1. What Happened?

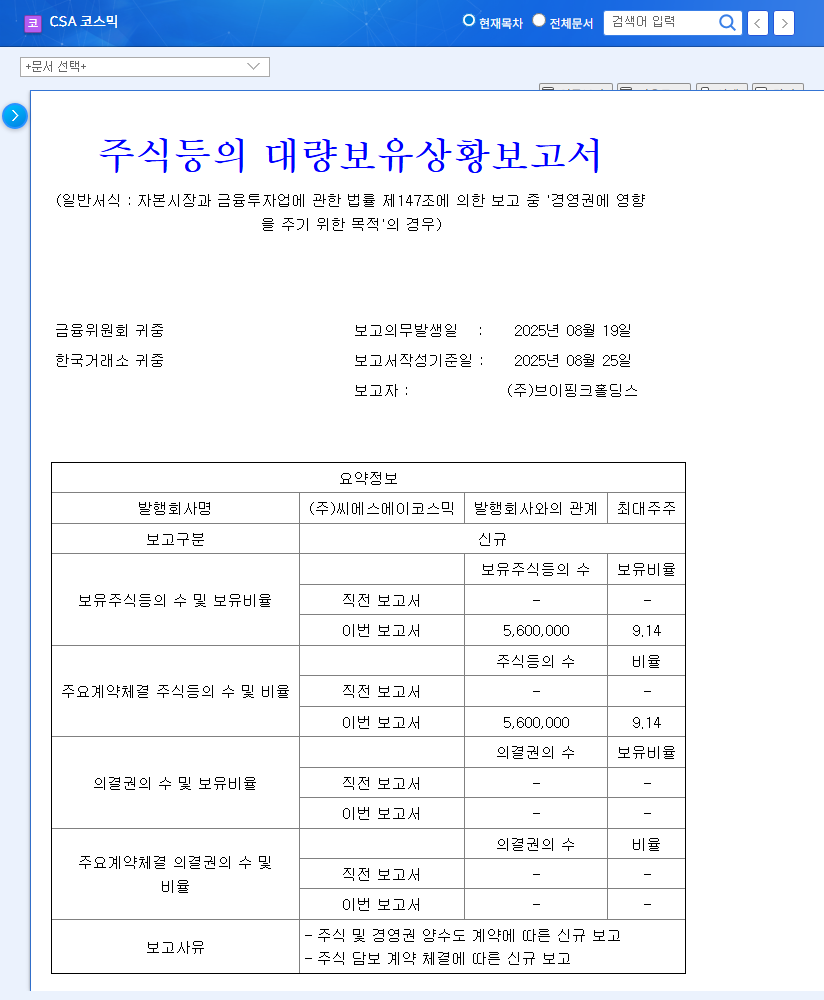

Seong-A Cho, the largest shareholder of CSA Cosmic, sold 2,976,714 shares (4.86%) to SW Investment Partnership. This reduces Cho’s stake from 15.50% to 10.64%. This sale stems from a share transfer agreement and signals a potential change in the company’s largest shareholder.

2. Why Did This Happen?

CSA Cosmic is currently facing contrasting fortunes: a struggling cosmetics business and a growing construction materials sector. The cosmetics business has seen a sharp decline in sales due to weakened consumer sentiment, while the construction materials sector shows steady growth. This change in major shareholder could signal a shift in management strategy. While the company has secured funds through rights offerings and convertible bond issuances to lay the groundwork for business expansion, there is also the possibility of stock dilution.

3. What’s Next?

- Short-term: Increased downward pressure on stock price due to the sale and heightened uncertainty regarding the change in management.

- Long-term: Potential restructuring of the cosmetics business and accelerated growth in the construction materials sector, depending on the new major shareholder’s strategy. Financial soundness and the possibility of stock dilution are also key variables.

4. What Should Investors Do?

CSA Cosmic is at a crucial juncture. Instead of reacting to short-term price fluctuations, investors should closely monitor the new management’s strategy and business performance, making investment decisions from a long-term perspective. Carefully evaluating the new major shareholder’s plans, the potential turnaround of the cosmetics business, and the company’s ability to secure financial health are crucial.

Frequently Asked Questions

What are CSA Cosmic’s main businesses?

CSA Cosmic operates in the cosmetics and construction materials sectors.

How will the change in major shareholder affect the stock price?

Short-term volatility may increase due to uncertainty. Long-term price direction will depend on the new management’s strategy.

What should investors be aware of?

Carefully consider the new management’s plans, the potential for a turnaround in the cosmetics business, and the company’s financial health.