1. Emart IR: What’s it all about?

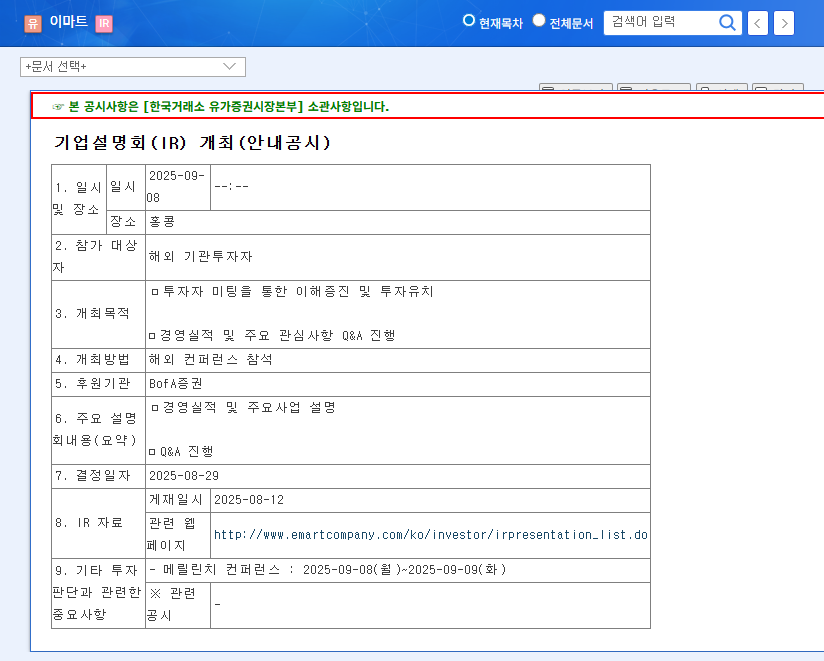

This IR meeting aims to strengthen communication with investors and enhance corporate value. Management will present recent financial results, share performance updates on key business segments and future strategies, and answer investor questions.

2. Behind the Profitability: Why the Turnaround?

Emart achieved a return to operating profit through cost efficiency measures and business structure improvements. Strong performance in the hotel/leisure, IT services, and overseas business segments, along with enhanced shareholder return policies, also contributed. However, declining sales, the sluggish construction division, and high debt levels remain challenges.

3. Key IR Watch Points: What to Look For?

- Growth Strategy: Investors should focus on whether Emart can present a concrete future growth plan and sales increase strategy.

- Financial Health: Solutions for addressing high debt and interest burdens are crucial.

- Management Transparency: Efforts to address market concerns and build investor confidence are essential.

4. Investor Action Plan

Investors should carefully review the IR announcements and make investment decisions based on a comprehensive analysis of the company’s fundamentals and potential risks. Maintaining a neutral stance and awaiting the IR presentation is currently advisable.

Frequently Asked Questions

When is the Emart IR meeting?

It will be held on September 8, 2025.

How is Emart’s recent performance?

While sales have declined, Emart has returned to operating profit. Growth has been driven by the hotel/leisure, IT services, and overseas business segments.

What should investors be aware of when considering Emart?

Investors should consider declining sales trends, the struggling construction division, and high debt levels. Carefully analyzing the IR presentation before making investment decisions is crucial.