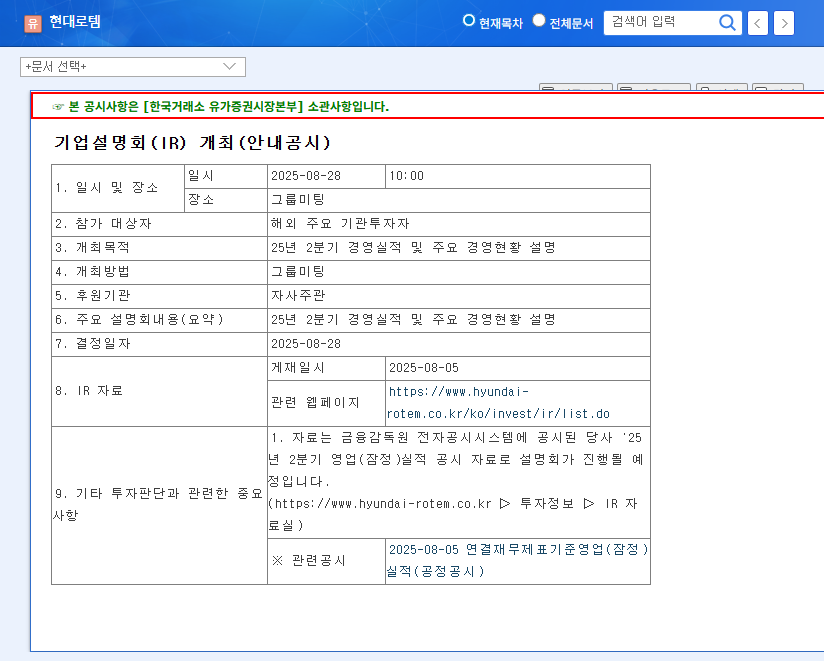

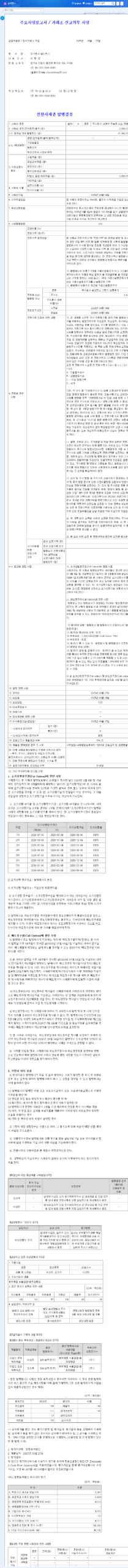

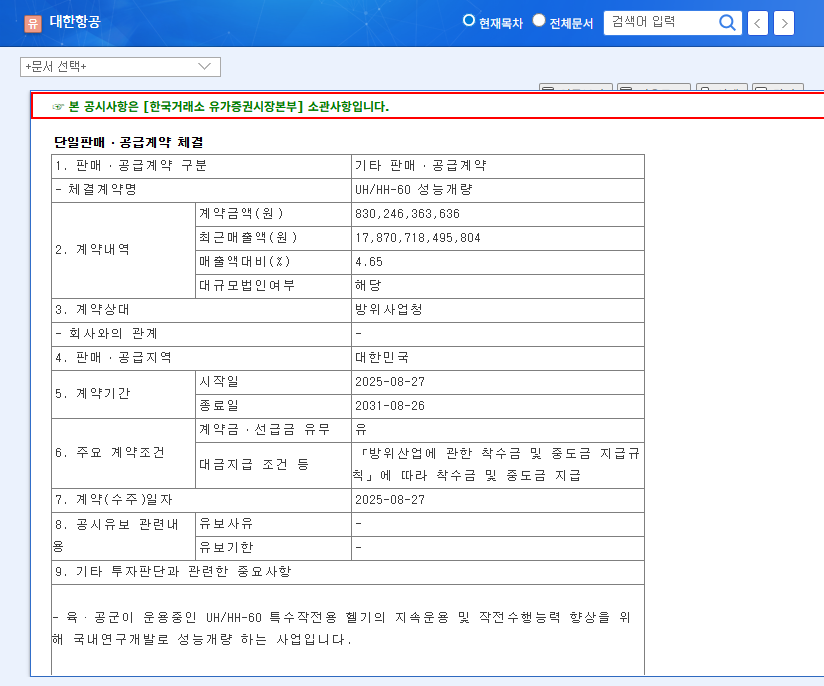

1. Hyundai Rotem Q2 2025 Earnings: Key Highlights

Hyundai Rotem reported positive results for Q2 2025. Key business segments, including Defense Solutions, Rail Solutions, and Eco Plant, exhibited solid growth. The increase in order backlog is a particularly encouraging sign, supporting future revenue stability and growth.

2. Growth Drivers and Positive Factors

- Expanding order backlog (KRW 216.368 trillion)

- Consistent growth across Defense, Rail, and Eco Plant divisions

- Focus on future growth engines, including hydrogen-electric trains

- Improved financial health and credit rating (Debt ratio 134%, Credit rating A+)

3. Investment Considerations and Potential Risks

While the outlook is positive, investors should be aware of potential risks. Factors such as exchange rate volatility, rising raw material prices, and intensifying industry competition could impact investment returns.

- USD and EUR exchange rate fluctuations

- Rising raw material (SUS LT2T) prices

- Increasing competition in the defense and railway industries

4. Investment Strategies: A Guide for Investors

Despite the positive growth potential, investment decisions require careful consideration. The following strategies may be helpful:

- Positive long-term investment outlook

- Focus on managing exchange rate volatility and hedging strategies

- Monitor macroeconomic indicators, including interest rates and oil prices

- In-depth analysis of the IR presentation content

- Analyze the company’s strategies for addressing rising raw material prices and competition

What are Hyundai Rotem’s main business segments?

Hyundai Rotem operates in three main segments: Defense Solutions, Rail Solutions, and Eco Plant.

What was Hyundai Rotem’s order backlog in Q2 2025?

KRW 216.368 trillion.

What are some key risks to consider when investing in Hyundai Rotem?

Key risks include exchange rate volatility, rising raw material prices, and increased competition.