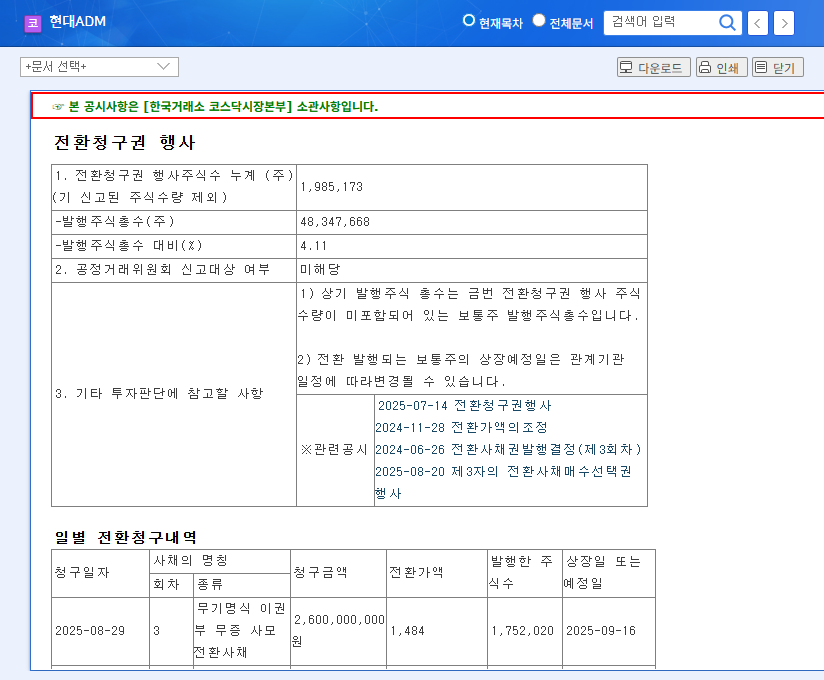

1. What is Hyundai ADM’s Warrant Exercise?

Holders of Hyundai ADM’s convertible bonds are exercising their warrants, leading to the listing of approximately 2 million new common shares. Simply put, it’s like converting debt into equity, which can dilute the value of existing shareholders’ stakes. Imagine a pie being divided among more people.

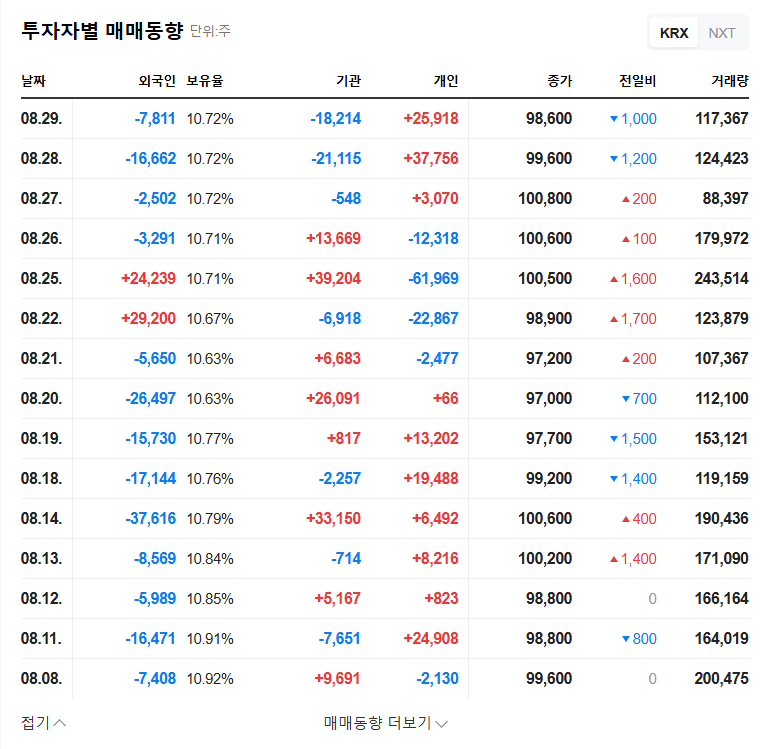

2. How Will This Affect the Stock Price?

Short-term downward pressure on the stock price is expected. A sudden influx of 2 million shares into the market can lead to a supply glut, pushing prices down. Considering Hyundai ADM’s current weak financial condition and business uncertainties, this downward pressure could be even greater.

