1. What Happened?

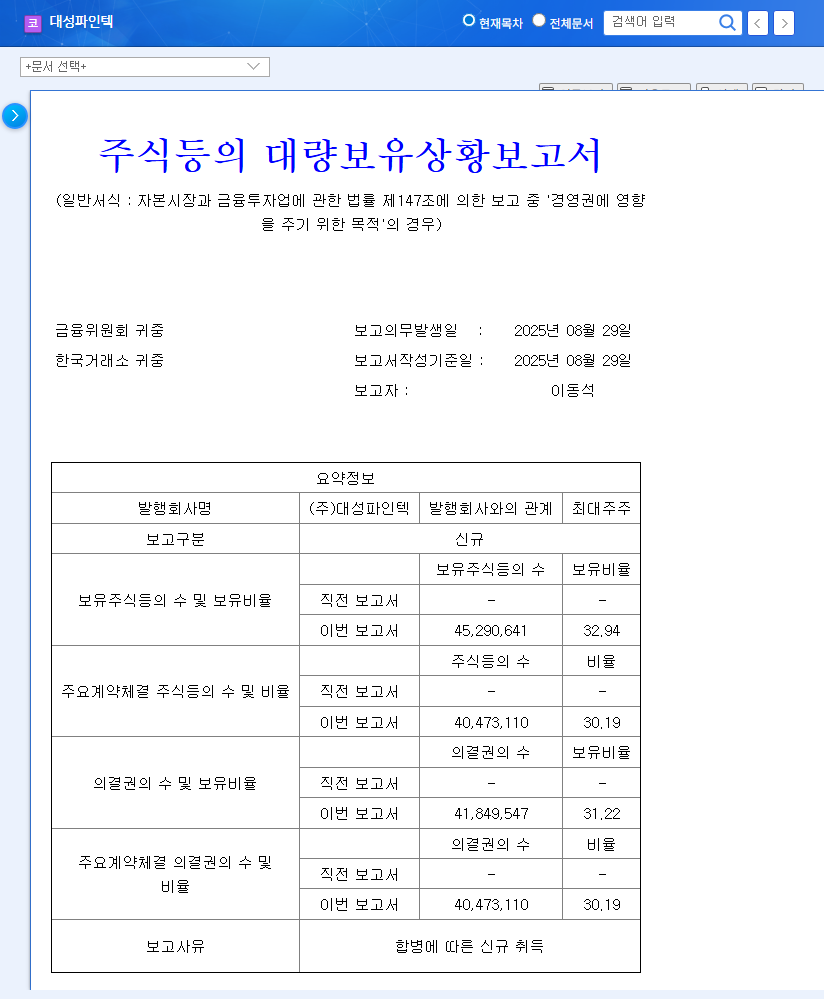

On August 29, 2025, CEO Dong-Seok Lee increased his stake in Daesung Finetec to 32.94% for the purpose of “influencing management.” This is a significant event that suggests not only a consolidation of management control but also the possibility of a merger.

2. Why Does It Matter?

This stake increase is a critical factor that will determine Daesung Finetec’s future direction. While there are expectations of securing long-term growth drivers through stabilized management, there are also uncertainties and risks associated with a potential merger. Despite the stable growth of the FINE BLANKING business and the recovery of the renewable energy business, the increasing financial burden is a point that investors should carefully consider.

3. What’s Next?

- Positive Scenario: Strengthened management could create a stable business environment, enabling the pursuit of long-term growth strategies and enhancing corporate value.

- Negative Scenario: The merger process could lead to unexpected costs, insufficient synergy effects, and a deterioration of the financial structure.

4. What Should Investors Do?

Investors should closely monitor the disclosure of merger-related information and the progress of the situation. It’s crucial to carefully analyze the merger target, conditions, and potential synergy effects, and continuously monitor changes in the company’s financial soundness. Investors should make investment decisions from a long-term perspective, without being swayed by short-term stock price volatility.

Frequently Asked Questions

What is the purpose of CEO Dong-Seok Lee’s stake increase?

Officially, it has been reported as “influencing management,” but the possibility of a merger cannot be ruled out.

How will a merger affect Daesung Finetec’s stock price?

It could have a positive or negative impact depending on the merger conditions and synergy effects. Careful analysis of merger-related information is necessary.

Is Daesung Finetec’s financial status healthy?

Despite the solid performance of the FINE BLANKING business, the increasing debt burden requires continuous monitoring.