investor Sentiment

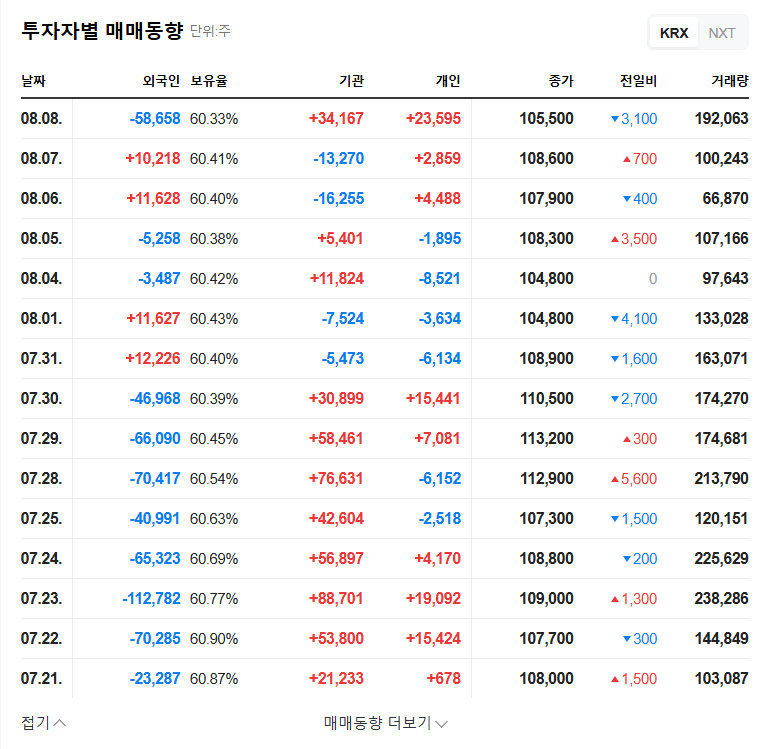

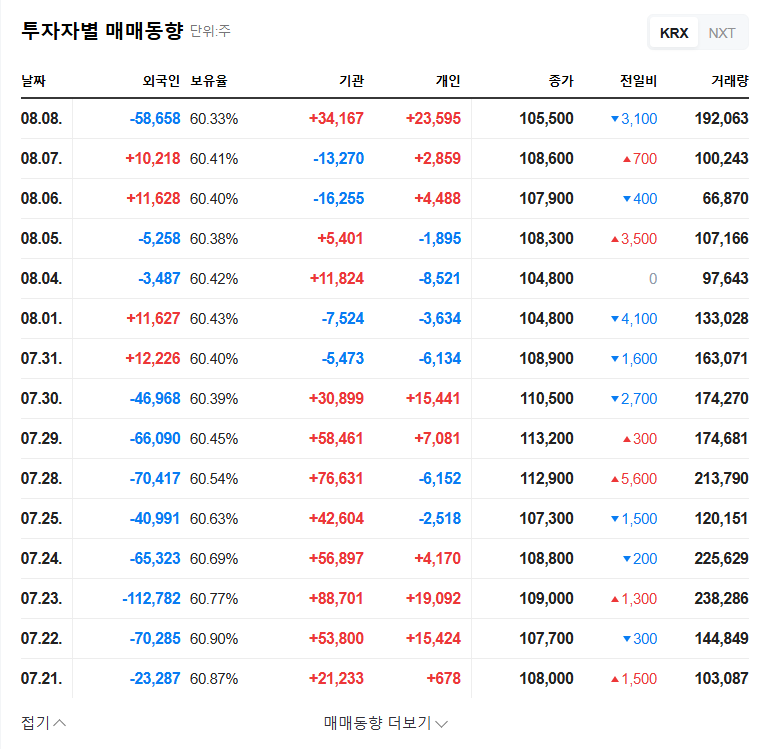

This NDR is crucial for gauging Coway’s future growth potential. The Q2 earnings release and future strategy announcements could significantly influence investor sentiment. Particularly with the recent stock price correction, this NDR could be a turning point.

- Positive Factors: Stable rental business foundation, accelerating overseas market growth, shareholder return policy.

- Negative Factors: Profitability management issues, exchange rate and interest rate volatility, intensifying competition.

3. What Should Investors Do? Analyzing Key NDR Content

Investors should carefully analyze the Q2 earnings, overseas market growth strategies, profitability improvement plans, and responses to macroeconomic variables presented at the NDR. Pay close attention to the specific plans for North American expansion and the potential reversal of declining operating profit margins. The Q&A session with management will be vital to assess their ability to address market concerns and build investor confidence.

4. Investor Action Plan

- Review NDR Content: Thoroughly examine the presentation materials and Q&A session to understand the company’s current situation and future strategies.

- Develop Investment Strategy: Adjust your investment position based on the NDR outcomes.

- Continuous Monitoring: Monitor market reactions and stock price movements following the NDR.

Q: When is Coway’s NDR scheduled?

A: It will take place on September 1st, 2025, at 10:00 AM.

Q: What are the key topics of this NDR?

A: The NDR will cover Q2 2025 earnings results, key management updates, future business strategies, and a Q&A session.

Q: What are the key risks to consider when investing in Coway?

A: Investors should be aware of factors such as profitability management, exchange rate and interest rate volatility, and increasing competition. Careful analysis of the NDR content and subsequent market reactions is crucial.