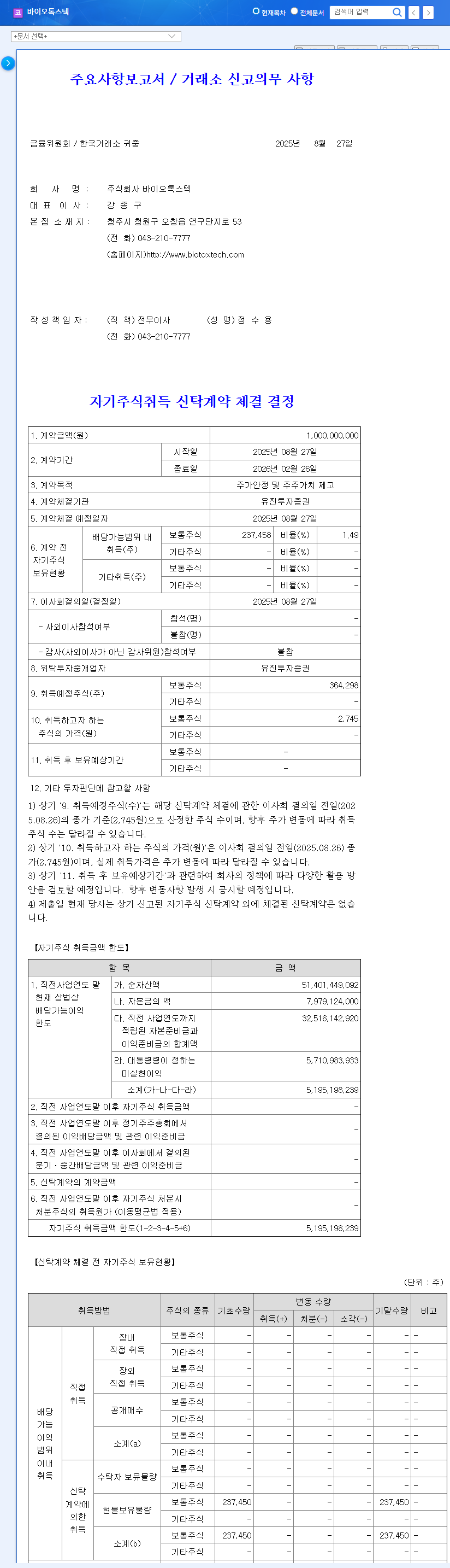

3. How Should Investors Respond?

- New investments should be approached with extreme caution. Investing in Hyundai ADM at this time could be very risky.

- Existing shareholders? Consider selling your shares or reducing your holdings.

- Continuous monitoring is necessary. Closely watch the company’s financial restructuring efforts, bio business performance, and CRO business results.

4. What Does the Future Hold for Hyundai ADM?

Hyundai ADM has growth potential in new bio businesses such as anticancer drug development, but the probability of success is uncertain, and its financial situation is not favorable. Make informed investment decisions based on thorough research.

What does Hyundai ADM’s warrant exercise mean?

It’s the exercise of the right to convert convertible bonds into shares, and approximately 2 million new shares will be issued.

How will this affect the stock price?

It’s highly likely to put downward pressure on the stock price in the short term. The increased supply due to the new share listing is the main reason.

How should investors respond?

New investments should be approached with extreme caution, and existing shareholders may consider selling or reducing their holdings. Continuous monitoring of the company’s future business outlook is crucial.